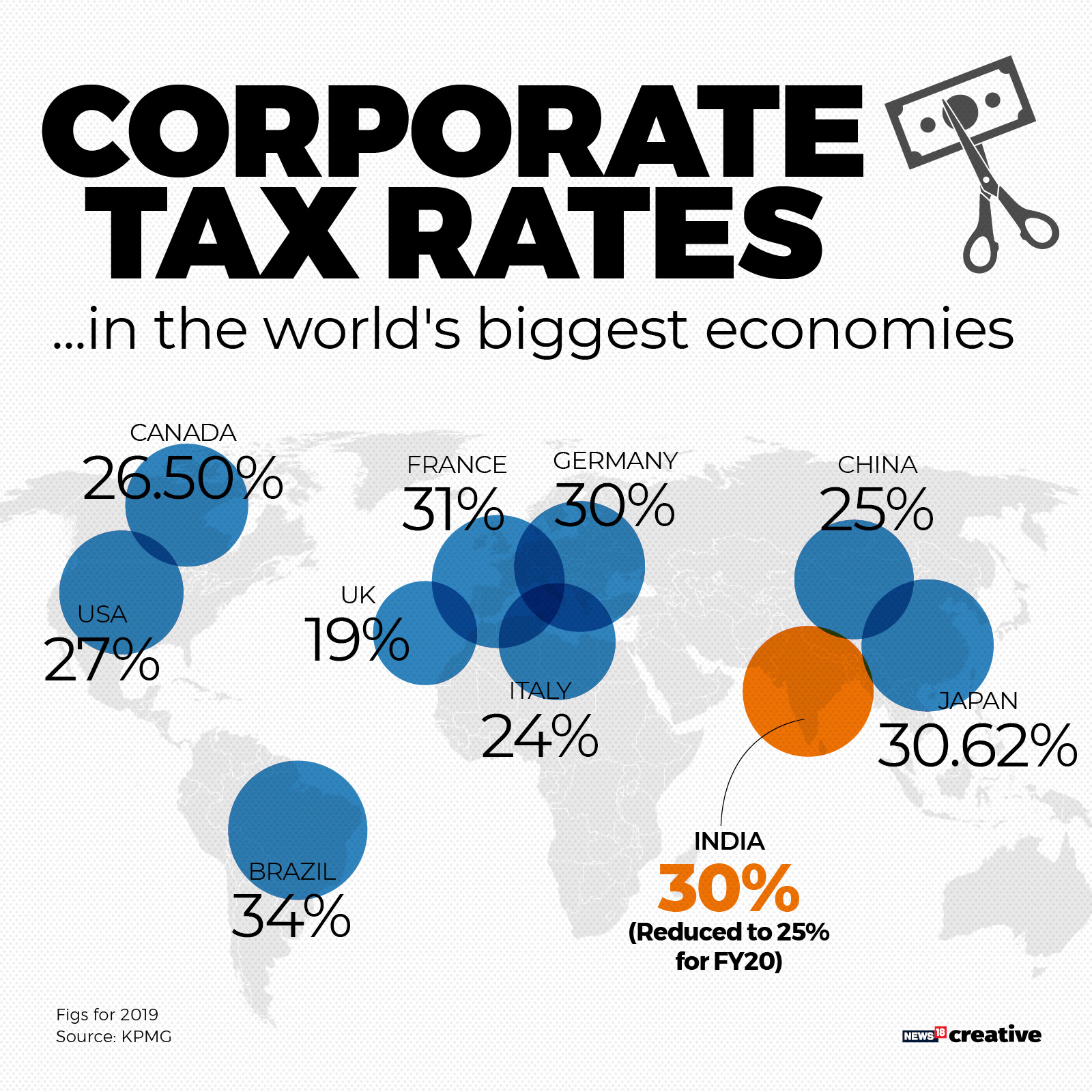

India has finally become tax competitive. Slashing Corporate tax rate to 22 percent is revolutionary, said experts, hailing the government slashing corporate tax to 25.17 percent inclusive of all cess and surcharges for domestic companies. Making the announcement, Finance Minister Nirmala Sitharaman said the new tax rate will be applicable from the current fiscal which began on 1 April. Industry, stock market and experts cheered slashing of corporate tax rate and other announcements by Finance Minister Nirmala Sitharaman saying the big bang reforms will push economic growth and investments. [caption id=“attachment_7363111” align=“alignleft” width=“380”]  File image of finance minister Nirmala Sitharaman. PTI[/caption] Industry, stock market and experts cheered slashing of corporate tax rate and other announcements by Finance Minister Nirmala Sitharaman saying the big bang reforms will push economic growth and investments. Uday Kotak, CEO, Kotak Mahindra Bank, termed reducing corporate tax rate to 25 percent as a ‘big bang reform’. He said in a tweet:

Reducing corporate tax rate to 25% is big bang reform. Allows Indian companies to compete with lower tax jurisdictions like the U.S. It signals that our government is committed to economic growth and supports legitimate tax abiding companies.A bold, progressive step forward.

— Uday Kotak (@udaykotak) September 20, 2019

Biocon CMD Kiran Mazumdar Shaw also applauded Finance Minister Nirmala Sitharaman.

Corporate Tax Rate Cut From 30% To 25.2% To Spur Growth- this is a great move which will firmly revive growth n investment. My hats off to FM @nsitharaman for this bold but most needed move. https://t.co/yhvJ9IcMmm

— Kiran Mazumdar-Shaw (@kiranshaw) September 20, 2019

By slashing the corporate tax rate, the government has “recognised today the need to make Indian companies globally competitive , said Hitesh. D. Gajaria, Partner and Co-head of Tax, KPMG in India. He termed the move a hugely positive step that he believes will conserve much needed funds in the hands of corporates to turbo charge investments leading to more employment and capacity creation. It Will also reduce litigation on contentious issues around incentives.

Sitharaman also said companies opting for 22 percent income tax slab would not have to pay minimum alternative tax (MAT). Gajaria welcome the MAT reduction from 18 to 15 percent and said the next follow-through step eagerly awaited are moving the tax on dividends to shareholders and freeing companies from the dividend distribution tax burden. In another major announcement, the government has also decided to expand the scope of CSR 2 percent spend on incubation, IITs, NITs, and national laboratories. Now CSR 2 percent fund can be spent on incubators funded by Central or State Government or any agency or Public Sector Undertaking of Central or State Government, and, making contributions to public funded Universities, IITs, National Laboratories and Autonomous Bodies (established under the auspices of ICAR, ICMR, CSIR, DAE, DRDO, DST, Ministry of Electronics and Information Technology) engaged in conducting research in science, technology, engineering and medicine aimed at promoting SDGs. Welcoming the move, Frank D’Souza Partner and Leader Corporate and International Tax, PwC India said, “the reduction in the corporate tax rate is a welcome move and makes India attractive for new investments. Also, the changes to CSR contributions and the relief on buy-back tax, will address past concerns and also help in channelling funds towards R&D initiatives.” Experts weigh in with their comments on the government’s bold move: Jatin Dalal, Chief Financial Officer, Wipro Limited The government has taken a giant leap in tax reforms. It’s a huge boost to corporates and will enhance India’s position as a competitive destination for fresh foreign investments. ‘Make in India’ now gets a fresh impetus with reduced rates of corporate income tax. MAT rate reduction is also a bold move. Clarification on grandfathering of buyback tax on inflight buyback programs as of 5 July 2019 is a comforting outcome. This would go a long way in restoring confidence in the market and nudge companies to make fresh investments. Rajnish Kumar, Chairman, SBI The large reduction in corporate taxes across the spectrum of all companies is perhaps the boldest reform in the last 28 years! Such a rate cut will boost corporate bottomline, facilitate a reduction in product prices. Additionally, the move to incentivise setting up new manufacturing units in India comes at the most opportune time for foreign companies who could be actively looking for opportunities to invest globally! This move could also materially lead to India effectively integrating with the global supply chain and a boost to Make in India campaign! Ajay Piramal, Chairman, Piramal Group The announcement made by the Finance Minister today is commendable. With this the government has signalled that it is listening to the industry and is willing to embrace it as a partner for progress of the Country. We are certain that this Big Bang reform will kickstart the economy. Surplus funds available to companies will be invested in capex and talent. The NBFC sector will save between Rs. 250 - 300 crore that can potentially be redeployed as loans. In a climate of global slowdown, this reform will make India an attractive destination for FIIs and long term investors. The announcement has brought parity to India’s corporate tax rate compared to that of advanced markets thus making it very competitive. Anil Agarwal, Executive Chairman, Vedanta Resources The reduction of corporate taxes, including surcharges and cess, will significantly boost the economy and will provide a huge impetus for the manufacturing and infrastructure sector. We are confident this step, in coming days, will boost economic growth so that GDP can attain its true potential of 8-9 per cent. The journey looks extremely bright for creation of thousands of jobs in India and helping the country to march towards the $5 trillion-mark. Sugata Sircar, CFO, Schneider Electric-India The series of confidence building measures announced by the government recently and underscored by the Finance Minister on Friday is expected to create a positive sentiment in the market in terms of demand generation as well as investment. The lower rate announced for domestic manufacturing companies formed after October 2019 is expected to boost investments in the manufacturing sector. Ashishkumar Chauhan, MD & CEO, BSE The slew of historic measures has brought down Indian corporate tax rates to amongst the lowest in the world especially for the new manufacturing companies. These decisions will be celebrated as historic and will go a long way in improving ‘Ease of Doing Business In India’ even further. There are several other fiscal measures that have also been announced which all point to the government’s commitment to promote the business activities and enhance job creation manifold. These announcements will further boost the investor confidence and start the investment cycle. Gopichand P Hinduja, Co-Chairman, Hinduja Group The tax reduction is an excellent step that was needed for Indian economy revival and manufacturing sector. It shows government is well seized of the economic challenges facing all of us. I only wish more such steps, which government is already contemplating, could be taken together in one go like tapping NRI investments, with this one so as to create deeper impact, instill more confidence in economy and amongst corporates. This would certainly help put businesses back on track, generate more employment and most importantly, keep India as the principal investment destination amidst global slowdown. Ashok Mohanani, Chairman, EKTA World, Vice President, NAREDCO Maharashtra Investors and homebuyers have been on the other side of the fence lately due to uncertainty and bleak economy outlook. Today’s announcement has brought in a ray of light for the economy at large, resulting in a rise in Sensex by 1900 points. This has led to a spike in investor wealth by as much as Rs 2.11 lakh crore. We are expecting this to lead to a positive change in sentiment for the real estate sector. Furthermore, the sector has also requested the FM to allow one time restructuring of loans to ensure completion of housing projects, and reduction of home loans to 7 percent whereby we will be able to attain Housing for All by 2022. TS Kalyanaraman, Chairman and Managing Director, Kalyan Jewellers It is very positive to see the government move pragmatically and provide the much needed liquidity boost to the economy. Lower tax rate will increase transparency in the gems and jewellery industry which will ultimately lead to a shift from unorganized to organized sector. We welcome this dynamic decision implemented by the government. SR Patnaik, Partner & Head-Taxation, Cyril Amarchand Mangaldas This is an extremely important and very courageous move which should give a significant push to the market and industry. We hope this move is expected to unleash the animal instinct in the Indian industry and put the economy back on the high growth. Specifically, the reduction of the Indian corporate income tax, clarification on the buyback tax and super rich tax are very encouraging. Archit Gupta, Founder and CEO, ClearTax The government has played well to respond to the slowdown. Several economies have shown that reduction in direct tax rates is positively co-related to increase in economic growth. While this also means there will be no indirect tax rate cuts. This is a welcome move and much needed boost to the economy. It also shows a switch in direction to a regime with overall lower tax rates (with minimal exemptions). Similar direction may as well be expected on direct taxes for individuals in the future. A bold and brave move from the government for an across the board reduction in corporate tax rates will lead to a lowering of prices which will lead to a boost in consumption. Combined with other measures already announced to recover banking and ease up lending, this is essential oiling to the wheels of the economy. Vikram Kirloskar, president, CII The cut in corporate tax from 30 percent to 22 percent without exemptions has been a long standing demand of industry and is an unprecedented and bold move by the government. The Finance Minister’s mega corporate tax stimulus is a major move to boost investors sentiments, encourage manufacturing and awaken animal spirits in the economy. Coming just ahead of the festive season, there could not have been a better news as the entire country gets ready to celebrate. Vikram Doshi Partner-Tax and Regulatory, PwC India Reduction of corporate tax rate for new manufacturing companies to 15 percent and for existing manufacturing companies to 22 percent will give impetus to “Make in India” initiative by making India a competitive destination for global investments. Anand Kripalu, Managing Director and CEO, Diageo India We welcome the bold changes introduced by the Government, which will strengthen India Inc’s role as the nation’s job and wealth creators. The increased tax savings will boost cash flows, spur domestic and foreign investment, provide competitive tax rates and act as an economic driver towards ‘Make in India’. Abhishek Jain, Tax Partner, EY India With various enquiries and investigations after the issuance of the Circular on treatment of post-sale discounts, the FMCG and automotive sector in specific were quite apprehensive on discounts and the larger impact it could have in the upcoming festive season. The withdrawal of the circular would bring quite a relief to them. The extension for new return formats till April 2020 would give businesses the much needed additional time to make appropriate changes to their ERP system, business processes, etc. Separately, this would also give additional time for testing both to the Govt and businesses and hence could help mitigate to an extent the initial teething issues on the new return compliances. Sudeep Sen, Head of Industrial, Manufacturing & Engineering Vertical, TeamLease Services The new corporate tax structure will infuse a fresh life to the auto and manufacturing sectors. The revised tax rate for new manufacturing companies will help them to effectively use their savings in multiple ways, especially enabling them to recover from the current slowdown and to plan ahead. It will also encourage companies to revamp their production lines, invest in new automation and boost skill development that can further help in employee retention. Bringing the tax rates at par with other countries is likely to reduce the possibility of companies shifting their production units away from India. This will help in tackling brain drain and create more employment opportunities. Aditya Ghosh, CEO, OYO India and South Asia This is a bold step to provide a fillip to the Indian economy. Just ahead of the festive season, the honourable finance minister by reducing the corporate tax rates, has given a triple booster dose to the economy as this will increase the retained earnings of the companies which will result in investible surplus for the future, shift India at par with its regional peers thereby removing one of the issues related to manufacturing and exports and maintain macroeconomic prudence by continuing to stimulate the investment cycle. We congratulate the Finance Minister and the Govt. of India for this progressive move. Saurabh Srivastava, Chairman & Co-founder, Indian Angel Network The government’s decision to cut down the tax rates is bound to provide a radical spur to the corporate activities in the country. If implemented effectively, it will reduce the cost of capital which will result in a greater influx of funding into businesses. Indian companies stand to benefit greatly from this initiative. Likewise, the decision of encouraging businesses to reroute their CSR 2% spending into state-sponsored incubators will further contribute towards driving innovation and entrepreneurship with renewed vigor. This falls in line with the Government’s aspirational ‘Start-up India’ vision. Vishal Gondal, Founder & CEO, GOQii We welcome the radical announcement of the government. Increased cashflow savings should spur investment and job creation. It’s a strong reiteration of the intent to usher progressive reform and serve as a catalyst towards a fit financial health. Bhavin Turakhia, Founder and CEO, Flock We welcome the latest steps taken by the Government of India to spur growth and boost investor sentiment as such a move was required. The announcement by the Finance Minister in terms of slashing effective corporate tax to 25.17% inclusive of all cess and surcharge for domestic companies will greatly benefit Indian corporates, with the startup sector slated to see an inflow of investments and an uptick in growth. These measures will go a long way in not only augmenting local businesses but also spur the overall growth of the economy. Madhavan Menon, Chairman & Managing Director, Thomas Cook (India) We welcome the announcement of the Finance Minister on the government’s planned amendments in the Income-tax Act. This move will certainly see infusion of positive sentiment in the industry at large, more so in the current environment. With the overarching intent of catalysing growth and investment, we anticipate positive impact for the Travel & Tourism sector, and with it a boost to our Corporate and MICE travel segments as well. Arun M Kumar, Chairman and CEO, KPMG in India The decision to reduce corporate tax rates is a bold step that should lead to increased investments and returns and thus higher employment. Farroukh Kolah, Vice President & Chief Financial Officer, SOTC Travel Travel and Tourism industry is a vital contributor to the country’s growth. The announcement on lowering the corporate tax from 30 percent to 22 percent, which is now at par with the South Asian countries, will have a significant and positive impact on the economy. The reforms undertaken by the government will help businesses with higher post-tax profits hence incentivising investments into the country and will boost the current economic growth rate. Varun Kapur, Executive Director, Travel Food Services The recent announcement of relaxing corporate tax rate is a bold move by the government which will accelerate industrial activity and bolster investment across all sectors. It is bound to increase capital formation in the country, leading to business expansion and job creation. This will offer a two fold benefit to the end consumer-Allow companies such as ourselves to accelerate expansion plans coupled with job creation; trickle-down effect from the increased consumer confidence and spending power of the Indian consumer, will provide an impetus to growth. The vigour that will be introduced with these measures will kick start the economy and put it back on the rapid trajectory that we as a country have got accustomed to.’’ Pratik Jain, Partner & Leader, Indirect Tax, PwC India In line with the bonanza announced under Income tax, the decisions taken by GST Council should also help in improving the market sentiments. As was rightly said by the Finance Minister, the decisions taken were primarily aimed at simplification of tax and rationalisation of tax rates. Reduction in tax from the peak rate of 28 percent to 18 percent for hotels having tariff of more than Rs 7,500 and from 18 percent to 12 percent for hotels having tariff less than Rs 7,500 should give a boost to the tourism industry. However, from a policy standpoint, it’s better to not link the rate of tax with price points. Reducing tax rate on outdoor catering services from 18 percent to 5 percent brings in parity in rates with restaurant_s._ Martin Schwenk, Managing Director & CEO, Mercedes-Benz India Reduction in corporate tax to 22 percent is a shot in the arm as it is directly correlated to economic growth. Reduction of corporate tax has been on the agenda and it will also boost ‘Make in India initiatives. It will promote investment, help sustain profitability during challenging times and should also improve buying sentiments, thus helping the auto sector in long term. Rohit Poddar, Managing Director, Poddar Housing and Development It is a historic announcement on tax reforms by the Ministry of Finance. Slashing the corporate tax from 35% to 25.17% followed by a significant reduction in MAT will foster a constructive environment for the new ventures. These reforms will make the country one of the most favorable destinations for foreign investors. It is expected to translate into an increase in external investment and CAPEX in the economy. The government has taken a call to bear the burden of fiscal deficit to boost the economy but the new tax structure is expected to attract more external investment which will eventually trim down the rough edges of deficit for the economy. Ritesh Kanodia, partner, Dhruva Advisors

The tax rate cut on hotel industry will provide a boost to the tourism sector. This will also take away the litigation around composite services whereby hotel rooms were liable to 28 percent (for tariff above 7500) and services such as dry cleaning, fitness, etc. liable to 18 percent.

Aakash Vaghela, Co-founder and Managing Director, AV Organics We congratulate the finance minister for this progressive move. The government’s intent towards the easier tax regime is a step in the right direction. The move will give fillip to the Indian economy ahead of the festive season thereby increasing jobs in the long-term. The reduction in corporate tax will give a stimulus to Make in India investments while improving ease of doing business rankings. Vinod Subramanian, CEO, Logo Infosoft (irisVyapaari) This is a welcome move as it will reduce the outflow to the companies and they can spend more on capacity expansion as well as on modernisation leading into demand for the capital goods and increase in the GDP. Companies have to do a cost benefit analysis either to avail the lower income tax rate or avail the various incentives /exemptions. This is one way of providing a level playing field for all the companies. Prabhakar Kudva, Director, Samvitti Capital The cut in corporate tax rates while seems like a one time gain it has huge multiplier effects. Companies with high ROE and high tax rates should benefit the most. These gains should be partially transmitted to the consumers which should allow these companies to kick start revenue growth and incentivise them to invest in Capex. It is a win-win for the businesses as well as consumers.  G Radhakrishna, Chairman and Managing Director of RKEC Projects The announcement of reduction in corporate tax rate is really a big positive move by the Government as this step would stimulate corporate earnings and would enable companies to make new capital investments. These measures were much needed by the economy in terms of boosting private capex cycle and consumption. Rajiv Mehta, Lead Analyst, Yes Securities The direct benefit of the massive tax cut would be ~15% on earnings, 2.5-5% on book value and 30-80bps on capital position for most Banks and NBFCs. It is tantamount to a large recapitalisation of the financial system, strengthening growth capacity and loss-absorbing buffer. Since it’s a big step towards rekindling the corporate capex cycle and revitalizing sagging consumption, it would also be credit positive for Banks and NBFCs; undermining prospects of a deep and elongated NPL cycle. In general, risk aversion in the economy could reduce as the multiplier and sentimental impact of the corporate tax cuts play out. Our Top Picks are HDFC Bank, ICICI Bank and SBI. Rajiv Singh, CEO, Karvy Stock Broking After a large number of minor measure, the government announced a bold and major measure to revive animal spirits. The high corporate tax rate meant that Indian companies were not competitive and this move helps address this and shall also boost FDI. The effective tax rate now stands at 25.17 percent, and for new companies the effective tax rate will be 17 percent. The measure is thus a boost for start ups as well. Additionally, the finance minister also announced that there will be no tax on buybacks announced before July and no surcharge on capital gains as well. Reduction of corporate tax has been on the agenda for a while, and this should help in boosting the capex cycle, also it gives companies space to cut prices to boost demand. The corporate tax cut should go a long way in a revival of the economy. Rajat Mohan, Senior Partner, AMRG & Associates Economy is currently going through a downward spiral because of various domestic and global factors, new minister has been trying to rebound the domestic demand by pushing across various fiscal and monetary packages, some of such changes have been approved by GST council today.Tax rationalisation will attract immediate appreciation from neitizens and short term investors, however for long term perspective revenue implications would be massive, which would either widen the fiscal deficit or limit the public spending already promised in earlier budgets. The government is trying to combat problems of business cycle and unemployment with a tax package, which seems to be devoid of economic knowledge. Prayesh Jain, Lead Analyst, Yes Securities Many companies were paying more than 30 percent tax after the expiry of tax benefits for their plants. Hence, these companies would benefit from the reduced overall corporate tax rate cut. Reduced tax benefits for R&D in the recent past also led to an increase in effective tax rates for most companies in the sector. Hence, we expect these companies to let go off the R&D tax benefits and adopt the new tax regime. These measures will increase the room for additional discount offerings by these companies (current discounts already at an all-time high), which can possibly drive volumes in the ensuing festive season. Auto Sector can see increased FDI inflow considering the lower tax rate of 15% for new manufacturing units. Vinod Ramnani, Non-Executive Director of Opto Circuits The announcement of reduction in corporate tax rate is a bold move by the Government. This was much needed by the economy to boost consumption and investment cycle. The overall sentiment of the market and corporate should lift and the economy should start showing some signs of recovery. Mayank Jalan, President, Indian Chamber of Commerce While the government’s initial announcements had targeted to attract more foreign investments in India, Indian Chamber of Commerce (ICC) feels that the latest announcements will go a long way in promoting the indigenous industries, amid the ongoing economic uncertainty. ICC believes that the reforms will give fillip to the manufacturing sector in India thereby boost the Make in India initiative that can ultimately increase domestic production and hence help in the revival of GDP to move towards $5 trillion economy. Santosh Joshi, Founder & CEO, BankEdge Lower base tax rate of 15 percent for new companies formed after 1 October is also a big positive step for getting the economy back on track. These steps will allow manufacturing and financial services sector companies to proceed with capex plans and credit growth. Profitability for companies will increase with lower taxes and would enable them eventually to make new capital investments. Ninad Karpe, Partner at 100X.VC This a true game changer and a turning point for funding for incubators. It recognizes the fact that Innovation is critical for India with the incubators playing an important role and it needs support from the CSR spend bucket. Sanjay Vakharia, CEO, Spykar The announcements and slew of measures by the finance minister are in the right direction. It has brought cheer to the markets and this will be helpful in raising the sentiments of the people. More importantly the incentives offered by way of a reduction in taxes to encourage setting up of manufacturing business will go a long way in realizing the Make in India goal. And enhance employment opportunities which is so critical to the countries well being. Overall the announcements will set the tone hopefully for a brighter and cheerful festive season. Manju Yagnik, Vice Chairperson Nahar Group and Vice President NAREDCO (Maharashtra) The announcements made by the Finance Minister has given companies across the various sectors more than just a festive reason to celebrate. It surely is a milestone achieved by the government in order to get the Indian economy back on track as taxes charged have been a constant worry for consumers and entrepreneurs alike. Reduction in the tax rate will boost the investments in manufacturing, local companies by charging a total rate of just 15 percent, creating scope and quality demand among different industries. This move is also expected to change the financial situations of the working class, as more can be possibly offered by corporate companies. Ramesh Nair, CEO & Country Head-India, JLL To give strength to India’s ambitious ‘Make in India’ initiative, the government has proposed a tax rate of 15 percent for new domestic companies incorporated on or after 1st October 2019 and commences manufacturing by 31st March 2023. The measure is expected to bolster the growth of industrial real estate development in the country. According to the announcement, the total revenue foregone for the reduction in corporate tax rate and other relief estimated is at INR 1,45,000 cr. This quantum of money will act as an incentive to the industry in terms of savings and will result into further investments. Moreover, companies will also have a leeway to pass on the benefit to consumers, thereby reviving demand. Parth Mehta, Managing Director, Paradigm Realty The announcement by the finance minister on corporate rate tax cut slashed to 22 percent from 30 percent for existing companies with the effective rate at 25.7 percent with all surcharges and 15 percent for New Manufacturing Companies incorporated before October 2019 will benefit corporate India and shall boost investment cycle in the economy. This move is in the right direction to boost economic growth. The decision towards enhanced surcharge of funds not applicable to capital gains including derivates FPI’s is seen as a bold step by the Government. This move shall invite investments in capital markets by FII. Farshid Cooper, Managing Director, Spenta Corporation The slashed corporate tax is a very positive move from the government. The tax measures will help India to compete globally and minimize the tax cash outflows which would be reinvested back in the economy. Further, in the long run, this will give the required boost to employment. In the medium term, we can expect improved liquidity flow and increased consumer demand across the board. This is especially important given that the festive season is around the corner and several businesses are banking on this time to boost sales in an otherwise relatively tepid year. George Heber Joseph, CEO & CIO, ITI Mutual Fund This is one of the most credible response from the government I have seen in my entire career. There will be a paradigm shift in the promoters confidence level and business environment. Exemption of MAT is a big cash flow positive measure along with reduction in corporate taxes. We strongly believe this is the time to be allocating money into equities aggressively. Sectors which has been impacted the most will be the ones benefiting in a big way. In three years possibility of generating reasonably good returns is very high and potentially could be above the long term average Nifty Returns. Sudhir Kapadia, National Tax Leader, EY India Amidst the foreboding business ambience, the finance minister today presented a truly bold and transformative pre Diwali package for the beleaguered corporate sector. Instead of the hitherto half-hearted attempts on reduction of rates selectively for “smaller “ companies, there is now an across the board application of a lower 22 percent (25.17 percent with surcharges) for companies of all sizes and in any sector of the economy in lieu of not availing any exemptions or incentives. This will effectively leave companies in the hitherto nominal tax rate of 35 percent with a direct cash booster of 10% of their profit before tax (PBT) across all sectors. Harpreet Singh, Partner, Indirect Tax, KPMG in India On expected lines, GST council has not tinkered with rates on normal passenger cars, biscuits and other products. In view of GST collections falling short of target and southward revenue implications of reduction in GST rates, perhaps this is the right move. The need of the hour is to look at increasing the tax base by introducing structural reforms such as inclusion of petroleum products, electricity under GST, simplification of compliances and reducing the data collection points, etc. For a considerable time, different States have been expressing concern over high GST rate on hotel rooms and had accordingly demanded a reduction. The said move is likely to assuage the situation and provide thrust to India’s tourism industry. Satish Magar, President CREDAI National The finance minister’s generous reduction in corporate tax makes India the most competitive investment destination and beckons entrepreneurial activity to reach new highs. The series of announcements by FM are most reassuring as they tell of the Government being sensitive to the economic needs of the people. We are most hopeful that the special needs of housing would soon get addressed to further accelerate the investment cycle. Mandar Agashe, Founder and Vice President, Sarvatra Technologies This is a brilliantly strategic move by the government to revive the widespread economic slowdown across sectors in India. The relief is bound to boost the ‘Make in India’ initiative, especially in the start-up space, catalyzing a slew of global investments into the country. This move will also the sentiments in the rural non-agricultural MSME fraternity who are often faced with a dearth of funds, and thus enhance digital payments in these areas. This rejuvenation of the manufacturing sector will once again make India a competitive market, and in turn invigorate the lagging employment rates as well. A lethal combination of the power surplus in the country, GST reforms and this corporate tax relief of 15% will make India a hotspot for FDIs due to the ease of doing business, creating a pathway for the 5 trillion dollar economy envisioned by the government. Dayanand Agarwal, Managing Director of DRS Dilip Roadlines This is fantastic move by the government in terms of providing much needed stimulus to economy. Reduction in effective corporate tax rate to about 25 percent means direct benefit in profitability for companies. The further lower base tax rate of 15% for new companies formed after Oct 1 is also a big positive step to boost investments. These measures would spur growth for companies and would enable them to make new capital investments. Rahul Gupta, Currency Research Head, Emkay Global Financial Services The news of government lowering corporate tax has rejoiced the market, stocks rallied sharply with Bank Nifty posting its biggest single day gain in 10 years. This gave rupee a big boost and USD/INR spot dropped to 70.67. The move was imperative as we are in a low demand cycle amid global idiosyncrasies. The RBI has been providing support to the economy by reducing interest rates since 2019 however economy needed some boost from the fiscal front as well. Meanwhile, the bond market did not take the fiscal announcement very well. Also, FM was unable to justify the fiscal concerns, thus the 10 year yield surged nearly 25 bps keeping rupee gains under check.Thus, unless USD/INR spot doesn’t end below 70.80, we expect prices to bounce 71.50 in next week. Jairaj Purandare, Chairman, JMP Advisors The removal of the enhanced surcharge levied in the Budget on long term and short-term capital gains should be applicable on capital gains from debt instruments, futures and options and other income such as interest. The amendment is proposed to be made effective from 1 April 2019 and appropriate notifications will be issued in this regard. While this announcement will have significant implications for FPIs, it will also be applicable to all domestic investors on short-term and long-term capital gains from above mentioned securities. Ashok Shah, Partner, N A Shah Associates LLP The announcement by the government to lower corporate rate of tax is a strong signal indicating that Government is prepared to go to a great length to boost the economy. The tax impact of the announcement would be that companies having turnover of less than Rs 400 crore will still be able to claim all exemptions/incentive which are available and pay tax at the rate of 25%. In the alternative, such companies can opt to pay tax at the rate of 22 percent without claiming any exemptions or incentives. Since the gap is only 3%, for companies availing tax benefit/incentive, benefit may be marginal. Companies having turnover of over Rs. 400 crores will see larger benefits. They can continue to claim exemption/incentives and pay tax at the rate of 30% In the alternative, they can pay tax at the rate of 22 percent without claiming any exemption/incentives. Kumarmanglam Vijay, Partner, J Sagar Associates The government’s move to announce the sweeping tax changes is unprecedented and the fact that these are being implemented through an ordinance in mid of the year gives confidence that it is willing to do all it can to spur the economic activity. Change in tax rates applicable to corporates are reduction in corporate tax rate to 25.17 percent (without any exemptions/incentives) for any domestic company. This should help large corporates invest in augmenting the businesses further. Companies incorporated on or after 1 October 2019 and making fresh investment in manufacturing can opt for tax rate of 17.01% (without any exemptions/incentives). Other companies intending to avail exemptions/incentives too can avail tax rate of 22 percent after the exemptions/incentives expire. Nikunj Ghodawat, Chief Financial Officer at CleanMax Solar The finance minister’s announcement today slashing the corporate tax from 30 percent to 22 percent will have a significant positive impact across all industries and uplift the business confidence and revival of the capex cycle. This change is perfectly in line with our demand from earlier this year requesting for the corporate tax to be at par with other South Asian countries. This will have a multiplier impact as each industry will have the possibility to pass on the tax benefit to the end user, thus relaying the impact across the economy up to the last mile consumer. Rajan Wadhera, president, SIAM We welcome the bold announcements made by Hon’ble Finance Minister today, including the reduction of corporate tax rate to 22% and No Minimum Alternate Tax for companies not availing incentives under Income Tax Act. Additionally, the reduction of corporate tax to 15% for new companies making fresh investments from 1st October 2019, will support investment and also FDI in the auto sector. This is expected to give a big boost to Make in India for automobile industry.Expansion of scope of CSR expenditure to include incubation centers and R&D activities will also help with R&D expenditures in automobile sector. All these set of fiscal measures are expected to uplift market sentiments and improve demand for automobiles. Sampath Reddy, CIO, Bajaj Allianz Life Insurance The government announced large fiscal stimulus by slashing corporate tax rates for domestic and new manufacturing companies, in a bid to deal with the current economic slowdown and help pump-prime the economy, and promote investment. For domestic company, the corporate tax rate has been reduced to 22% (plus surcharge) from 30% (plus surcharge) earlier. However, this is applicable for companies that are not using any other tax incentives/exemptions. To attract new investment, the corporate tax rate of new domestic company incorporated from October 2019, making new investment in manufacturing will be 15 percent (plus surcharge). These measures are a welcome move to boost manufacturing and investment, which has been impacted amidst the recent economic slowdown. Arun Thukral, MD & CEO, Axis Securities Finally, the government has come with strong economic stimulus. Taking a hit on revenues which is estimated to be approximately Rs 1.45 lakh cr annually, the finance minister today announced reduction in corporate tax for existing companies to 22 percent (25.17 percent effective tax) from 30 percent. To encourage Make in India initiative, all the new manufacturing companies in India would be eligible for a 15% tax rate (17.01% effective tax). Both these measures would bring India in the league of those countries who offer low tax rates thus attracting investments. Additionally, in response to concerns in equity markets, FM announced not to levy an enhanced surcharge on capital gains introduced in Budget. These measures are expected to boost the earnings of corporates, provide stimulus to GDP growth including employment and also cheer equity markets with reversal of foreign flows into the domestic market. Anshuman Magazine, Chairman and CEO, India, South East Asia, Middle East and Africa, CBRE The tax announcements made by finance minister is indeed a welcome measure and will definitely boost the government’s ambitious Make in India program. Once the corporate tax rate of 22 percent for local companies and new tax rate of 15 percent on companies formed after October 2019 comes into effect, investments are likely to surge in the manufacturing sector. The lower tax rates, shows the government’s commitment towards reigniting the economy’s growth engines and augurs well for the broad economy as well as entrepreneurs. Further the boost to the manufacturing ecosystem will not only generate jobs and lead to wealth creation but will also have cascading impact on other sectors including real estate and is likely to push demand for warehousing and commercial real estate space. Dinesh Kanabar, CEO, Dhruva advisors The industry demand was for a tax rate of 25 percent. The FM has proposed 20 plus surcharge!! This is really encouraging. The reduction of MAT, partial roll back of buy back tax are also very welcome moves. This should be a big booster for Make in India. Akila Agrawal, Partner & Head-M& Cyril Amarchand Mangaldas The corporate tax relief announced by the Government will definitely boost the economy and increase capital investments. Increase in capital investments will lead to more job opportunities and growth. Whilst it may take some time for the investments to materialise, it is a step in the right direction. One should also examine how this move impacts government spending. Madhu Sudhan Bhageria, Chairman and Managing Director, Filatex India We welcome the announcement of reduction in effective corporate tax rate to about 25 percent as this would directly lead to big jump in profitability for manufacturing companies like us. Moreover, the lower base tax rate of 15% for new companies formed after 1 October is a again a great bold move to boost capital investments in private sector. These measures were much needed by the economy in terms of lifting private investments, consumption and overall sentiments. The reduction in taxes would ensure hundreds of billions of dollars in FDI and FII flows over the medium term. We are very happy that this would also enable to picking up the domestic demand for textile industry and thus consumption of our products like polyester yarns. Ravi Saxena, MD, Wonderchef The new tax structure announced by the finance minister ahead of the festive season is a big push for the home appliances sector which grows with the growth of economy and households. By announcing a reduction in Corporate Tax to 22 per cent for existing companies and 15 per cent for New Manufacturing Companies the government has answered a long-standing demand of the corporates. This would encourage the competitiveness of Indian manufacturing by minimising tax cash outflows which would be ploughed back into Economy. Not only will there be an increase in the domestic investments in the manufacturing sector but huge FDI inflow is also expected as the FM made it clear that foreign companies in a joint venture with Indian companies, having an office in India will also get tax benefits. Vijay Mansukhani, MD, Mirc Electronics The announcement of reduction in corporate tax rate is really a big positive move as this will enable manufacturing companies to make new capital investments. This will increase the profit margins and capital investments across the sectors Base tax rate of 15% for new companies formed after 1 October is a big bold announcement steps to boost investments. The overall demand scenario would improve across sectors as the Government has directed public sector Banks and NBFCs to increase retail credit, the consumer spending during this festive season should increase, which should have good positive impact on consumer durables like LED televisions, air conditioners and washing machines. Dhaval Kapadia, Director-Portfolio Specialist, Morningstar India The details/fine print of the measures announced is awaited. Based on the broad announcements around corporate tax rate cuts, it appears that the government is trying to boost corporate or private capital investments which have been growing at slow pace over the last few years. These measures don’t directly address slowing / falling consumption demand for various goods such as autos, FMCG, etc. Whether corporates would expand/add capacities in an environment of slowing consumption is unclear. This measure would probably add to corporate earnings but durable growth in earnings would require revival in consumption demand. Kewal Chand Jain, Chairman of Kewal Kiran Clothing We welcome the announcement as the lowering of corporate tax rate would mean higher profitability and higher return on investments. This is really great move for across all sectors, as it would help in boosting private investments, consumption and overall sentiments. It’s an unique way to welcome Diwali by Government of India. As the announcement is a bold step with the perspective of pick-up in consumption and investments scenario, the demand for overall consumption would also see a positive growth in the coming period. Prathap C Reddy, Chairman, Apollo Hospitals We heartily welcome the measures announced by the hon’ble Finance Minister today. Corporate India has for long been advocating standardised rates of corporate taxation, as a tool to drive creation of investible surplus and enhanced dividend payouts to drive purchasing power. Siddarth Bharwani, VP-Brand & Marketing, Jetking Infotrain The recent announcement by the finance minister on the reduction of corporate tax to 22 percent, comes as boon to the corporate sector. The revenue generated from the said deductions can be redirected towards facilities that can assist in the training of students which will in turn help them in achieving better placements in companies, thereby increasing the employability ratio in the country, currently at 47 percent. Firms will now also be able to spend their 2 percent CSR on IITs and NITs, resulting in usage of advanced technologies in institutions, thus propelling the education sector in India. H Sudarshan Balal, president, Nathealth Reduction in corporate tax and other relief would create a favourable business climate for the companies which were under tremendous pressure due to several internal and external market forces. Rahul Grover-CEO, SECCPL India has one of the highest corporate tax structures at currently 30 percent in the world and the corporate tax rate cut to 22 percent is a laudable initiative which will help revive the economy. With this reduction and revised tax measures, we can expect an increase in the overall growth and development of the economy. The additional capital which will be saved can be deployed back into the business for future investments of the company. As the festive season is underway, this move is sure to improve sales and accelerate revenue generation within the business. Kishan Jain, Director, Goldmedal Electricals The government’s latest announcement on the slashing of effective corporate tax to 25.17 percent inclusive of all cess and surcharge for domestic companies will promote local manufacturing and provide much needed employment opportunities to citizens. Also, these measures will aid the domestic production of energy efficient solutions such as LED lighting and immensely benefit companies operating in this space. We are positive that the economic situation improves in the coming months, which will also boost demand in the consumer electrical segment. Narayan Mahadevan, Co-Founder at BridgeLabz This is a welcome move by the government as it will help encourage startups across the country in securing support from the industry. As incubators ourselves, we recognize the important role played in nurturing the startups ecosystem. With corporates being given further permissions to utilize the CSR funds for funding incubators, it will create a close synergy between the industry and the startup ecosystem. One of the areas to support in this would be to look at the startups and organizations which are helping disadvantaged youth to upskill. It will help uplift and upskill several capable engineers across the country. Shubika Bilkha, Partner, EdpowerU The recently announced reduction in corporate tax and other announced measures, should help in positively impacting the sentiment. The current economic situation has been a cause of increased mental stress, anxiety, job insecurity, frustration and reduced motivation across leaders and employees at corporates in India. Organizations are increasingly investing in initiatives that build resilience, improve motivation, manage stress in these difficult times and work on the mental framework of teams. Any governmental measures that provide some relief are important to ensure that a positive mindset and outlook return to drive our economy forward. Akhil Shahani, Managing Director, The Shahani Group We are glad that the Finance Minister has listened to the concerns of industry and quickly gave us initiatives to battle the slowdown in our economy. We appreciate her decisiveness in this regard. Now, fast growing companies like ours will be greatly benefitted as we will be able to reinvest a larger share of our profits due to lower corporate taxes and also give higher returns to our investors due to lower capital gains tax."

)

)

)

)

)

)

)

)

)