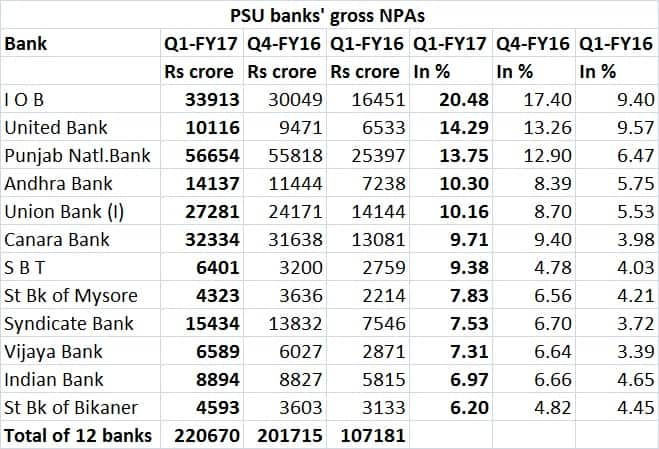

Is Chenna-based public sector lender Indian Overseas Bank (IOB) staring at a crisis situation? Let’s look at the numbers. At the end of the June quarter, the total gross non-performing assets (GNPAs) of the lender have touched a record high of 20.48 percent of its total loan book (of Rs 1,65,556 crore). In other words, one out every five rupees lent by the bank has now gone bad. According to a Firstpost analysis, that’s the highest level of bad loans in at least 14 years. Total losses of the bank, in the last one year (four quarters put together) stood at Rs 4,467 crore. The numbers indeed say it is. To be sure, at present, there is no immediate threat to the depositors and investors as the government has recently infused some money into the bank. But the situation can turn serious going ahead if the lender fails to generate money on its own or from the government. [caption id=“attachment_2946456” align=“alignleft” width=“380”]  PTI[/caption] Total bad loans of IOB in the June quarter stood at Rs 33,913 crore compared with Rs 30,049 crore in the preceding quarter (17.4 percent) and Rs 16,451 crore or 9.4 percent in the year-ago quarter. After making all the provisions on bad loans too, the bank’s net NPA stood at close to 14 percent of its book. With one-fifth of its total loans turning NPA, the bank will need nothing less than a major government bailout to stay afloat, said one of the leading banking analysts, who didn’t want to be named since they stopped covering the bank long back. “There is no doubt that the bank is indeed facing a crisis situation on account of the huge NPAs. Either it needs to repair itself and generate money on its own or must be bailed out by the government immediately,” said the analyst. In the latest round of capital infusion in July, when the government infused Rs 22,915 crore in 13 PSBs, the Chennai-based lender had got Rs 3,101 crore, one of the largest shares for any bank. The country’s largest lender, State Bank of India (SBI), and by far the best performing one among the lot, was given Rs 7,575 crore. This means IOB, a bank where the crisis is deepening and has a much smaller balance sheet, received almost half of what SBI got. In the June quarter, the bank used Rs 2,137 crore as provisions to cover its bad loans compared with Rs 2,666 crore in the preceding quarter and just Rs 663.57 crore a year ago. Going by the current trend, much of the money the government infused in the bank will go into providing for bad loans or to put it in other words, is going down the drain. Firstpost couldn’t immediately contact the bank for a response. Presently, IOB has a market cap of Rs 5,000 crore. The shares of the bank are trading at Rs 26.40 a piece on the BSE. Dissecting the problem Though the part of the reasons for the sharp jump in the NPA level of IOB can be attributed to the ongoing bad loan clean-up exercise forced on banks by the Reserve Bank of India (RBI) under Raghuram Rajan in September last year, the fact is that the trouble in the bank was brewing much before that. The bank, started by the Chettyar community in the pre-Independence era as a small bank, had high bad loans before the lender went public in 2000. Though the situation improved in the subsequent years, the bank never recovered from the NPA problem. “IOB has been among the state-run banks with the highest bad loan levels even before the bad loan clean-up began. The pace of increase in bad assets increased after the exercise began,” said the analyst quoted before. Like many other PSBs, IOB’s current plight can be attributed to years of reckless lending, weak credit appraisal processes and inefficiency of the management. Major chunk of the current pile of bad assets are loans given to small and large companies lent over a period of years, where hardly any repayment has happened.  The IOB-crisis would require the Narendra Modi government prepare an urgent bailout plan to rescue the bank. It also indicates that the government’s current capital infusion programme is too inadequate considering the huge funding gap in the public sector banks. Under the ‘Indradhanush’ revival plan for PSBs, the government plans to infuse Rs 70,000 crore in the four-year period between 2015-16 and 2018-19 in the state-run banks. But, analysts and rating agencies have cautioned that this money is not sufficient considering the requirement of state-run banks. For instance, rating agency ICRA estimated that the equity capital required by PSBs would be in the range of Rs 40,000-50,000 crore, much higher than that announced by the government this year. Hence, the government will need to increase the fund infusion significantly for 2017-19, Icra said. Another rating agency, Fitch too said the same. “Fitch believes pressures on public bank credit profiles will remain, and more capital than the Rs 70,000 crore earmarked through to FY19 will be needed from the government to restore market confidence and position the sector for long-term growth.” Larger malaise IOB symbolises a larger problem seen in the public sector banking space. PSBs are suffering from inefficient managements, government intervention and tough competition from private rivals. Many state-run banks are facing serious asset quality issues. There are at least four more state-run banks with NPAs above 10 percent. These are United Bank of India (14.29 percent), Punjab National Bank (13.75 percent), Andhra Bank (10.30 percent) and Union Bank of India (10.16 percent). There are two more with over 9 percent GNPAs, Canara Bank (9.71 percent) and State Bank of Travancore (9.38 percent). All of these will require substantial amount of capital infusion from the government. The bigger question is how much of these funds, which ultimately use the taxpayers money, comes back to the system for productive lending. In the past nine years, the government has infused Rs 1.18 lakh crore in these PSBs. As Firstpost has said before , the government’s decision to front load the annual capital infusion for PSBs may have come as an immediate relief for some of the cash-strapped banks, but it is only a painkiller, not a medicine that can cure India’s state-run banks from the ‘begging bowl syndrome’ or the ritual of lining up before the North Block every year to get government funds to stay afloat. There has been no respite from the NPA additions yet, also due to a slowing economy. Clearly, finance minister Arun Jaitley has a tough task ahead to deal with this problem. The total bad loans in the banking system rose to Rs 6 lakh crore in March, of which public sector banks have a share of Rs 5.4 lakh crore. In percentage terms, the gross NPAs of the scheduled commercial banks have risen from 5.43 percent in March 2015 to 9.32 percent in March 2016. The government owns stakes up to 80 percent in some of these banks. Thus far, it has refused to prepare a privatisation road map for these lenders except in some cases like IDBI Bank, also due to the trade union resistance. For instance, in IOB, the government owns 73 percent stake. As Firstpost has argued time and again, there is no logic in government insisting to be the owner of PSBs and control these banks. Given that the cash-constrained government doesn’t have the wherewithal to keep funding the massive capital requirements of PSBs (Basel-III and credit expansion), it will have to eventually go for privatisation of these entities. But, again the question arises who will invest in these lenders with cracked balance sheets. The solution is once the ongoing clean up exercise repairs the books of these banks, the government should work out a road map to privatise these entities. As it appears now, the government’s yearly capital infusion is just enough for most PSBs to cover their bad loans. Data contributed by Kishor Kadam

The solution is once the ongoing clean up exercise repairs the books of these banks, the government should work out a road map to privatise these entities

Advertisement

End of Article

)

)

)

)

)

)

)

)

)