The start of a new year always elicits reflections of what has gone by – and predictions of what’s in store ahead.

In a note to clients, Reliance Mutual Fund collated the predictions of 10 brokerages (foreign and local) on different economic metrics as well as on the stock markets.

[caption id=“attachment_184850” align=“alignleft” width=“380” caption=“Reuters”]

[/caption]

[/caption]

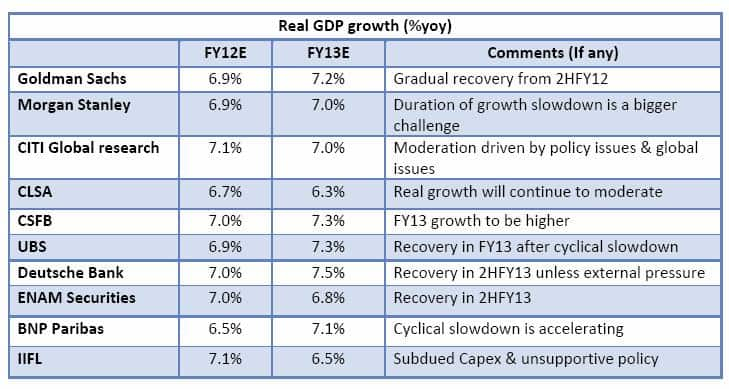

We start with real GDP growth, which most brokerages estimated would remain in a tight range of 6.9-7.1 percent for the year ending March 2012. The only exception was BNP Paribas, which predicted the economy would expand by just 6.5 percent. The next year’s growth estimates are in a much wider band – between 6.3 percent and 7.5 percent.

Source: Reliance Mutual Fund

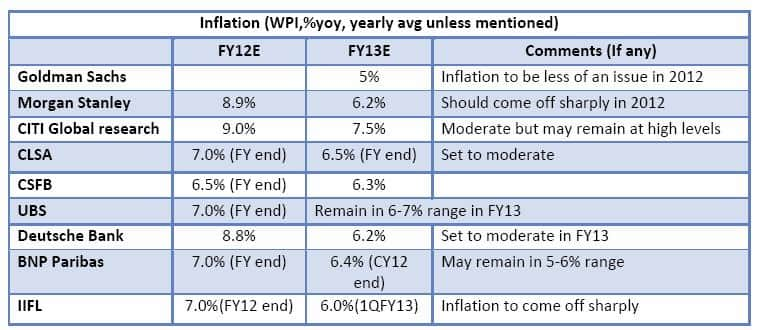

Inflation is expected to keep troubling the economy: in the financial year ending March 2012, inflation is expected to remain around 7 percent. The next year, inflation is expected to remain between 6 and 7 percent. Only Citi thought inflation would surge to 7.5 percent, while Goldman Sachs thought inflation would fall to 5 percent.

Source: Reliance Mutual Fund

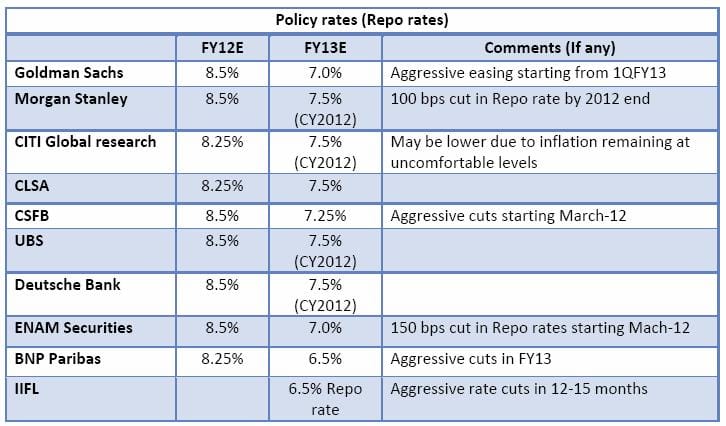

In terms of interest rates, most brokerages believe the Reserve Bank of India will start cutting rates from March-April 2012. The rate they are betting on is the repo rate – the rate at which commercial banks borrow from the central bank.

Source: Reliance Mutual Fund

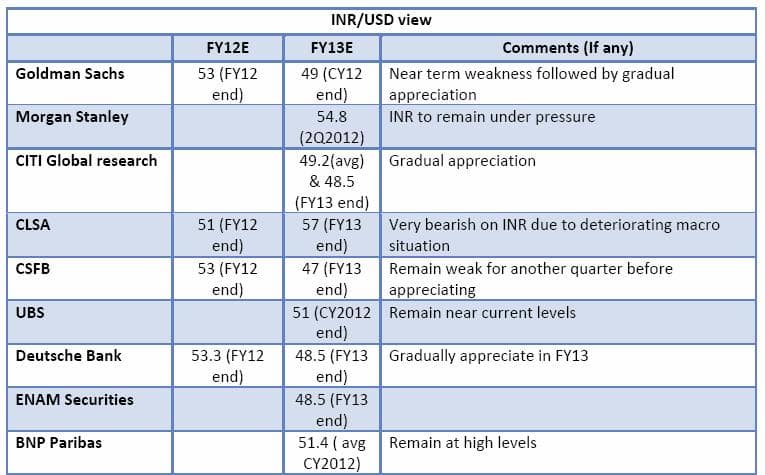

The big shocker on the rupee: CLSA expects the rupee to tumble all the way to 57 against the dollar in the year ending March 2013. In contrast, CSFB thinks the rupee will improve to 47 against the dollar in the same period. Clearly, there’s no consensus emerging on where the currency will head in the medium term. That’s not surprising, given that a host of global factors are shrouded in uncertainty (the ongoing sovereign debt crisis, the outlook for the US economy, a hard landing for the Chinese economy). In the current year ending March, the bet is that the rupee will remain tied to 51-53 levels against the greenback.

Source: Reliance Mutual Fund

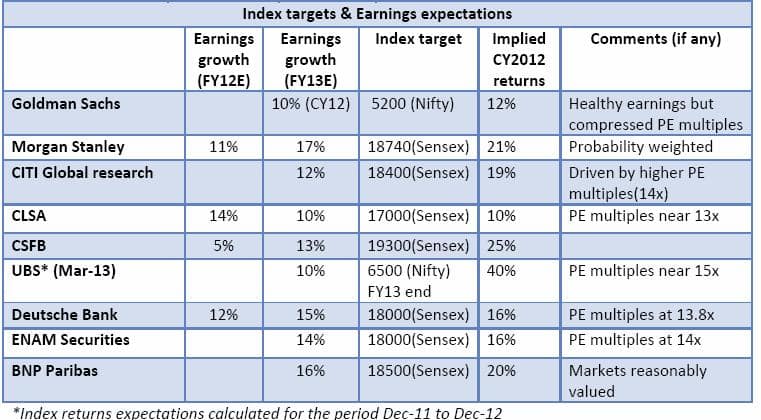

In terms of Sensex targets, there seems to be an almost unanimous consensus on how much the benchmark index will rise over the next 12 months: to around 18,000. The most upbeat assessment comes from CSFB, which expects the Sensex to jump to 19,300, while the most downbeat estimate comes from CLSA, which forecast the index at 17,000. Sensex earnings are forecast to grow between 10 percent and 17 percent in financial year ending March 2013, up from the 5-12 percent expected in the year ending March 2012.

Impact Shorts

More Shorts

Source: Reliance Mutual Fund

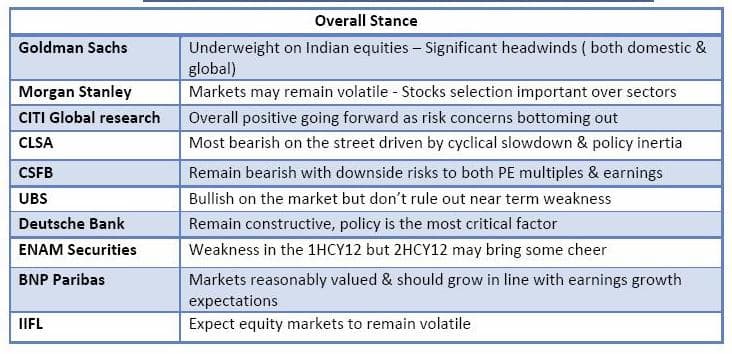

In terms of overall stance, most brokerages expect the expected: more volatility. Only Citi and UBS seemed relatively positive on Indian equities, while Enam Securities thought that the second half of 2012 could bring in cheer for Indian investors.

Source: Reliance Mutual Fund

)