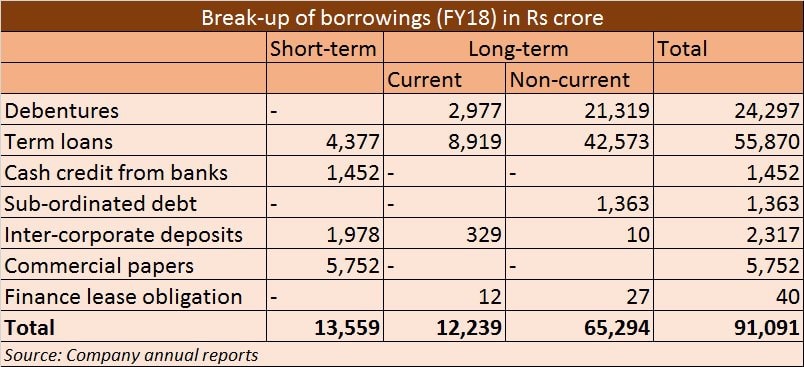

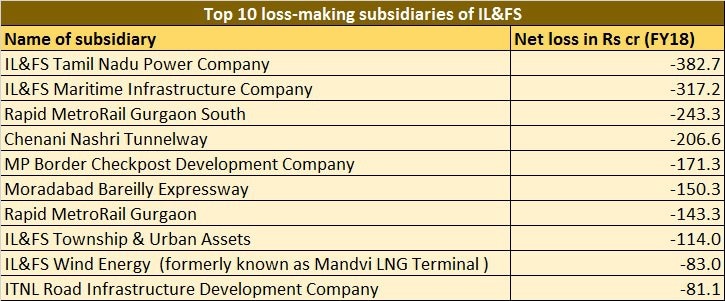

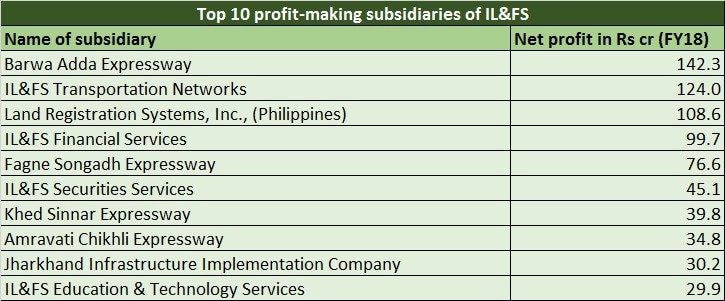

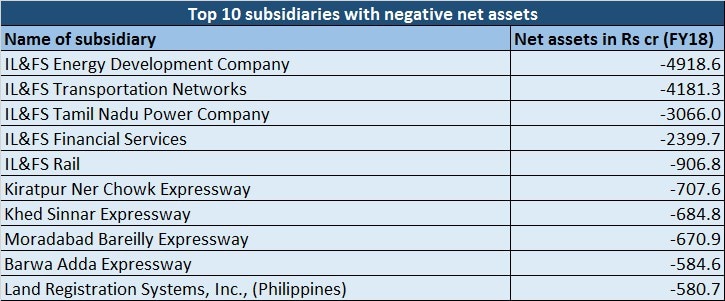

Earlier this month (4 September), it came to light that Infrastructure Leasing and Financial Services (IL&FS) group had defaulted on a short-term loan of Rs 1,000 crore from SIDBI, while a subsidiary has also defaulted Rs 500 crore dues to the development finance institution. On 14 September, it again defaulted on a repayment of Rs 105 crore commercial papers (CPs) and the next day, it defaulted on Rs 80-crore inter-corporate deposits (ICDs). On 24 September also, the crippled infrastructure conglomerate defaulted on interest payments on commercial papers, the third time in a month. “The commercial papers which were due on 24 September, could not be serviced by the company,” the company had said in a BSE filing. [caption id=“attachment_5251861” align=“alignleft” width=“380”] Representational image. Reuters.[/caption] IL&FS has come under the scanner of multiple regulators, including SEBI, for alleged defaults related to financial disclosures and corporate governance. IL&FS, which is credited for building the longest tunnel in the country (the Chenani-Nashri tunnel), is sitting on a debt pile of around Rs 91,000 crore with IL&FS alone having nearly Rs 35,000 crore, IL&FS Financial Services Rs 17,000 crore, and has been downgraded to junk status by rating agencies following the default. Of this, Rs 57,000 crore are bank loans alone, most of which are from state-run lenders. Meanwhile, a subsidiary IL&FS Financial Services has informed stock exchanges that IL&FS, the promoter and majority shareholder of the company, has filed an application with the National Company Law Tribunal, Mumbai Bench on 24 September 2018 seeking certain reliefs in connection with filing of a scheme of arrangement under Section 230 of the Companies Act, 2013 in respect of IL&FS. The company and certain subsidiaries /joint ventures/ associates of the Company (details of which are listed out in the Annexure) which scheme will be prepared in compliance with applicable law and subject to necessary consents of the shareholders, creditors, regulators and the board of directors of the respective entities, it had said. Here are eight charts that focus on IL&FS’ financials and other details: While between FY14 and FY18, IL&FS’ revenue has risen by 62.6 percent from Rs 11,561 crore to Rs 18,799 crore; the company turned from black to red - from net profit of Rs 244 crore in FY14 to a net loss of Rs 1,887 crore in FY18. While IL&FS group has a consolidated debt of Rs 91,000 crore (FY18) with IL&FS alone having nearly Rs 35,000 crore, IL&FS Financial Services Rs 17,000 crore sits as a standard asset for most of the lenders, according to a Nomura India report. The company’s debt almost doubled (up 87 percent) from Rs 48,671 crore in FY14 to Rs 91,091 crore in FY18. It has short-term debt of Rs 13,559 crore and long-term debt of Rs 77,531 crore as on 31 March 2018.

Out of IL&FS’ debt pile of Rs 91,000 crore, Rs 57,000 crore are bank loans alone. State-owned financial institutions banks have significant exposure to the company. Between FY14 and FY18, IL&FS’ total assets grew by 76 percent from Rs 65,716 crore to Rs 1,15,815 crore. State-owned LIC is the largest shareholder with a fourth of the firm’s equity, while Orix Corporation of Japan owns 23.5 percent. Other shareholders include Abu Dhabi Investment Authority with 12.5 percent stake, IL&FS Employees Welfare Trust with 12 percent, HDFC with 9.02 percent, Central Bank of India with 7.67 percent and State Bank of India (SBI) with 6.42 percent at the March-end 2018. LIC Chairman V K Sharma had said that as a shareholder it would not allow debt-ridden IL&FS to collapse and would explore options to revive it.

(With PTI inputs)

The IL&FS has come under the scanner of multiple regulators, including SEBI, for alleged defaults related to financial disclosures and corporate governance.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)