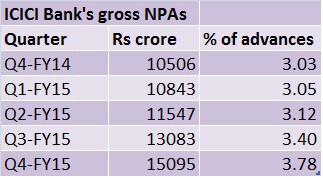

It’s not just the battered state-run banks of the country, the pain emerging from high bad loans seems to have gripped ICICI Bank, India’s second largest lender by assets, too, if one goes by the signals from banking analysts. [caption id=“attachment_2371846” align=“alignleft” width=“380”]  Reuters[/caption] Asset quality headwinds and build-up of concentration risk to a single corporate group are likely to impact the asset quality of ICICI Bank by escalating provisioning requirements, a July 29 report from brokerage Ambit Capital said. Under norms, banks need to set aside more money to cover bad and restructured loans. This impacts their profitability. “The delinquency breakup of the standard loan book suggests that early delinquencies (31-90 day due) have almost doubled from 3.6% of loans as at FY14 to 6.4 per cent of loans as at FY15,” Ambit has said in the report. Addition of fresh bad assets and increased slippages from restructured assets is likely to dent ICICI Bank’s earnings, it said. ICICI Bank is slated to announce its April-June quarter results on Friday.  “The trends are even worse in the corporate term loan book (45 per cent of the loan book) where early delinquency levels have increased to ~12% vs 5% a year ago. Given the continued weakness in the economy, some of these early delinquencies might slip into NPAs, further adding to the bank’s stressed assets,” the report said. Concentration risk Ambit has warned about the build-up of concentration risk on the book of ICICI Bank. Concentration risk is high as ICICI Bank’s exposure to a single company and “group of companies under the same management group” has increased both in percentage terms and absolute terms over the last year, Ambit said. ICICI Bank’s exposure to ‘a single corporate group’ has increased to 32.8 percent of its capital funds as of 2014-15 compared with 29.1 percent as of 2013-14, the report warned. In absolute terms, the exposure to the biggest corporate group increased ~18% on year in 2014-15. The Ambit report doesn’t name the corporate group. According to a 25 July CNBC-TV18 report, ICICI Bank has an exposure of Rs 5,780 crore to debt-ridden infrastructure firm, J P Associates. In fact, the bank has the largest exposure to the group among a host of lenders, including State Bank of India and IDBI Bank, among others. ICICI Bank has been witnessing a worsening in its asset quality in the recent quarters. The gross NPAs of the bank rose to 3.78 percent of the total loans as of end March 2015 from 3 percent in the year-ago period. The weak asset quality position has made investors risk averse, pushing ICICI Bank’s share price down by 17 percent so far this year. Until now, bad loans have been primarily a worry of the state-run banks while private banks have largely managed to retain stable asset quality. Over 90 percent of the total NPAs in the banking system are on the books of state-run banks, while private sector banks have largely managed to retain asset quality. HDFC Bank, another leading private bank, came up with a good earnings card from the April-June quarter. Gross NPAs of the bank as a percentage of total loans stood at 0.95 percent in the June quarter, slightly higher than 0.93 percent in the preceding quarter, but lower than 1.07 percent in the year-ago quarter. Axis Bank, another large private lender, too has reported a relatively lower Gross NPA level at 1.38 percent. (Data support from Kishor Kadam)

ICICI Bank has an exposure of Rs 5,780 crore to debt-ridden infrastructure firm, J P Associates

Advertisement

End of Article

)

)

)

)

)

)

)

)

)