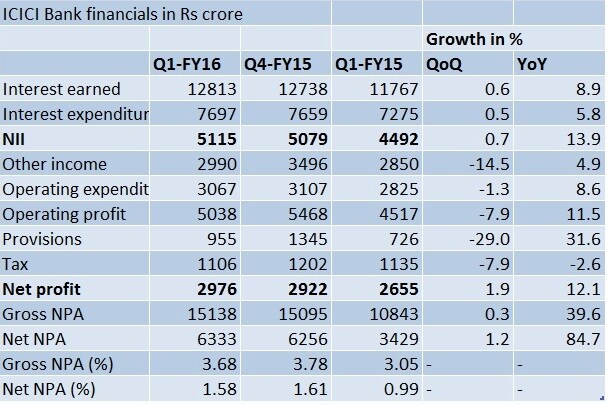

Mumbai: ICICI bank has come with a decent set of numbers in the April-June quarter. The gross non-performing assets (NPAs) of the bank, during the quarter, has shown a marginal decline, contrary to analysts’ expectations that the lender would report a higher number in the first quarter.[caption id=“attachment_2007383” align=“alignleft” width=“380”]  Making profits but concerns exist. Reuters[/caption] The provisions have also shot up on a year-on-year basis. Net profit, for the quarter, stood at Rs 2,976 crore, up 12 percent, from Rs 2,655 crore in the year-ago quarter. Provisions rose to Rs 955 crore from Rs 726 crore in the year in the corresponding period in previous year. The gross NPAs, as a percentage of total loans, marginally declined to 3.68 percent in the April-June quarter from 3.78 percent in the preceding quarter. But the total loans restructured in the quarter stood at Rs 12,600 crore from Rs 11,000 crore in the year-ago period. The incremental restructuring in the first quarter stood at about Rs 1,600 crore, while the bank witnessed fresh slippages also equal to this amount. Even though ICICI Bank’s numbers have come in line with expectations, it is a bit early to say the bank is past the worst period as far as asset quality woes are concerned. One needs to see the asset quality situation in the context of total stressed assets of the bank, which includes the restructured loans. This currently stands at closer to 7 percent of the total loan book.  Among the large private banks, ICICI bank has the largest exposure to high-risk segments such as metals and mining projects. Till 31 March, the bank has total exposure of Rs 37,600 crore to the metal sector and about Rs 7,300 crore to mining. Together these two segments constitute 10.2 percent of its loan book. As against this, this ratio is 6.8 percent to Axis bank. Also, as a 29 July Ambit report pointed out recently, ICICI Bank is running a risk of build up of concentration in its loan book. Concentration risk is high as ICICI Bank’s exposure to a single company and “group of companies under the same management group” has increased both in percentage terms and absolute terms over the last year, Ambit said. ICICI Bank’s exposure to ‘a single corporate group’ has increased to 32.8 percent of its capital funds as of 2014-15 compared with 29.1 percent as of 2013-14, the report warned. In absolute terms, the exposure to the biggest corporate group increased 18 percent on year in 2014-15. The Ambit report doesn’t name the corporate group. But, according to a 25 July CNBC-TV18 report, ICICI Bank has an exposure of Rs 5,780 crore to debt-ridden infrastructure firm, JP Associates. In fact, the bank has the largest exposure to the group among a host of lenders, including State Bank of India and IDBI Bank, among others. “The ICICI Bank April-June quarter numbers are decent. But it is early to say the worst is over,” said Vaibhav Agrawal, vice-president, research at Angel Broking. Improvement in stressed assets will depend on how fast the economic recovery takes shape. A clear picture on the asset quality trend will emerge only after a few quarters. (Kishor Kadam contributed to this story)

The gross NPAs, as a percentage of total loans, marginally declined to 3.68 percent in the April-June quarter from 3.78 percent in the preceding quarter.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)