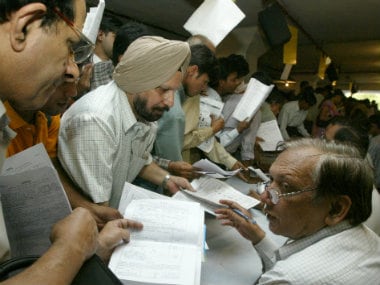

It has become customary and fashionable for the government to appear martinet-strict about deadlines only to relent on the D-day. The same was in evidence on 31 July, 2017, the last date for non-business income-tax payers to file their income-tax returns (ITR) for the assessment year 2017-18. The Finance Minister Arun Jaitley had sternly told the nation in the morning that the deadline was cast in stone and no extension would be available only to eat his words in the evening! It is now also customary for the government of all political persuasions to slam the tax evaders while announcing a tax amnesty scheme in the next breath with a stern warning each time—last opportunity to come clean. It is better to avoid stentorian warnings and announcements if you know for sure that at the end of the day you are going to look sheepish by relenting. Be that as it may.  The government should have known that with as many as one million new taxpayers registering themselves with GSTN, there was bound to be an encore on the income-tax front also, having been effectively smoked out. It should have beefed up the ITR servers a la the Indian Railway Catering and Tourism Corporation (IRCTC) which is fully geared to take on the online railway ticket booking rush including the seasonal ones. At any rate, the eleventh-hour warning to the eleventh-hour ITR filers is simply not desirable as it only makes everyone including the computers and the system trip. Instead the following three steps could have been taken: 1. It was foolish on the part of the government to implement penalty for belated return from the assessment year 2018-19. Budget 2017 which introduced this measure should have rolled out this salutary measure from the assessment year 2017-18 itself. As it is there is no penalty if there is no tax due except when ITR is not filed even by 31 March of the assessment year in which case a flat penalty of Rs 5,000 could be levied. 2. Penalty to be meaningful should go up with every passing day. From next assessment year, the penalty is Rs 5,000 for delays up to 31 December of the assessment year and goes up to Rs 10,000 thereafter but is capped at Rs 10,000 where the income doesn’t exceed Rs 5 lakh. 3. There should be rewards for early birds like quicker refunds along with higher interests. It must be remembered that ITR must be filed on time even for assessment year 2017-18 for the following reasons: 1. Normally interest @ 1 percent per month is paid on excess tax paid reckoned from the beginning of the assessment year i.e. 1 April, but for late filers the interest clock starts ticking only from the date of filing of return; 2. Those who deposited cash during the demonetisation period have to file their returns on time lest the department snaps at their heels constantly; and 3. Losses except from house, property cannot be carried forward for a set-off in future unless ITR was filed on or before the due date. The due date has been extended by five days i.e. till 5 August, 2017. While this could keep those filing during these five days at par with those who filed on or before 31 July, 2017, the department is guilty of encouraging sloth both on the part of last-minute filers and the systems managers. It sends the laughable message that the government is bound to blink first though at the eleventh hour. More laughable is the latitude given—file during these five days first and then link your PAN and Aadhaar by 31 August 2017. Why? What is the tearing hurry in allowing people to jump the gun? If the linking of the two documents is as simple and robust as was touted then why postpone the denouement? Mark my words, there would be another sheepish relaxation—those who are unable to link the two can authenticate or verify their returns by signing the printed return and posting it to income-tax IT cell at Bangalore. For God’s sake do not prescribe deadlines unless you are confident of adhering to it by putting your foot down come what may. Server collapse is an excuse that can wash with online sellers but not with law-enforcing agencies.

The Finance Minister Arun Jaitley had sternly told the nation in the morning that the deadline was cast in stone and no extension would be available only to eat his words in the evening.

Advertisement

End of Article

)