Kingfisher’s continuing troubles are having at least one good effect on the sector - they’re reducing over-capacity and improving yields for other airlines that can still manage to fly passengers.

According to a Kotak Institutional Equities report dated 19 March, yields (revenues per passenger per kilometre) have stayed strong in the current quarter because of the constantly reducing capacity of Kingfisher.

[caption id=“attachment_250583” align=“alignleft” width=“380” caption=“Currently, cash-strapped Kingfisher is operating just 100 flights a day. Reuters”]

[/caption]

[/caption]

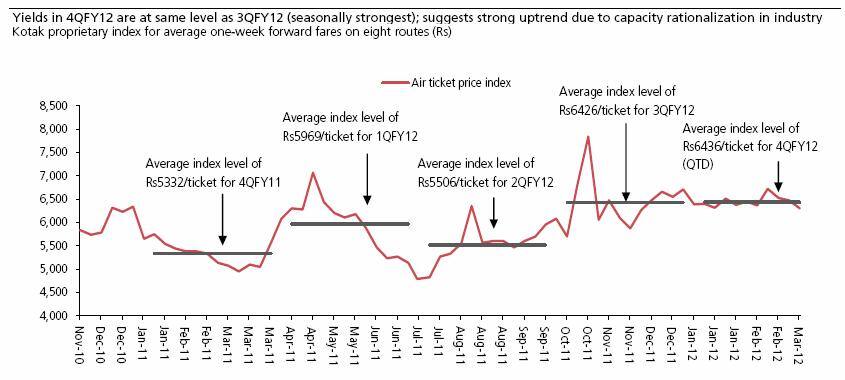

According to the brokerage’s proprietary index, the average one-week forward fares for eight routes are marginally higher than the fares seen in the December-ending quarter, traditionally the strongest quarter for the aviation industry.

“Our index for average one-week forward fares on eight routes is up about 0.5 percent in 4QFY12 (January-March 2012) versus 3QFY12 (December-ending quarter). As per usual trends observed in the past years, yields in 4Q go down an average of about 5-7 percent from average levels of 3Q,” the report says (click on chart below for expanded view).

[caption id=“attachment_250516” align=“aligncenter” width=“617” caption=“Source: Kotak”]

[/caption]

[/caption]

Currently, cash-strapped Kingfisher is operating just 100 flights a day. That means the airline is operating just 16 aircraft, assuming that one aircraft on average makes 6.25 flights a day, Kotak says. Its market share would have also slipped to single digits from around 12 percent in January. “In view of the cash-flow problems being faced by the airline, it is unlikely that the airline would be able to restore operations,” the brokerage report notes.

Impact Shorts

More ShortsKotak estimates Kingfisher’s fewer operating aircraft have reduced the industry’s capacity by 12 percent. “In our understanding, none of the players in the industry would increase their capacity by more than 10-12 percent,” it adds.

It believes in the new financial year starting 1 April, capacity additions in the sector will be practically flat or in the low single-digits. That means even with a 8-10 percent growth in passenger numbers, the passenger load factor, which measures an airline’s passenger carrying capacity, will rise and aid in keeping yields at current levels.

In fact, if fuel prices correct by 10-12 percent, SpiceJet could return to profitability, the brokerage predicts. Kotak has a ‘buy’ rating on the airline with a target price of Rs 45. The stock is currently trading at Rs 23.

However, it maintains a ‘sell’ rating on Jet Airways as it thinks cash-flow issues could affect the financial recovery of the airline. The stock is currently trading at Rs 337.85.

)