When the going gets tough, the usual practice is to hoard cash and slash dividends. Declining profitability and high debts should force promoters to adopt a conservative approach when it comes to dividend payouts, but India’s real estate sector thinks otherwise.

At a time when most real estate developers are facing a financial crunch because of high interest rates, drying up of cash flows from banks and slowing sales volumes, the promoters of these companies are busy rewarding themselves with hefty dividends.

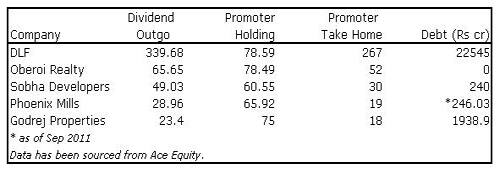

Ironically, realty companies like DLF, Oberoi and Prestige Estates, where promoter holding is more than 50 percent, have doled out massive dividends. Promoters of India’s largest real-estate developer, DLF, which has a total debt pile of Rs 22,545 crore, hold more than 78 percent in the company. The company has given dividend worth Rs 339 crore, of which Rs 267 has been pocketed by promoters.

[caption id=“attachment_365295” align=“alignleft” width=“380” caption=“By dolling out dividends they are signalling that it is time to cash out as they will not be able to deliver returns going forward. Reuters”]

[/caption]

[/caption]

Meanwhile, Oberoi Realty, whose debt is nil, has gifted its shareholders Rs 52 crore of the total dividend payout of Rs 65 crore. Sobha, Phoenix Mill, and Godrej Properties are other listed companies that have made the promoters extremely rich this quarter.

This is despite big real estate developers resorting to desperate measures like selling their land banks, half-finished projects and other non-core assets to reduce the burgeoning debt burden.

Impact Shorts

More ShortsSee chart below:

[caption id=“attachment_365324” align=“aligncenter” width=“500” caption=“Chart:Sanjit Oberoi/Firstpost”]

[/caption]

[/caption]

Such a move basically has two implications:

1 The builder is trying to paint a rosy picture for the investor to improve his brand image.“He is trying to win brownie points by showing that he is sharing his profits with investors even when the market is down and out,” an industry expert told Firstpost. But when the promoter is the largest stakeholder, this logic pales.

2. It is clear that builders and promoters know they can no longer fudge the accounts and the balance-sheet. By dolling out dividends they are signalling that it is time to cash out as they will not be able to deliver returns going forward.

“The balance-sheets of realty players is similar to that of Satyam, except they can polish it with much ease,” another expert told _Firstpost o_n condition of anonymity. Builders are well aware of the financial stress, but camouflage this stress by polishing the balance-sheet over and over again. The easiest way of doing this is by showing income as advances instead of revenues. For example, if a builder sells a flat for Rs 1 crore, but receives an advance payment of Rs 5 lakh, he will record it as an advance and not as a revenue. Revenues are only recorded when the builder begins the construction of a builder. All other advance payments are recorded as advances, which helps them paint a rosy picture in terms of profit margins.

But knowing that investors will sooner or later figure out the manipulation in accounts, builders are probably doling out dividends to avoiding further deterioration in market valuations.

Shobhit Agarwal, Joint Managing Director - Capital Markets, Jones Lang LaSalle India, said this would be in line with their strategy to retain shareholder interest in a time of market turmoil. One of the metrics used to evaluate stock performance is the dividend yield. “The primary intention would therefore be to prevent the shares of the company from falling further,” he said.

)