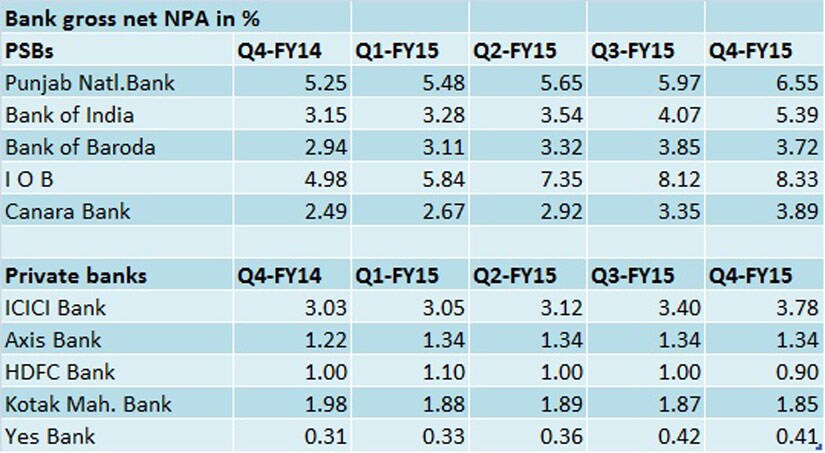

Private sector banks have begun the earnings quarter (April-June) on a healthy note. HDFC Bank, the first large private bank announcing the results, has come up with a good earnings card. Profit numbers have been healthy and the asset quality is stable even though there is slight increase in stress sequentially. Net profit came at Rs 2,695 crore in the first quarter as compared with Rs 2,233 crore in the year-ago quarter. Gross non performing assets (NPAs) as a percentage of total loans stood at 0.95 percent in the June quarter, slightly higher than 0.93 percent in the preceding quarter, but lower than 1.07 percent in the year-ago quarter. Bank’s overall provisioning burden, which includes that from bad loans, has gone up in the quarter to Rs 728 crore from Rs 482 crore in the year-ago period. [caption id=“attachment_2354606” align=“alignleft” width=“380”]  Reuters[/caption]The notable trend HDFC Bank numbers indicate is that private banks continue to beat the economic downtrend, while their public sector counterparts, except State Bank of India (SBI), are finding it difficult to do so mainly due to their poor capital base. Other private banks, which will announce their earnings in the weeks ahead, are likely to log good numbers. But that might not be the case with state-run banks. They are likely to report high NPAs in the April-June quarter as well. Going by the current indications, banks with major exposure to the infrastructure and power sectors are likely to experience asset quality shocks in the June quarter, since there has not been any material improvement in project implementations so far and fresh capital formation. Any revival might take a few more quarters. Big chunk of bad and restructured loans require banks to set aside substantial amount of money as provisions under the current norms. For newly restructured loans, the provisioning required is 15 percent of the total loan value. If the asset goes totally bad, the provisions can rise to 100 percent. Rise in stressed assets in recent years have thus added to the capital requirement of banks.  The government’s flip-flop on the bank capitalisation plan has added to the confusion. Finance minister Arun Jaitley, who initially refused to capitalise banks with adequate capital citing performance issues, has now been forced to rethink on the strategy, after much persuasion from the Reserve Bank of India. But even with the proposed additional capital infusion of about Rs 11,200 crore (above the budgeted Rs 8,000 crore), the government would not be able to sufficiently capitalise government banks since they need capital also to meet Basel-III norms and fund credit expansion besides making provisions on stressed assets. Cutting the government’s stake in these banks and letting these banks open to private investments are the long-term solution. The government’s strategy with respect to state-run banks has been wrong from the early days of this government. The NDA government has largely followed the model of the UPA when it comes to denying operational autonomy to state-run banks. When state-run banks were pushed to lend aggressively to high-risk infrastructure and agriculture, without being able to ensure the end-use, the health of their balance sheets deteriorated further. Jaitley should do his research on how private banks have managed to beat the phase of economic downtrend while state-run banks have been continuously hit hard. The key differentiating factor has been the freedom to take business decision and operate without external intervention (read political and business interests) — something absent in state-run banks even today. Currently, over 90 percent of the bad loans in the banking system (about Rs 3 lakh crore) is on the books of state-run banks. The distribution of restructured assets in the banking system also follows the same pattern. It would be useful for the government to plug the holes while doing it math on bank recapitalization, so that the taxpayers’ money is spent wisely. (Kishor Kadam contributed to the story)

It would be useful for the government to plug the holes while doing it math on bank recapitalization, so that the taxpayers’ money is spent wisely

Advertisement

End of Article

)

)

)

)

)

)

)

)

)