There are news reports that Finance Minister Nirmala Sitharaman held two separate meetings—one with realtors’ associations and other with homebuyers’ groups, to discuss how to strengthen the realty sector. The government is deliberating on offering a Goods and Services Tax (GST) boost to the real estate sector. [caption id=“attachment_4219349” align=“alignleft” width=“380”]

Representational image. Reuters[/caption] News reports state that “homebuyers who met the minister proposed that GST on premium housing projects be increased from the existing 5 percent (excluding input tax credit) to 8 percent (including input tax credit) — a move that would eventually reduce the cost of a project substantially”. The said news report also stated that “the present GST regime of 5 percent without ITC (input tax credit) is actually translating into a tax burden of around 14 percent for consumers". This calls for an analysis of the numbers and an investigation of whether the stated arguments are true or not. A quick back of the envelope calculation gives a very different picture. To begin with, there is a need to discuss some basics. Goods and Service Tax (GST) is levied on the sale price of the goods by the supplier. The buyer is able to use that GST as Input Tax Credit (ITC). This goes in the following manner elaborated in Table 1 below. Say a person buys goods worth Rs 100 and has to pay 5 percent GST on the same, which is Rs 5. This translates in a total price of Rs 105. When the same person later sells the same goods for say R. 150 and has to pay 5 percent GST then he will collect Rs 7.50 from his customer. Now he has collected Rs 7.5 as GST from his customer but he will not have to pay full Rs 7.50 to the government. He will deduct Rs 5 he paid to his supplier as GST on purchase of raw materials, and pay the balance Rs 2.50 to the government. This deduction of Rs 5 from Rs 7.50 is called as Input Tax Credit (ITC). This ITC set-off is available in the purchase of nearly all goods and services. Here it is pertinent to note that weighted average GST on construction cost is around 18 percent. This is because materials like cement and bathroom fittings attract a GST rate of 28 percent and TMT Steel Bars, services, labour, etc., attracts a GST rate of 18 percent. The GST rate on gravel and crushed stones, tiles, etc is 5 percent, whereas bricks attract a GST rate of 12 percent. Weighted average levy of GST comes to around 18 percent. In all further calculations, a weighted average GST rate of 18 percent is used. This could vary based on the location of the project and type of construction. Again for the purposes of this analysis, construction cost is assumed to be Rs 2,500 per sq ft and this cost can also change depending on the location of the project and input costs and type of construction. A Grade C quality G+4 product can be constructed for as low as Rs 1,500 per sq ft whereas a Grade A high rise tower would cost as high as Rs 7,000 per sq ft or even higher. The argument made by the real estate sector is that the increase in GST Rates with ITC benefits will help in making real estate affordable for consumers. Whether that is true or false is highlighted in Table 2 below.

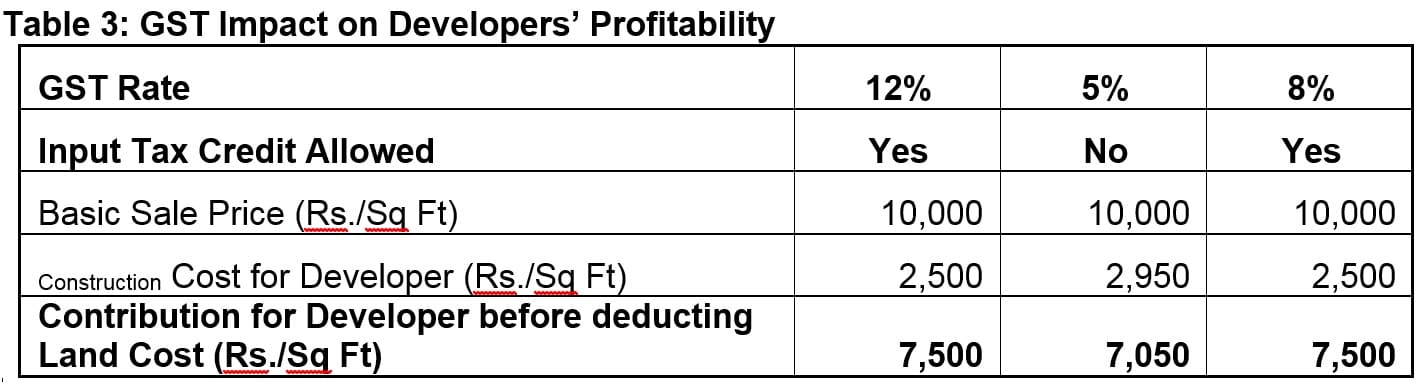

As the table above depicts, India had a 12 percent GSTrRate on residential housing units (which don’t come in affordable housing) till March 2019. Then from March 2019, GST rates were reduced to 5 percent for the same. The only difference was that in case of 12 percent GST, the developers got ITC and hence were paying GST to the government after deducting GST paid on the purchase of goods and services. However, the new 5 percent GST rate that was applicable from March 2019 did not have that facility of claiming ITC for GST paid on the purchase of goods and services. On a quick study of calculation in Table 2 above it is visible that government reduced GST rate from 12 percent (with ITC) to 5 percent (without ITC) and the total GST earned by the government reduced from Rs 1,200 per sq ft to Rs 950per sq ft. At the same time, the net price of real estate for consumers fell from Rs 11,200 per sq ft to Rs 10,500 per sq ft. If the government accepts the proposal of increasing GST rate to 8 percent (with ITC), then net tax collected by the government will reduce to Rs 800 per sq ft, while the net price of the same property will increase to Rs 10,800 per sq ft for the buyer. To summarise Table 1, if this new proposal is accepted then both the Government and consumers will be hurt. However, in this whole process of revising GST Rate and changing from non-availability of ITC to availing ITC, the beneficiary happens to be the real estate sector. That is elaborately highlighted in Table 3 below.

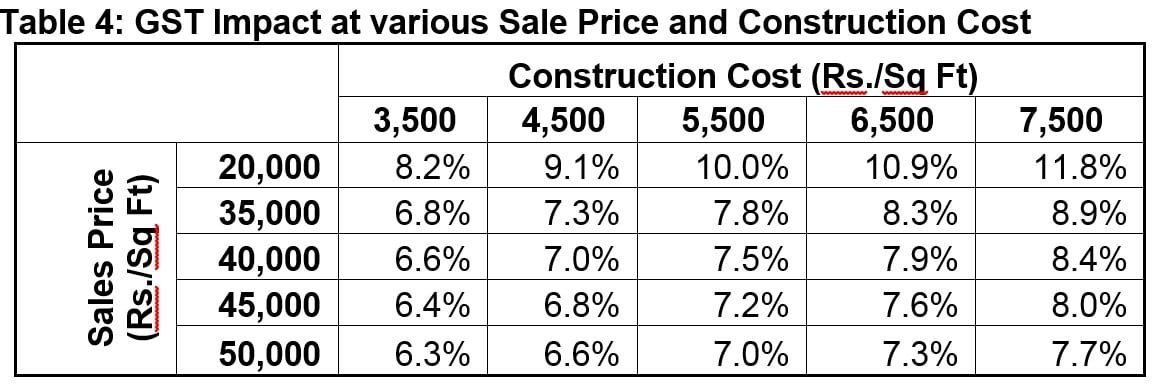

As is now very well known, when ITC is allowed for set-off against payment of GST, then the amount of GST paid on purchases is not part of the cost. This is because GST paid on the purchase is adjusted against the payment of GST to the Government from GST collected from the customers. This is shown in Table 1 above. However, if the GST is not allowed for set-off as ITC, then the said GST paid on the purchase of goods and services becomes a part of the cost structure. In the case of 5 percent GST (without ITC) the construction cost would increase to Rs 2,950 per sq ft as against Rs 2,500 per sq ft in case ITC was allowed. As a result, the profitability of the developer would fall from Rs 7,500 per sq ft when ITC is allowed to Rs 7,050 per sq ft when ITC is not allowed and the said ITC amount has to be factored as an increased cost. Here it is pertinent to note that there is an impact of anti-profiteering provisions. This is because earlier in pre-GST era, excise duty on products like steel, cement, etc., was not allowed for set-off and hence became a part of the total cost structure. With the enactment of GST, excise was replaced with GST and it was allowed for set-off as ITC. Thus the cost of construction reduced to that extent. A very quick calculation of what is the total tax payable in case of 5 percent GST (without ITC) shows that highest impact of GST paid as a percentage of Basic Sale Price would be when construction cost is as high as Rs 7,500 per sq ft on a Basic Sale Price of Rs 20,000 per sq ft. The said percentage stands at 11.8 percent or for sake of convenience it can be considered as 12 percent. However, once the Basic Sale Price Starts increasing then the total GST paid as a percentage of Basic Sale Price starts reducing. This is highlighted in Table 4 below.

To sum up this proposal of increasing GST Rate to 8 percent and allowing ITC is detrimental to both the government and consumers. The government will get lesser GST revenue despite the fact that consumers will be shelling out more money from their pockets due to a higher GST rate. The only party benefited by that move is the real estate developers, who will be able to reduce their construction cost by availing ITC and thereby increase their profitability. (The writer is a Chartered Accountant and a Financial Consultant, author of “Diagnosing GST for Doctors” published by CNBC Books18 and commentator on economic and financial matters. He tweets at @sumeetnmehta)

This proposal of increasing GST Rate to 8 percent and allowing ITC is detrimental to both the government and consumers

Advertisement

End of Article

)

)

)

)

)

)

)

)

)