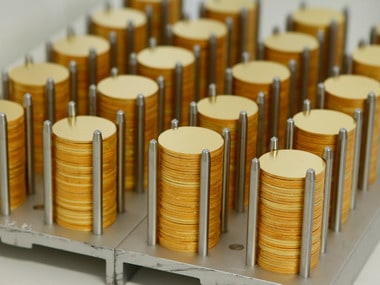

Gold rose to its highest level in more than three months on Tuesday, capping its best year in nearly a decade, on weakening dollar and year-end buying in thin-volume trading. Spot gold hit its highest since 25 September at $1,524.20 and was last up 0.5 percent to $1,522.89 per ounce by 0405 GMT. US gold futures rose 0.4 percent to $1,524.70. Bullion is set to post its best year since 2010, having gained nearly 19 percent, mainly driven by a tariff war between the world’s two largest economies and quantitative easing by major central banks. “One of the main drivers behind gold’s gain is the weakening in the dollar,” said Margaret Yang Yan, a market analyst at CMC Markets, adding prices are also rising on bargain hunting in year-end. [caption id=“attachment_5889311” align=“alignleft” width=“380”]  Representative image. Reuters[/caption] The dollar slipped against a basket of rivals, making gold cheaper for holders of other currencies “However, the upside is kind of limited because quantitative easing or rate-cutting cycle has come to an end for now and we don’t see a possibility of any rate cuts in 2020,” Yan said. The US Federal Reserve cut interest rates three times this year before agreeing to pause. Lower interest rates reduce the opportunity cost of holding the non-yielding bullion. On the trade front, a Phase 1 deal was likely to be signed next week, White House trade adviser Peter Navarro said on Monday. “With liquidity much reduced in Asia, there is some potential for gold to spike higher on low volume with some risk hedging added into the mix,” said Jeffrey Halley, senior market analyst, Asia Pacific at OANDA in a note. “The next resistance is at $1,535 an ounce.” Asian shares slipped as investors locked in gains. Speculators raised their bullish positions in COMEX gold contracts in the week to 24 December. Elsewhere, palladium rose 0.2 percent to $1,910.31 per ounce. Plagued by sustained supply deficit, it was the biggest precious metal gainer this year with a gain of over 51 percent, its best since 2017. The price of the metal, used mainly in catalytic converters in vehicles, rose to an all-time peak of $1,998.43 on 17 December. Silver rose 1.1 percent to $18.12 and was poised to register its best year since 2010, rising about 17 percent. Platinum gained 1.4 percent to $971 and for the year was set to gain about 23 percent, its best since 2009.

The dollar slipped against a basket of rivals, making gold cheaper for holders of other currencies

Advertisement

End of Article

)

)

)

)

)

)

)

)

)