A day after touching an all-time-high level,

gold prices on Friday slipped Rs 140 but traded above the Rs 38,000-mark at Rs 38,330 per 10 gram, on easing demand from jewellers despite the precious metal gaining overseas and sustaining above the psychological level of $1,500 an ounce. According to the All India Sarafa Association, in the national capital, gold of 99.9 percent and 99.5 percent purity reduced Rs 140 to Rs 38,330 and Rs 38,160 per 10 gram, respectively. Sovereign gold, however, remained steady at Rs 28,500 per eight grams. On Thursday, gold touched the Rs 38,000-mark for the first time by soaring Rs 550 to hit a fresh high of Rs 38,470 per 10 gram. The rise in gold prices hasn’t impacted footfalls much, primarily because the demand has been muted due to the current month being considered inauspicious for gold purchases in some regions in the country and also because of the monsoons that have raged havoc in some states. [caption id=“attachment_4295239” align=“alignleft” width=“380”] Representational image. Reuters[/caption] Jewellers do not rule out consumers buying the precious metal once the festival season begins next month. By 15th of this month, the marriage season will begin in the south and customers will begin shopping for weddings and related events, they said. “The quantity of gold that will be purchased will be considerably down owing to the rise in price of gold,” said Ashish Pethe, partner, Waman Hari Pethe Jewellers, a Mumbai-based jeweller. Purchase of gold for investment, however, is going up. But there is muted demand for gold jewellery for social obligations though customers are curbing their consumption owing to hike in prices, said Suvankar Sen, fourth-generation scion of the Kolkata-based Senco Gold and Diamonds which has close to 100 stores in 25 cities. The price of gold has shot up primarily on account of the US-China trade war, the softening of interest rates by the US Fed, and the consistent buying of gold by central banks across the globe. Central banks bought 224.4 tonnes of gold in Q2 2019**.** This took H1 buying to 374.1 tonnes – the largest net H1 increase in global gold reserves in 19-year quarterly data series, said World Gold Council, a market development organisation for the gold industry.

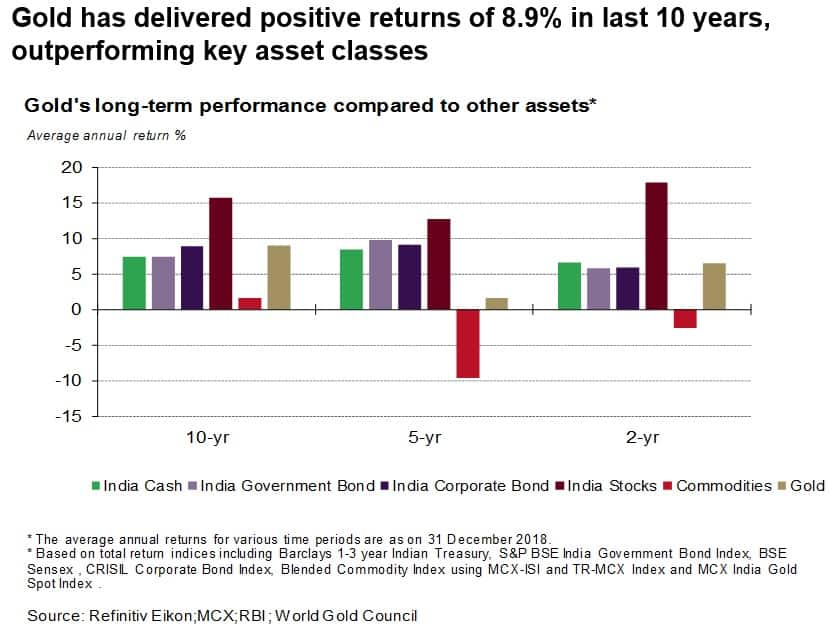

The US-China trade war shows no signs of abating and US President Donald Trump does not seem to be wanting to do anything much to solve the situation, said analysts. The US Federal Reserve cut the benchmark lending rate on 31 July for the first time in more than a decade, moving to stimulate the economy after a year of sustained pressure from President Donald Trump. The target for the federal funds rate is now 2.0-2.25 percent, 25 basis points lower. The price of gold is expected to rise further this year. However, some analysts were of the view that Rs 40,000 for 10 grams of gold could be the high-water mark and the price of gold may not go up beyond this figure. “I feel the price situation will worsen this year primarily because of the US-China trade war situation,” said Anantha Padmanabhan, Chairman, All India Gems and Jewellery Council. “One of the reasons for the continuing rise in gold prices is that investors have started moving from investing in equities to gold as the stock markets have been quite volatile,” he said. Gold continues to be the best asset class and the purchase of gold will be high given the geo-political situation, said Somasundaram PR, Managing Director, World Gold Council. “The stock markets have been volatile for some time. Gold is an asset class that will give the investor returns in the long-term”, he said, explaining why the yellow metal was increasingly preferred as an investment in present times. “Some of the price hikes in gold is due to momentum investing,” he added. Central banks across the globe are diversifying into gold and this has contributed majorly to the sharp spike in gold prices, Somasundaran said. In 2018, 660 tonnes of gold was purchased by central banks. Gold is seen as a safe haven and governments investment in gold has gone up across the globe, he said. (With agency inputs)

The US-China trade war shows no signs of abating and US President Donald Trump does not seem to be wanting to do anything much to solve the situation, said analysts. The US Federal Reserve cut the benchmark lending rate on 31 July for the first time in more than a decade, moving to stimulate the economy after a year of sustained pressure from President Donald Trump. The target for the federal funds rate is now 2.0-2.25 percent, 25 basis points lower. The price of gold is expected to rise further this year. However, some analysts were of the view that Rs 40,000 for 10 grams of gold could be the high-water mark and the price of gold may not go up beyond this figure. “I feel the price situation will worsen this year primarily because of the US-China trade war situation,” said Anantha Padmanabhan, Chairman, All India Gems and Jewellery Council. “One of the reasons for the continuing rise in gold prices is that investors have started moving from investing in equities to gold as the stock markets have been quite volatile,” he said. Gold continues to be the best asset class and the purchase of gold will be high given the geo-political situation, said Somasundaram PR, Managing Director, World Gold Council. “The stock markets have been volatile for some time. Gold is an asset class that will give the investor returns in the long-term”, he said, explaining why the yellow metal was increasingly preferred as an investment in present times. “Some of the price hikes in gold is due to momentum investing,” he added. Central banks across the globe are diversifying into gold and this has contributed majorly to the sharp spike in gold prices, Somasundaran said. In 2018, 660 tonnes of gold was purchased by central banks. Gold is seen as a safe haven and governments investment in gold has gone up across the globe, he said. (With agency inputs)

The loose monetary policies of countries and the central banks across the globe diversifying into gold has also contributed majorly in the sharp spike in gold prices,

Advertisement

End of Article

)

)

)

)

)

)

)

)

)