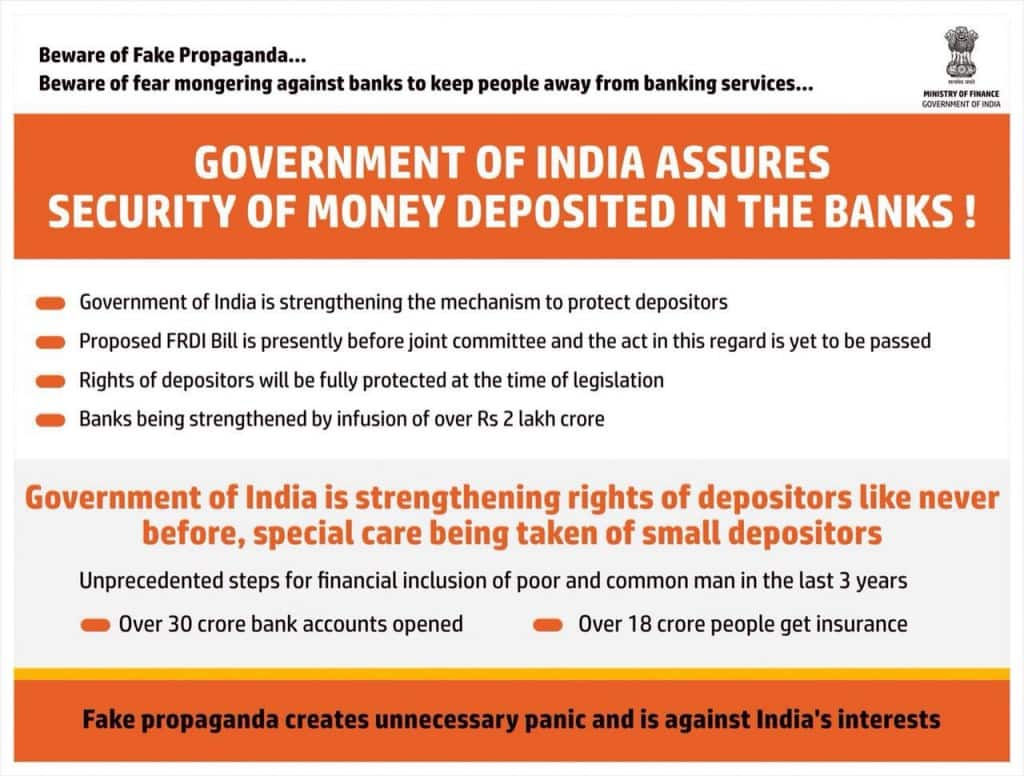

New Delhi: Seeking to allay concerns of depositors over provisions of a draft law, Finance Minister Arun Jaitley on Monday said the government will fully protect public deposits in financial institutions even as he hinted at openness to changes in the proposed FRDI Bill. Jaitley said the government’s massive Rs 2.11 lakh crore capital infusion plan in banks was to strengthen banks and there was no question of any lender failing. If any such situation arises, the government will “fully protect” the deposits made by customers, the finance minister said here adding that “the government is very clear about it”. Jaitley made the comment to allay concerns with regard to a provision in the Financial Resolution and Deposit Insurance (FRDI) Bill, 2017, first introduced in the Lok Sabha in August this year and currently undergoing scrutiny by a joint parliamentary committee. [caption id=“attachment_4239155” align=“alignleft” width=“380”] File image of Finance Minister Arun Jaitley. PTI[/caption] The so-called “bail-in” clause in the draft legislation has been commented upon by experts as of bringing potential harm to deposits, in the form of savings accounts. “The Bill is before the joint committee of Parliament. Whatever are the recommendations of the committee, the government will consider,” he said. He said rumours are being spread about the provisions of the bill. “The government has already clarified and said it is committed to strengthen PSU banks and financial institutions. About Rs 2.11 lakh crore is being pumped in to strengthen the public sector banks.” The FRDI Bill proposes to create a framework for overseeing financial institutions such as banks, insurance companies, non-banking financial services (NBFC) companies and stock exchanges in case of insolvency.

The ‘Resolution Corporation’, proposed in the draft bill, would look after the process and prevent the banks from going bankrupt. It would do this by “writing down of the liabilities”, a phrase some have interpreted as a “bail in”. The draft bill empowers Resolution Corporation to cancel the liability of a failing bank or convert the nature of the liability. It does not specify deposit insurance amount. At present, all deposits up to Rs 1 lakh are protected under the Deposit Insurance and Credit Guarantee Corporation Act that is sought to be repealed by this bill.

The ‘Resolution Corporation’, proposed in the draft bill, would look after the process and prevent the banks from going bankrupt. It would do this by “writing down of the liabilities”, a phrase some have interpreted as a “bail in”. The draft bill empowers Resolution Corporation to cancel the liability of a failing bank or convert the nature of the liability. It does not specify deposit insurance amount. At present, all deposits up to Rs 1 lakh are protected under the Deposit Insurance and Credit Guarantee Corporation Act that is sought to be repealed by this bill.

Arun Jaitley made the comment to allay concerns with regard to a provision in the Financial Resolution and Deposit Insurance (FRDI) Bill, 2017, first introduced in the Lok Sabha in August this year and currently undergoing scrutiny by a joint parliamentary committee

Advertisement

End of Article

)

)

)

)

)

)

)

)

)