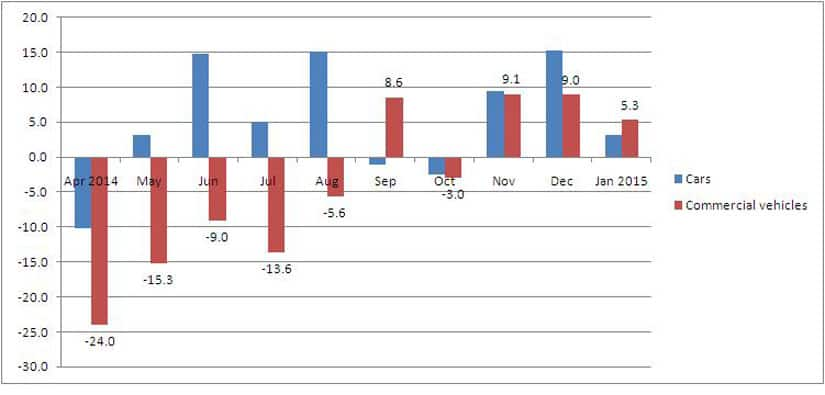

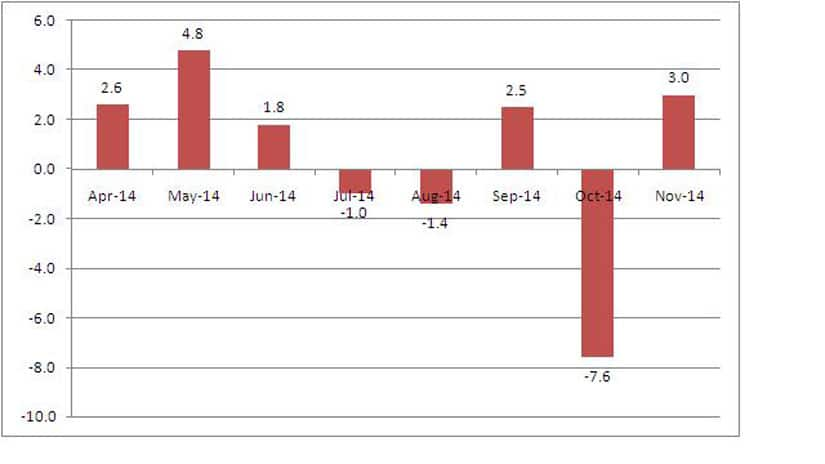

First we were told that in 2013-14, Indian economy actually grew by 6.9 percent and that the sub-5 percent growth rate estimated earlier was a myth. Now, here is a bigger surprise: India is expected to grow at 7.4 percent in the fiscal year 2015, at the same pace China grew in 2014. In other words, as news reports said, India has theoretically become world’s fastest growing economy. The revision in the GDP growth estimates has been affected due to a change in the base year for computing national accounts to 2011-12 from the earlier 2004-05. As part of this exercise, new methodology and data have been incorporated while computing the GDP number. [caption id=“attachment_2091055” align=“alignleft” width=“380”]  Reuters[/caption] Credit assessor, India Ratings, in a recent note had pointed out that such base year change is a global phenomenon. The agency even suggested that “the base year should be changed frequently considering fast-changing economic structure and to update/estimate national accounts based on latest available information”. According to a 1 February press release, real GDP or GDP at constant (2011-12) prices stood at Rs 92.8 lakh crore and Rs 99.2 lakh crore in 2012-13 and 2013-14, respectively. This would mean a growth of 5.1 percent during 2012-13, and 6.9 percent during 2013-14. Under the old method, these numbers stood at 4.5 percent and 4.7 percent respectively. Going by the fresh base, the advanced GDP growth estimate for the current fiscal year stands at 7.4 percent. Experts, however, are not buying the new estimate on the face value. As this _Firstpost_ article argues , there is nothing much on the ground to suggest that the economy is booming. Here are four graphics that say what is wrong with the over-the-top GDP estimate: Vehicle sales data  The recovery in car sales, an indication of consumer sentiment, has been wobbly. So is the case with the commercial vehicle sales data. In a high-growth economy, commercial vehicle sales will also boom signifying a buoyant economic activity. As per the data from the Society for Indian Automobile Manufacturers, in January 2015 car sales rose a meagre 3.1 percent on year and commercial vehicle sales rose just 5.3 percent. A month earlier, which was also the festival season, sales in both the vehicle segments were 15.3 percent and 9 percent higher over the year-ago period. The latest data shows consumers have become less confident. Bank credit  There is yet no meaningful pick up in bank credit offtake as banks’ loan growth is lagging at just 9.6 percent in December. Corporations are not yet confident of kick starting the investment cycle. Industrial activity, which had come to a standstill towards the end of the UPA regime, continues to lag, as reflected by the bank credit growth trend. Direct tax collection  Gross direct tax collection stood at about 13 percent, falling short of the budget estimate of 16 percent. It stood at Rs 5.46 lakh crore during the April-December 2014, just 12.8 percent higher than the year-ago period. Net direct tax mop-up, meanwhile, rose just 7.4 percent to Rs 4.48 lakh crore and corporate tax 12.9 percent to Rs 3.50 lakh crore. Budget estimated the direct tax collections in the current year grow 16 percent to Rs 7.36 lakh crore. An increase in tax collection denotes higher profitability of the companies. That’s just not happening yet. Manufacturing sector output  Though on a whole, the index of industrial production is seen marginally better manufacturing sector output is lagging. In November 2014, the production just rose 3 percent on year after a 7 percent decline the month earlier. While as per the GDP estimate, the manufacturing sector output is should see a 6.8 percent growth, Care Ratings feels, given the volatility in the data, the growth can only be 2-3 percent. (Data support by Kishor Kadam)

Experts, however, are not buying the new estimate on the face value; here are four graphics that explain why.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)