Mumbai’s Esplanade court extended the police custody of former Punjab and Maharashtra Co-operative Bank (PMC) chairman Waryam Singh and Housing Development and Infrastructure Limited (HDIL) directors Rakesh Wadhawan and Sarang Wadhawan till 16 October. The Economic Offences Wing (EOW) arrested all three last week for their alleged involvement in the Rs 4,355-crore fraud at PMC Bank. The Wadhawans were arrested on 3 October and Singh two days later.

Maharashtra: Accused in PMC Bank case, Rakesh Wadhawan, Sarang Wadhawan and Waryam Singh being brought out of Mumbai's Esplanade court. The court has sent them to police custody till 16th October in the case. pic.twitter.com/WDcC9hk1UA

— ANI (@ANI) October 14, 2019

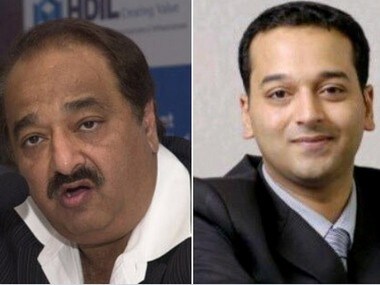

Since new pieces of evidence are being tracked every day, the investigating officer informed the court, two more days of custody is required to extract more information from the key accused in the bank fraud. In reply, the defence counsel said they will not object extension of their client’s custody but they should show some development in the case, media reports said. PMC Bank depositors on Monday held a protest, outside the city’s Esplanade Court, demanding reimbursement of their money from the bank. [caption id=“attachment_7447931” align=“alignleft” width=“380”]  HDIL’s Rakesh Wadhawan and Sarang Wadhawan. Image courtesy - CNBC-TV18.[/caption] “Our main issue is that the money of all PMC Bank depositors should be returned. According to reports, Finance Minister Nirmala Sitharaman has hinted that the PMC bank will be revived or merged with some other bank,” Sudhir, a depositor said. “My expectation as a depositor from the Finance Minister is that she should take onus for this situation. I want to get an assurance in writing from the government that my money is safe,” Mahesh Datlani, another depositor said. Union Finance Minister Nirmala Sitharaman had earlier met customers of PMC Bank on October 10 and heard their woes. “Finance Ministry may have nothing to do with it (PMC bank matter) directly because RBI is the regulator. But from my side, I’ve asked the secretaries of my ministry to work with the Rural Development Ministry and Urban Development Ministry to study in detail as to what is happening,” she had said. Last month, the RBI restricted the activities of the PMC Bank for six months and asked it to not grant or renew any loans and advances, make any investment or incur any liability, including borrowing of funds and acceptance of fresh deposits. The Reserve Bank of India (RBI) on October 3 stipulated the withdrawal limit for the depositors of Punjab And Maharashtra Cooperative Bank Ltd to Rs 25,000. PMC Bank is a multi-state scheduled urban cooperative bank with operations in Maharashtra, New Delhi, Karnataka, Goa, Gujarat, Andhra Pradesh, and Madhya Pradesh. With a network of 137 branches, it ranks among the top 10 cooperative banks in the country. PMC was placed under an administrator by the RBI on 24 September and suspended its management led by managing director Joy Thomas. The regulator has also banned the cooperative from extending fresh loans or taking deposits, apart from capping withdrawals at Rs 10,000 per each individual customer for the next six months. HDIL chairman and managing director Rakesh Wadhawan and his son Sarang were on Friday sent to police custody till October 9 in the Punjab Maharashtra Cooperative (PMC) Bank scam, an official said. They were arrested by the special investigation team (SIT) of the Economic Offences Wing (EOW) of Mumbai Police on Thursday and produced before a local court on Friday. EOW had registered an FIR on Monday against senior officials of HDIL and the PMC Bank for allegedly causing losses to the tune of Rs 4,355.43 crore to the bank. Property of Rs 3,500 crore belonging to the company was seized by the EOW during the investigation, he said. The Enforcement Directorate (ED) has also initiated investigation by registering a case of money laundering, another official said. ED officials raided six places in the city and suburbs and collected some important documents related to the case, he said. --With PTI inputs

)

)

)

)

)

)

)

)

)