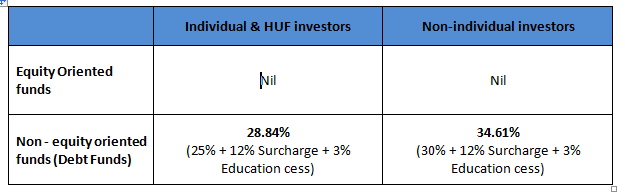

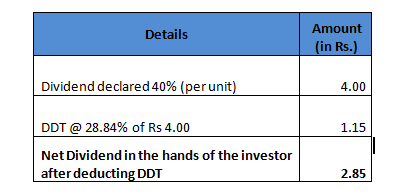

Shreya, a successful business woman, firmly believes in savings and has invested her money in Fixed Deposits and Mutual Funds. Her understanding is that all the interest earning from Deposits would attract an income tax of 10% in case the interest income is above Rs. 10,000/- p.a. She is unsure of the tax implication on mutual funds. While filing the income tax returns, the tax consultant mentions that Shreya will have to pay more tax on the interest income earned and on the mutual fund which she had redeemed in the previous year. She wants to understand the tax implications on her investments. An investor in mutual funds could earn the returns broadly in 2 forms;  Illustration disclaimer: The above example is only for illustration purposes & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. Dividends: The dividends would attract “Dividend Distribution Tax” (DDT), which would be deducted at source by Mutual Funds and then distributed further to the investors. There is no dividend distribution tax applicable on dividends declared by Equity Oriented Mutual Funds. DDT is applicable only on non-equity oriented mutual funds (Debt funds, Gold funds etc). Dividends received from mutual funds are tax-free in the hands of the investor.  Illustration disclaimer: The above example is only for illustration purposes & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. Dividend Distribution Tax (DDT) – Applicable tax rates for the Financial Year 2015-16 Dividend Distribution Tax (DDT) – Applicable tax rates for the Financial Year 2015-16 Dividends are declared on face value of the mutual fund units i.e. Rs. 10/-. If a mutual fund declares a dividend of 40%, it means an investor would get Rs. 4/- as dividend for every unit he is holding.  The post DDT amount of Rs. 2.85 would be passed on to the investor, which is tax-free in his hands. Illustration disclaimer: The above example is only for illustration purposes & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. Taxation on interest income: The common misunderstanding on treatment of interest income earned from bank deposits is that it is exempted if the interest earned is less than Rs 10,000/-p.a and taxed at 10% if the earning is more than Rs. 10,000/- p.a which is deducted by the bank before paying the interest. But in reality, the interest earned through deposits is fully taxable. It is taxed at marginal tax rate. This means that the interest income will be treated as “income from other sources” and will get added to the total income while computing the tax liability. The investor would end up paying tax based on his income tax slab. So effectively, an investor with an annual income of more than Rs. 10 Lakhs would fall in 30% income tax slab and would end up paying close to 30% tax on the interest income from deposits as well. Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully. This is a sponsored post.

Shreya, a successful business woman, firmly believes in savings and has invested her money in Fixed Deposits and Mutual Funds. Her understanding is that all the interest earning from Deposits would attract an income tax of 10% in case the interest income is above Rs. 10,000/- p.a. She is unsure of the tax implication on mutual funds. While filing the income tax returns, the tax consultant mentions that Shreya will have to pay more tax on the interest income earned and on the mutual fund which she had redeemed in the previous year.

Advertisement

End of Article

Written by FP Archives

see more

)

)

)

)

)

)

)

)

)