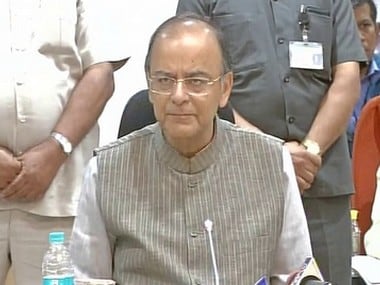

New Delhi: Finance Minister Arun Jaitley is slated to meet heads of PSU banks on 12 June to discuss the NPA issue and the steps being taken by them to expedite recovery of bad loans that have hit unacceptably high levels. Apart from financial performance review, the meeting will take stock of status of stressed assets and various measures taken to clean up balance sheets of the banks so that they can start lending, sources said. Non-performing assets (NPAs) of public sector banks (PSBs) have gone past the Rs 6 lakh crore mark, the bulk of which are in sectors such as power, steel, road infrastructure and textiles. [caption id=“attachment_3371884” align=“alignleft” width=“380”]  File image of Arun Jaitley, Union Finance Minister. Reuters[/caption] The scheduled meeting of 12 June will discuss the current status of stressed assets and pending cases before the joint lenders’ forum (JLF), the sources said. Besides, various measures taken by banks on the NPA recovery, turnaround plan and ambitious targets of various lenders will be discussed. Stock prices on the mend, the meeting will also discuss ways in which PSBs can tap markets to raise funds and ease the pressure on the exchequer of pumping in capital as per the Indradhanush plan. As per the scheme, public sector banks need to raise Rs 1.10 lakh crore from markets, including follow-on public offer, to meet Basel III requirements, which kick in from March 2019. Various other performance parameters like loan growth in education and housing, penetration of Pradhan Mantri Jan Dhan Yojana (PMJDY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri MUDRA Yojana. Progress on Stand Up India and promotion of digital payment are also part of the agenda. The meeting assumes significance as it will be the first after promulgation of the ordinance amending the Banking Regulation Act, 1949, earlier this month. The government empowered the RBI to ask banks to initiate insolvency proceedings to recover bad loans and promised more measures to resolve the NPA crisis. The RBI also made substantial changes in the related norms and also warned banks of monetary penalty for missing NPA resolution timelines. Jaitley had said the ordinance empowered the Reserve Bank to issue “directions to any banking company or banking companies to initiate insolvency resolution process in respect of a default under the provisions of the Insolvency and Bankruptcy Code (IBC), 2016”. Toxic loans of PSBs rose by over Rs 1 lakh crore to Rs 6.06 lakh crore during April-December of 2016-17. Gross NPAs of PSBs nearly doubled to Rs 5.02 lakh crore at the end of March 2016, from Rs 2.67 lakh crore at the end of March 2015.

Non-performing assets (NPAs) of public sector banks (PSBs) have gone past the Rs 6 lakh crore mark

Advertisement

End of Article

)

)

)

)

)

)

)

)

)