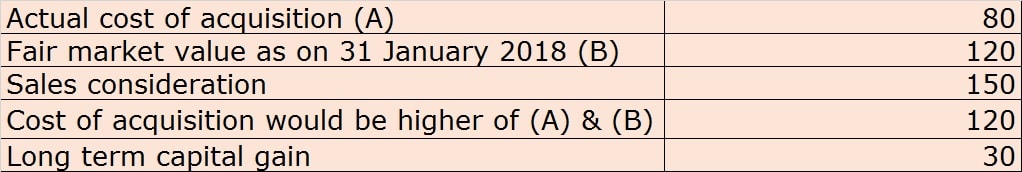

As we enter the second quarter of the ongoing financial year, it would be prudent to revisit some of the key personal tax changes introduced by the Finance Act, 2018, so that individual taxpayers can plan in a more holistic manner for the rest of this year. While individuals had expected the finance minister’s Budget to increase the deduction for a housing loan, to rationalise tax slabs and increase the 80C limit, to name a few, not much respite was provided. While, there has been no reduction in the income slabs, tax rates and surcharge rates, the cess of three percent was increased to four percent. That effectively increases the maximum marginal rate from 30.9 percent to 31.2 percent for individuals whose annual taxable income is between Rs 10 lakh and Rs 50 lakh; from 33.9 percent to 34.32 percent for individuals with a taxable income of between Rs 50 lakh and Rs 1 crore; from 35.53% to 35.88% for individuals with a taxable income exceeding Rs 1 crore. Excess revenue generated is proposed to be used for the education and health of families living below the poverty line and in rural areas. Standard deduction reintroduced That apart, a standard deduction of Rs 40,000 has been reintroduced, which can be reduced by salaried employees from their gross salary. This is a welcome change as the employee does not need to submit any documentation to the employer for claiming the same. However, the same does not result in any significant incremental benefit to a salaried individual as transport allowance of Rs 19,200 and medical reimbursement exemption of Rs 15,000, totalling Rs 34,300, have been withdrawn. This leads to a minimal net benefit of Rs 5,800 which can be additionally reduced by salaried employees from their gross salary and would lead to a maximum tax savings of about Rs 2,081, at the maximum marginal rate as compared to the erstwhile provisions. [caption id=“attachment_4495585” align=“alignleft” width=“380”]  Representational image. Reuters.[/caption] Long-term capital gains However, the key change this year has been the move to tax long-term capital gains (LTCG) (held for more than 12 months), arising from the transfer of listed equity shares or units of an equity oriented fund from FY 2018-19 onwards. Such capital gains that enjoyed tax exemption status, will now be taxed at the rate of 10 percent where the amount of such capital gains exceeds Rs 1,00,000. One must note that the indexation benefit will not be available; the Securities transaction tax should be paid on such listed shares (at the time of acquisition and transfer) and equity oriented mutual funds (at the time of transfer); and that the benefit under Chapter VI-A (like section 80C, 80D etc) cannot be availed – this is also the case with capital gains from other assets. Furthermore, a rebate under section 87A that provides for a marginally lower payment of tax to individuals earning below the specified limit cannot be availed – this rebate is allowed in respect of capital gains from other assets; capital gains up to 31 January 2018 will not attract the said tax to the extent of the fair market value as on 31 January 2018 i.e. tax exemption in respect of gains up to 31 January 2018 shall be grandfathered. The aforementioned can be understood by way of an example where shares were acquired up to 31 January 2018:  Now, under section 54EC of the Income Tax Act, taxpayers can claim exemption from any long-term capital gains subject to certain conditions, whereas the definition of long term capital assets for claiming the exemption is now limited to land, building or both. Further, a lock-in period of specified bonds for investment of capital gains (i.e. NHAI or RECL) for the purpose of claiming the exemption has been increased from three years to five years. Enhanced deductions for senior citizens The Budget did provide enhanced deductions for senior citizens. It increased the limit for the deduction of interest income from a savings bank account from Rs 10,000 to Rs 50,000 covering interest income from all deposits as specified; the limit for deductions from taxable income for health insurance premium, preventive health checkup or medical expenditure was increased from Rs 30,000 to Rs 50,000. In case of a single premium policy with a cover for more than one year, the deduction will be available on a proportionate basis for the period of the cover; the limit for deductions from taxable income of Rs 60,000 for senior citizens and Rs 80,000 for very senior citizens for the amount paid for medical treatment of specified diseases, was increased to Rs 1,00,000 . Relief to non-salaried individuals The benefit of tax-free withdrawal from the NPS, of up to 40 percent of the total amount payable on closure of the account, has been extended to non-salaried individuals. The extension of the benefit has been well-received because it provides a level playing field to both employee and non-employee subscribers. Secondly, prima facie adjustments during the processing of income tax returns will no longer be made by the IT authorities by adding income appearing in form 26AS/ 16A/ 16 which has not been included in the tax return. Typically, even though the tax returns for FY 2016-17 may have been filed correctly by taxpayers, additions were made by the authorities based on the above documents whereas such documents may not have been reflecting correct income for certain reasons. The change would avoid inconvenience to tax payers on account of unnecessary adjustment and is applicable from FY 2017-18. In light of the above, it can be said that efforts have been made to simplify the employer tax withholding process by reintroducing the standard deduction and to provide tax benefits to senior citizens. However, the net tax savings for a majority of all salaried individuals on account of the abovementioned changes has left a lot to be desired. The above changes should nonetheless be taken into account, for advance tax calculations and for your overall personal tax planning for the year. (Alok Agrawal is Partner, Deloitte India and Deepika Mathur is Director, Deloitte Haskins and Sells LLP).

Net tax savings for a majority of all salaried individuals, on account of the changes listed in the Finance Act, 2018, has left a lot to be desired.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)