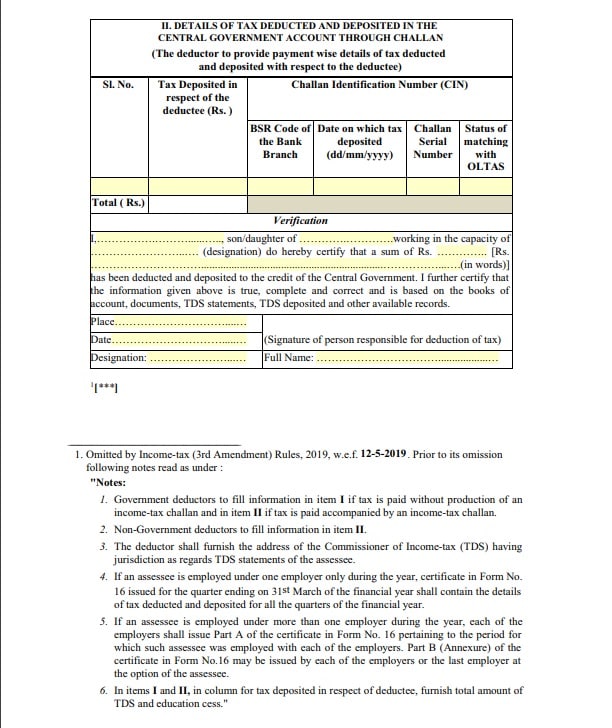

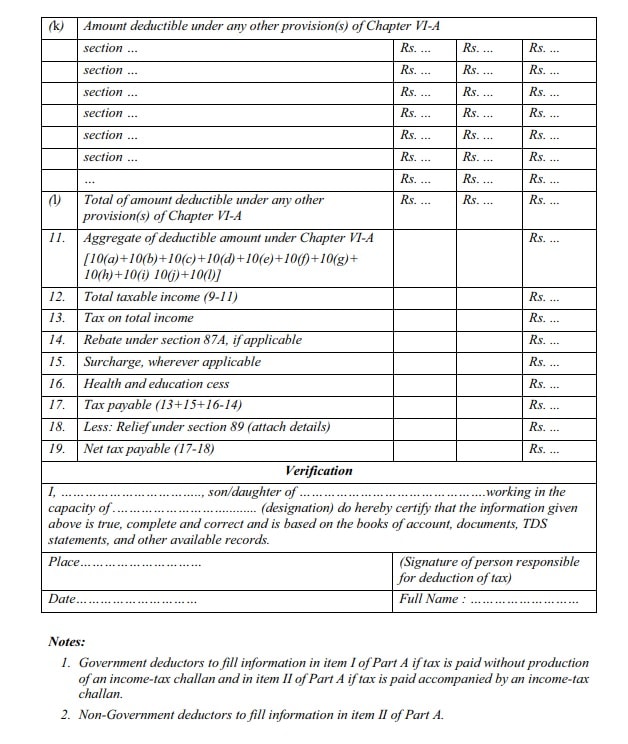

You would have received Form 16 from your employer by now. It is a certificate an employer issues to his/her employees. It validates that Tax Deducted at Source (TDS) has been deducted and deposited with the authorities on behalf of the employee. Form 16 is needed for filing Income Tax Returns. If you lose your Form 16, request for a duplicate from your employer. The Central Board of Direct Taxes (CBDT) has revised Form 16 this year. Though Form 16 has two parts – A and B, the information is quite detailed, unlike the previous years. Form 16 must be downloaded only from the Income Tax Department’s website,

TRACES, says Archit Gupta from

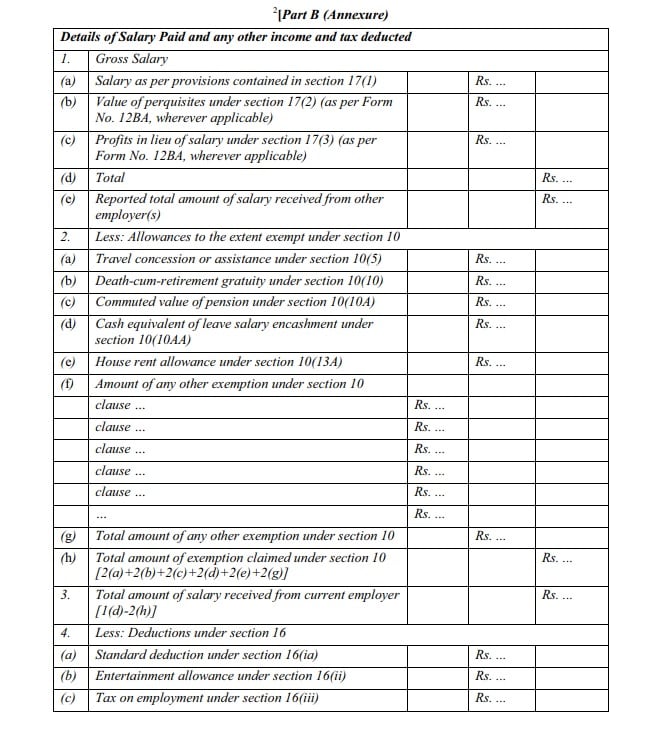

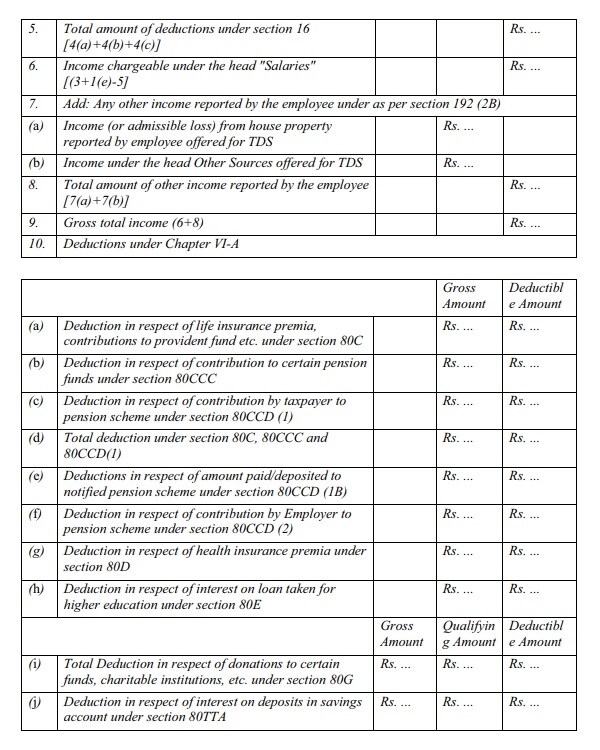

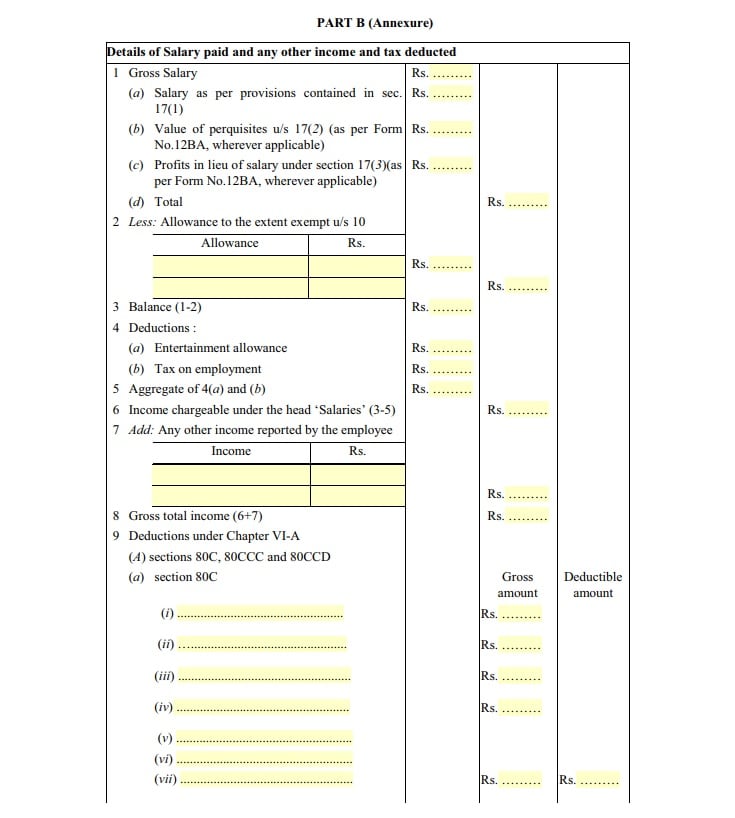

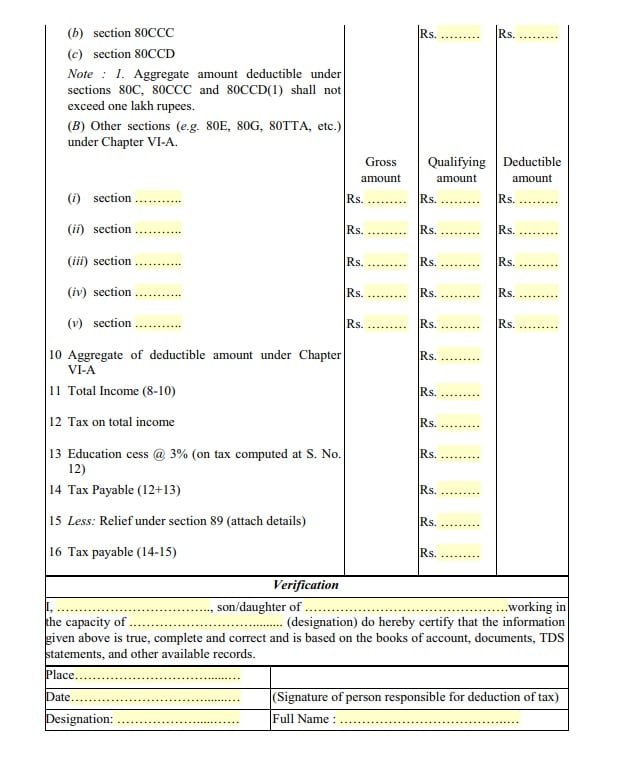

ClearTax. TRACES is TDS Reconciliation Analysis and Correction Enabling System and has been set up by TDS Centralised Processing Cell of the Income Tax Department. It is a website where a PAN holder can view the taxes that have been deducted and deposited against his/her PAN during a financial year. As a taxpayer, you can download Form 16 and Form 16A, TDS returns and check your annual tax credit statement (Form 26AS). Details needed from Form 16 while filing ITR 1. Allowances exempt under section 10 2. Breakup of deductions under Section 16 3. Taxable Salary 4. Income (or admissible loss) from house property reported by employee offered for TDS 5. Income under the head Other Sources offered for TDS 6. Breakup of Section 80C Deductions 7. Aggregate of Section 80C Deductions(Gross & Deductible Amount) 8. Tax Payable or Refund Due [caption id=“attachment_4401157” align=“alignleft” width=“380”]

Representational image.. Reuters[/caption] Additional information from your Form 16 required while filing your annual returns are: a. TDS Deducted by Employer b. TAN of Employer c. PAN of Employer d. Name and Address of Employer e. Current Assessment Year f. Your (Taxpayer’s) Name and Address g. Your PAN Form 16 Part A Download Form 16 through the TRACES portal. Prior to issuing the certificate, the employer should authenticate its contents. It is important to note that if you change your job in one financial year, every employer will issue a separate Part A of Form 16, for the period of employment. Some of the components of Part A are: a. Name and address of the employer b. TAN & PAN of employer c. PAN of the employee d. Summary of tax deducted and deposited quarterly, which is certified by the employer. Form 16 Part B This is an annexure to Part A. If you change your job in one financial year, then it is for you to decide if you would want Part B of the Form from both the employers or from the last employer. Some of the components of Part B notified newly for the FY 2019-20 are: a. Detailed breakup of salary b. Detailed breakup of exempted allowances under section 10 c. Deductions allowed under the income tax act (under chapter VIA), etc. Specific fields are notified for deductions mentioned below: 1. Deduction for life insurance premium paid, contribution to PPF etc., under section 80C 2. Deduction for contribution to pension funds under section 80CCC 3. Deduction for employee’s contribution to pension scheme under section 80CCD(1) 4. Deduction for taxpayer’s self contribution to notified pension scheme under section 80CCD(1B) 5. Deduction for employer’s contribution to pension scheme under section 80CCD(2) 6. Deduction for health insurance premium paid under section 80D 7. Deduction for interest paid on loan taken for higher education under section 80E 8. Deduction for donations made under section 80G 9. Deduction for interest income on savings account under section 80TTA

The Central Board of Direct Taxes (CBDT) has revised Form 16 this year.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)