The US Federal Reserve on Thursday kept interest rates unchanged, expressing confidence in the resilience of the American economy and signalling that any further reduction in borrowing costs could take longer than markets might hope.

After a two-day policy meeting, the Federal Open Market Committee (FOMC) voted 10-2 to keep the benchmark federal funds rate unchanged in the 3.50-3.75 per cent range. The decision, widely expected by markets, comes after the Fed delivered three consecutive rate cuts since September, amounting to a total reduction of 75 basis points.

“The economy has once again surprised us with its strength,” Fed Chair Jerome Powell said at a press conference, adding that the central bank now sees lower risks on both sides of its dual mandate, inflation and employment.

Powell said policymakers believe monetary policy is “in a good place” and that the Fed is “well-positioned” to wait and assess incoming data before deciding on any further moves. “There could be combinations, infinite numbers of combinations that would cause us to want to move,” he said, pointing to a renewed slowdown in the labour market or a clearer decline in inflation towards the Fed’s 2 per cent target as potential triggers.

Inflation risks ease, labour market stabilises

In its policy statement, the FOMC noted that economic activity continues to expand at a solid pace. While job gains have remained low, the unemployment rate has shown signs of stabilisation, falling to 4.4 per cent in December.

Inflation, however, remains above target. Powell said price pressures are still “somewhat elevated”, running about one percentage point above the Fed’s goal. He attributed much of the recent stickiness in inflation to higher goods prices, partly driven by tariffs imposed last year by the Trump administration. Powell said he expects the impact of tariffs to fade by the middle of this year.

Quick Reads

View All“Since our last meeting, the upside risks to inflation and the downside risks to employment have diminished,” Powell said, while cautioning that those risks have not disappeared entirely.

Two Fed governors, Christopher Waller and Stephen Miran, dissented from the majority decision, voting in favour of a quarter-percentage-point rate cut. Waller is widely seen as a contender to succeed Powell, whose term as Fed chair ends in May. Miran is currently on leave from his role as an economic adviser at the White House.

Despite the dissents, Powell stressed there was broad internal support for holding rates steady.

Fed independence in focus

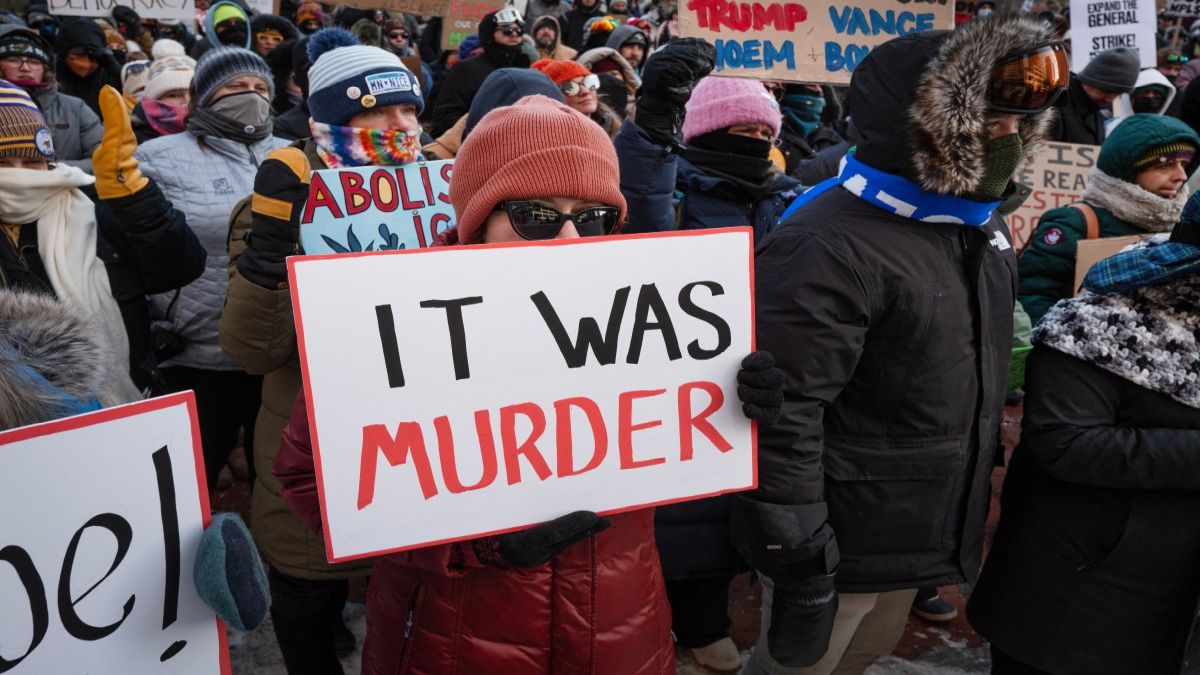

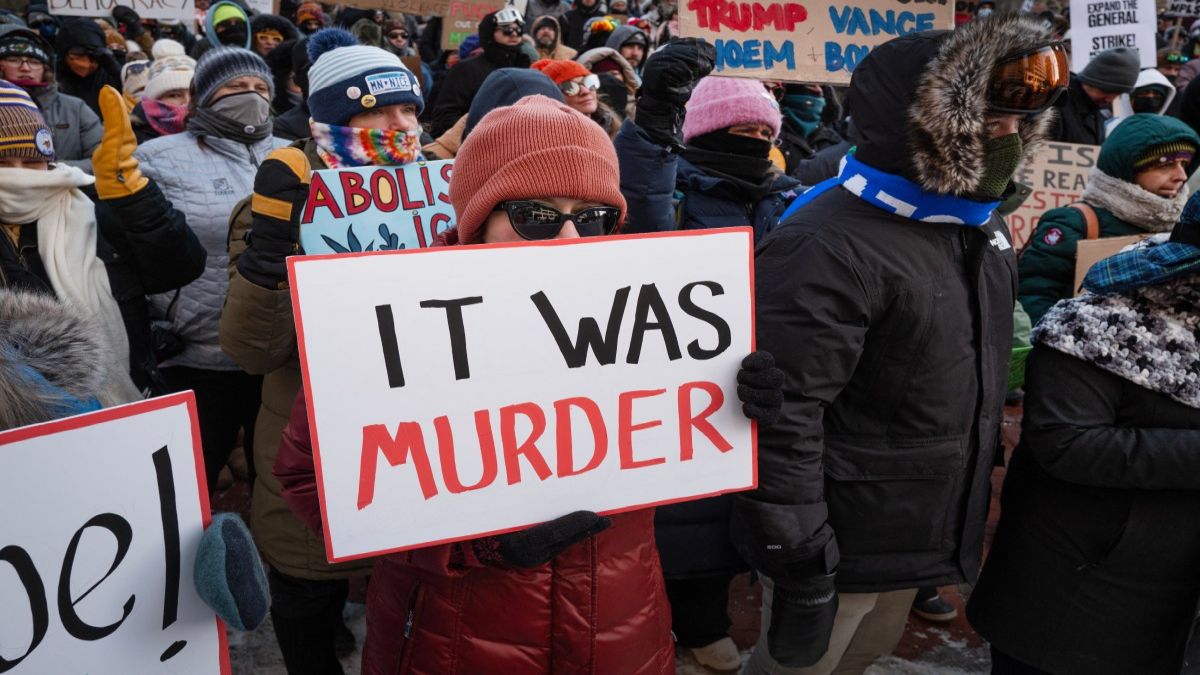

The rate decision was overshadowed during Powell’s press conference by questions over political pressure on the central bank. Powell faced queries about a criminal investigation opened earlier this month by the Trump administration and whether he would remain at the Fed after his term as chair ends.

President Donald Trump has repeatedly criticised the Fed for not cutting rates aggressively enough to stimulate growth. Powell has previously said the investigation appeared aimed at pressuring the central bank to align policy with the president’s preferences. On Thursday, he declined to comment further on the probe.

However, Powell offered pointed advice for his successor: “Don’t get pulled into elected politics,” he said, adding that accountability to Congress is essential for preserving the Fed’s independence.

Fed holds line despite Trump pressure

The Fed’s decision to hold rates steady comes amid intensifying pressure from US President Donald Trump, who has repeatedly called on the central bank to slash borrowing costs to further stimulate growth.

Trump has in recent weeks renewed his criticism of the Fed and Chair Jerome Powell, arguing that interest rates remain too high even as inflation shows signs of easing. The president has publicly pushed for aggressive cuts, framing lower rates as essential to sustaining economic momentum and supporting financial markets.

Powell, however, has resisted those calls, stressing that monetary policy must remain data-driven and insulated from political influence.

)

)

)

)

)

)

)

)

)