The hallmark of a good entrepreneur is how quickly he can adjust to the needs of a changing marketplace and rework his business or product offering accordingly. If this is one key test of entrepreneurial ability, Facebook founder Mark Zuckerberg seems to be on the road to scoring highly in it.

Battered and criticised bitterly after its controversial initial public offer (IPO) last year, Facebook today is in a very different scenario, given its robust April-June 2013 performance and the consequent rise in its stock price, which debuted last year at $38.

On Wednesday, as the Facebook stock crossed the psychologically crucial $38 mark after a year of struggle and battering, it perhaps proved not just that the company had taken on board the criticisms leveled against it but was also working towards overcoming what at one point was seen as its biggest weakness - the mobile revolution via smartphones.

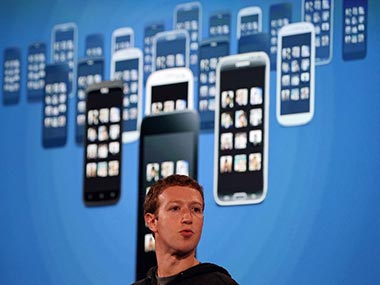

[caption id=“attachment_1003291” align=“alignleft” width=“380”] Mark Zuckerberg seems to have struck gold with mobile. AFP[/caption]

Mark Zuckerberg seems to have struck gold with mobile. AFP[/caption]

At the time it went public, naysayers were forecasting that Facebook, though riding on a wave of support thanks to its addictive social networking site, would stumble at some point soon, since it was essentially oriented towards computers and was not really geared to riding on the smartphone wave by way of mobile advertising. Critics pointed out its mobile strategy was still iffy and the rapid growth of users who were logging on to the Internet from smartphones would pose a serious challenge for Facebook if it was not able to orient itself towards this and capitalise on the revenues flowing from that segment.

A year later, Zuckerberg, his COO Sheryl Sandberg and the people at Menlo Park, California-headquartered Facebook seem to be having the last laugh. The biggest gains for the company during the quarter were, in fact, made from mobile advertising revenues, which accounted for a hefty 41 percent of its total revenues of $1.6 billion. That was proof enough that Facebook had worked on this major challenge and was on the road to overcoming it. For those who had said its revenue model was still unclear, this performance will have them going back to their calculators.

Impact Shorts

More ShortsNot surprisingly, the markets seem to have noted the change and the stock price finally moved back above the $38 mark, signal enough that Facebook was not going to be regarded as a flash in the pan like some other internet stories before it which vanished after some hype and hoop-la.

In fact, an AP report quotes research firm eMarketer as saying Facebook will likely hit the $2 billion mark in mobile revenues this year, a 13 percent share of the mobile ad market, up from a much lower 5 percent last year. A big, big change indeed.

In a report last week, The Wall Street Journal also adds that Facebook remains the most used mobile app in the US, which bodes well for its sharply growing mobile revenues. The report also pointed out that Facebook’s operating profit margin of 31 percent was much higher than the 22 percent clocked by Google.

With 1.15 billion members, Facebook today is a massive marketing platform for advertisers, with millions logging on to the social networking giant every day from across the world.

But restless to grow further, Facebook seems to be getting ready to build on this success and is now targeting TV-type advertisements for a hefty $2.5 million a day. A Bloomberg report quotes Sandberg as saying every night, as many as 88 million to 100 million people log on to the site during prime-time TV hours in the US alone. If the company can convert this ‘viewership’ into an advertising platform, the growth in revenues can be manifold. The growth of smartphones can only help further.

The Zuckerberg juggernaut just got more momentum. But in the fast-changing world of the Internet, new ideas and competitors are always lurking round the corner. How Zuckerberg and his mates negotiate these challenges will determine how big Facebook will eventually become.

Sourav Majumdar has been a financial journalist for over 18 years. He has worked with leading business newspapers and covered the corporate sector and financial markets. He is based in Mumbai.

)