The real growth of GDP in Q1 2016 is 7.0 percent. The ‘consensus’ view emerging from an economists’ poll was 7.5 percent. In an earlier article, I

had argued

that as more updated data gets incorporated in the GDP calculation, the numbers will become “more closely aligned to the popular perception of economic activity”. So the current 7 percent growth may be more reflective of the economic activity.[caption id=“attachment_2416354” align=“alignleft” width=“380”]

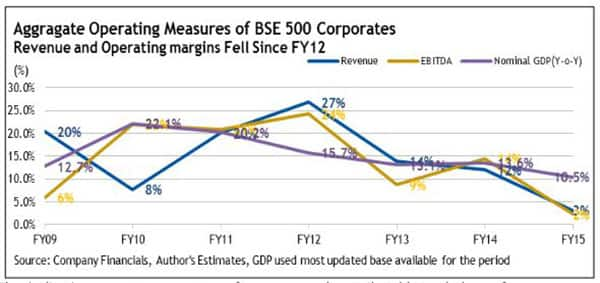

Reuters[/caption] While public discourse will express their ‘disappointment’ at the real GDP growth rate being at 7 percent (a solid number in its own right) as opposed to a higher number, what is most likely to go unnoticed and un-discussed in most forums is the nominal GDP growth rate. This for first quarter is 8.8 percent, possibly the lowest in a decade. And this is something corporate watchers may like to focus at times when the Indian economy is experiencing a dis-inflation. This article is an attempt to explain the dichotomy of an improving ‘real’ economy and the constrained performance of India Inc. The question this article tries to answer is how helpful will be a 7-8 percent real GDP growth, for the cause of reviving India Inc’s performance. Real and Nominal When everyone from Finance Minister Arun Jaitley to haloed multilaterals project India’s expected GDP growth rate from 7.5 percent to upwards of 8 percent, they refer to the ‘real’ GDP growth. Real GDP is the nominal GDP growth (based on price levels existing for the concerned period) adjusted for inflation. Generally the nominal GDP growth rate is higher than the real growth rate and the difference is attributed to positive value of economy-wide inflation. The adjustment factor, representing the economy-wide inflation, is called implicit GDP deflator. Thus in an inflationary economy, the GDP deflator ‘deflates’ the nominal growth rate to bring it down to the real growth rate. The GDP deflator usually tends to be broadly in line with other inflation measures such as wholesale price index (WPI) and consumer price index (CPI). With WPI and CPI in India falling in tandem over FY15 and FY16, it may be reasonable to assume that the GDP deflator’s trajectory will also be downwards. The likely impact of this is that the gap between the nominal GDP growth rate and real GDP growth rate may fall below 3 to 2 percentage points. For example, the real GDP growth may be 7.5 percent while the nominal growth for the same period may be 9.5 percent. Of course, if economy-wide inflation becomes negative (which is currently not the case in India), then the GDP deflator becomes a negative number. In such a scenario, one ends up with a situation where the real GDP growth is higher than the nominal GDP growth. Or the GDP deflator, when negative, even behaves like an inflator. How does falling inflation impact corporate performance in the short to medium term? For one, controlling inflation may temporarily affect corporates’ performance. This is because when a high-inflation economy tries to bring down inflation, there is a corresponding loss of productive output. In simple terms, the economy sacrifices some output in order to control the inflation. The sustained lower inflation thus achieved is likely to have a higher overall positive impact on the economy in the long run. In short, the output loss in the economy may have a negative impact on corporate performance, until the adjustment from a high inflation to a low inflation environment is achieved. Secondly, the dis-inflationary adjustment in the economy represented by the falling nominal GDP, tends to have a constraining impact on corporate performance. Of course, nominal GDP does not have a 1-on-1 linkage with aggregate corporate revenue or EBITDA. However, since the corporate numbers are not adjusted for inflation, the aggregated corporate numbers tend to exhibit some directional alignment with the nominal GDP growth number. The nominal GDP has fallen between FY10 (22.1 percent) and FY15 (10.5 percent). In fact, the nominal GDP growth in FY15 has been the lowest since FY04.The aggregate revenue growth and absolute EBITDA growth of BSE 500 corporates (excluding banking and financial services) has been falling since FY12.

Reuters[/caption] While public discourse will express their ‘disappointment’ at the real GDP growth rate being at 7 percent (a solid number in its own right) as opposed to a higher number, what is most likely to go unnoticed and un-discussed in most forums is the nominal GDP growth rate. This for first quarter is 8.8 percent, possibly the lowest in a decade. And this is something corporate watchers may like to focus at times when the Indian economy is experiencing a dis-inflation. This article is an attempt to explain the dichotomy of an improving ‘real’ economy and the constrained performance of India Inc. The question this article tries to answer is how helpful will be a 7-8 percent real GDP growth, for the cause of reviving India Inc’s performance. Real and Nominal When everyone from Finance Minister Arun Jaitley to haloed multilaterals project India’s expected GDP growth rate from 7.5 percent to upwards of 8 percent, they refer to the ‘real’ GDP growth. Real GDP is the nominal GDP growth (based on price levels existing for the concerned period) adjusted for inflation. Generally the nominal GDP growth rate is higher than the real growth rate and the difference is attributed to positive value of economy-wide inflation. The adjustment factor, representing the economy-wide inflation, is called implicit GDP deflator. Thus in an inflationary economy, the GDP deflator ‘deflates’ the nominal growth rate to bring it down to the real growth rate. The GDP deflator usually tends to be broadly in line with other inflation measures such as wholesale price index (WPI) and consumer price index (CPI). With WPI and CPI in India falling in tandem over FY15 and FY16, it may be reasonable to assume that the GDP deflator’s trajectory will also be downwards. The likely impact of this is that the gap between the nominal GDP growth rate and real GDP growth rate may fall below 3 to 2 percentage points. For example, the real GDP growth may be 7.5 percent while the nominal growth for the same period may be 9.5 percent. Of course, if economy-wide inflation becomes negative (which is currently not the case in India), then the GDP deflator becomes a negative number. In such a scenario, one ends up with a situation where the real GDP growth is higher than the nominal GDP growth. Or the GDP deflator, when negative, even behaves like an inflator. How does falling inflation impact corporate performance in the short to medium term? For one, controlling inflation may temporarily affect corporates’ performance. This is because when a high-inflation economy tries to bring down inflation, there is a corresponding loss of productive output. In simple terms, the economy sacrifices some output in order to control the inflation. The sustained lower inflation thus achieved is likely to have a higher overall positive impact on the economy in the long run. In short, the output loss in the economy may have a negative impact on corporate performance, until the adjustment from a high inflation to a low inflation environment is achieved. Secondly, the dis-inflationary adjustment in the economy represented by the falling nominal GDP, tends to have a constraining impact on corporate performance. Of course, nominal GDP does not have a 1-on-1 linkage with aggregate corporate revenue or EBITDA. However, since the corporate numbers are not adjusted for inflation, the aggregated corporate numbers tend to exhibit some directional alignment with the nominal GDP growth number. The nominal GDP has fallen between FY10 (22.1 percent) and FY15 (10.5 percent). In fact, the nominal GDP growth in FY15 has been the lowest since FY04.The aggregate revenue growth and absolute EBITDA growth of BSE 500 corporates (excluding banking and financial services) has been falling since FY12.

The decline in aggregate corporate performance may be attributable to plethora of reasons including correction in commodity prices, falling domestic (industrial and consumer) demand, low investment, lukewarm exports and the output decline as mentioned above. Some of the very same factors are also responsible for cooling off the inflation and bringing it under control. In the last couple of years the real GDP has shown a revival, thanks to, among other things, a falling inflation. Until such time, as a stable low inflation level, which will re-ignite growth, is not reached corporate watchers may have to live with a scenario of improving ‘real GDP’ growth but less than encouraging corporate growth. To illustrate with an example, if the FY16 nominal GDP (this is an illustration and should not be construed as a projection or prediction) is 9.5 percent because of falling inflation, the real growth turns out to be 7.5 percent. It is possible that the aggregate revenue growth or operating margin growth of a large set of corporates (such as BSE 500) may not show a significant improvement, even if the real economy suggests a higher GDP growth. Corporates may have to patiently wait for the inflation to come under control before a very significant revival in corporate performance occurs. The author is senior director - corporate ratings, India Ratings. Views are personal.

The decline in aggregate corporate performance may be attributable to plethora of reasons including correction in commodity prices, falling domestic (industrial and consumer) demand, low investment, lukewarm exports and the output decline as mentioned above. Some of the very same factors are also responsible for cooling off the inflation and bringing it under control. In the last couple of years the real GDP has shown a revival, thanks to, among other things, a falling inflation. Until such time, as a stable low inflation level, which will re-ignite growth, is not reached corporate watchers may have to live with a scenario of improving ‘real GDP’ growth but less than encouraging corporate growth. To illustrate with an example, if the FY16 nominal GDP (this is an illustration and should not be construed as a projection or prediction) is 9.5 percent because of falling inflation, the real growth turns out to be 7.5 percent. It is possible that the aggregate revenue growth or operating margin growth of a large set of corporates (such as BSE 500) may not show a significant improvement, even if the real economy suggests a higher GDP growth. Corporates may have to patiently wait for the inflation to come under control before a very significant revival in corporate performance occurs. The author is senior director - corporate ratings, India Ratings. Views are personal.

Even an 8% GDP may not bring about a quick revival in India Inc’s earnings. Here's why

Deep N Mukherjee

• September 1, 2015, 16:08:36 IST

Corporates may have to patiently wait for the inflation to come under control before a very significant revival in corporate performance occurs.

Advertisement

)

End of Article