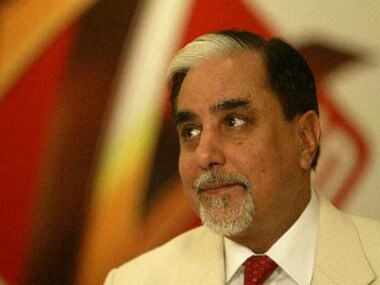

The Subhash Chandra-backed multi-faceted Essel Group’s management said it has successfully arrived at an understanding with lenders which are having pledge on shares held by the promoters. Due to the steep fall in the stock prices of ZEE Entertainment Enterprises Ltd and Dish TV Ltd., the Essel Group promoters held a meeting with the lending entities comprising of mutual funds, NBFCs and banks. On Friday, shares of Zee Entertainment and Zee Learn suffered the biggest single-day loss since listing. Zee Entertainment fell over 26 percent while shares of Zee Learn lost over 18 percent. [caption id=“attachment_5971361” align=“alignleft” width=“380”]  Subhash Chandra, Chairman, Zee Group. PTI[/caption] According to a statement from Essel Group, there will not be any event of default declared due to the steep fall in price. “As a result, there will be synergy and co-operation, amongst lenders leading to a unified approach. Lenders drew comfort from reiteration by the promoters for a speedy resolution through a strategic sale in a time-bound manner,” the statement from the company said. Speaking on this development, Subhash Chandra, Chairman of Essel Group, said, “I am pleased to share that we have achieved an understanding with lenders. We have always valued their immense trust and faith sown in us and the positive and progressive outcome of the meeting, is a true example of the same. I am very positive, that we will continue to take such positive steps in rising up from the current challenging times, with support of all stakeholders.” A Balasubramanian, CEO, Aditya Birla Sun Life AMC said, “We have always believed in the intrinsic value of ZEE Entertainment and most above, the sheer value system with which its promoters function. I am very glad with the outcome of the meeting, which enabled us to arrive at a consensus, in the interest of all stakeholders.” To keep watching India’s No. 1 English Business News Channel – CNBC-TV18, call your Cable or DTH Operator and ask for the Colors Family Pack (inclusive of 24 channels), available for Rs. 35/- per month, or subscribe to the channel for Rs. 4/- per day. To keep watching the Leader in Global Market & Business News – CNBC-TV18 Prime HD, call your Cable or DTH Operator and ask for the Colors Family HD Pack (inclusive of 25 channels), available for Rs. 50/- per month, or subscribe to the channel for Rs. 1/- per day.

According to a statement from Essel Group, there will not be any event of default declared due to the steep fall in share price.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)