Mumbai: Essel Group said on Sunday that it has sealed a formal agreement with its lenders to keep it afloat, under which it gets time till September to deleverage or pare its debt. The agreement is with those lenders who have taken pledged shares of the group flagship and listed entities, Zee Entertainment Enterprises and Dish TV India. On 27 January, the group had confirmed that an understanding with the lenders had been achieved, which was finalised on Sunday. The agreement was not to declare the company a defaulter as it had admitted that it could service the debt only up to December.

“As per the consent, the lenders have agreed that there will not be any event of default declared till 30 September 2019, due to the movement in the stock price of Essel Group’s mentioned listed corporate entities,” the company said in a late evening statement. “This consent provides the required amount of time for the management to complete the strategic sale process of its key assets without any compromise on the value,” the statement added.

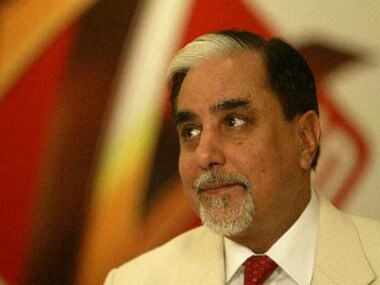

The management-led by promoter Subhash Chandra reassured the lenders that within the time frame a complete resolution will be achieved, leveraging the stake sale process, the company said. The lenders have showed full co-operation and have agreed to support the management as a team, the statement claimed. [caption id=“attachment_5971361” align=“alignleft” width=“380”]  Subhash Chandra, Chairman, Zee Group. PTI[/caption] The group of lenders, including banks, mutual funds and non-banking financiers agreed to support the management, it said. “I am glad that a formal consent with the lenders has been achieved today which seals and justifies their belief and trust in us and the intrinsic value of our assets. As one team, we are now positively focused on completing the strategic sale process, with the esteemed support of our lenders. We thank them for their trust, patience and above all for their complete co-operation extended, enabling us to take the next steps towards resolution,” Chandra was quoted as saying in the statement. The company, which has high debt, defaulted on some of the payments, which led to the share pledge. Chandra had on 25 January issued an apology to lenders through a public statement, stating that the company intended to pay back all of its debt, which came on a day when the group shares were puntered on the market plunging between 17 and 30 percent. He had admitted that his company was in a financial mess, and blamed it on aggressive bets on infra, which has gone out of control since the IL&FS crisis, and acquisition of Videocon’s D2H business. Apologising to lenders, he also alleged that some negative forces were out to sabotage his efforts to raise money through a strategic sale in the flagship company Zee Entertainment Enterprises.

)

)

)

)

)

)

)

)

)