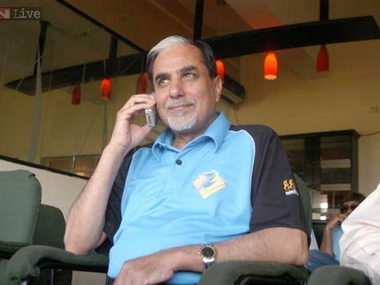

Mumbai: Subhash Chandra-led Essel Group on Tuesday said it has part-completed its promoter stake sale in flagship Zee Entertainment Enterprises, and is working on more divestments to pay off the Rs 13,000 crore owed to lenders. The group said it has sold 8.7 percent of its holding in ZEEL, and will be executing the sale for remaining 2.3 percent stake in the next few days. It had in July announced plans to raise Rs 4,224 crore from the sale of 11 percent ownership of ZEEL to the US-based Invesco Oppenheimer Developing Markets Fund, an existing investor. The Essel Group is in self-admitted financial difficulties since the NBFC crisis, as a slew of its non-media bets, including infrastructure, roads and power went awry and it was unable to refinance debt on the same. The statement said the completion of the first tranche of ZEEL stake sale should be seen as a reaffirmation of its commitment and as positive progress on an overall asset divestment plan. [caption id=“attachment_2832394” align=“alignleft” width=“380”] File photo of Zee Group chairman Subhash Chandra. Image courtesy: News18.com[/caption] “The Essel Group is also working actively on further divestments including its non-media assets and remains confident to complete the same,” it said. The group has time till September-end to pay-off the mutual funds who were owed Rs 13,000 crore as of January, when the crisis broke out. Subsequently, the debt had gone down to Rs 11,000 crore as of July. Even after the 11 percent stake sale, the group will still need to manage Rs 7,000 crore, and has so far been confident of meeting its commitments. Late August, it announced a deal to sell the 205 MW solar assets to Adani Green Energy for Rs 1,300 crore. Chandra had first announced that he would be selling half of his family’s holding in Zee last November without attributing any reasons, and followed that up with an admission of severe financial stress late January. Aggravating the situation for Chandra was a massive sell-off in the shares ahead of the January admission, which was attributed to interests sabotaging the stake sale plans. The family-owned 35.79 percent of ZEEL as of June, of which over 64 percent are pledged with lenders. After this deal, the family holding will go down to around 24 percent. The promoter family has said that if need be, it is willing to share more of ZEEL to meet the commitment of paying off the MFs by September. The MFs had to create the unprecedented restructuring package for their loans, after the value of the underlying securities crashed in January.

Subhash Chandra-led Essel Group on Tuesday said it has part-completed its promoter stake sale in flagship Zee Entertainment Enterprises, and is working on more divestments to pay off the Rs 13,000 crore owed to lenders

Advertisement

End of Article

)

)

)

)

)

)

)

)

)