The panic is slowly creeping in. Ambit Capital is now “cranking up” the economic crisis factor for India as it slashed GDP growth number from 7.2 percent to 6.2 percent for fiscal year 2013. (FY13). To gear up for this crisis, Ambit recommends “battleship” stocks, which include three categories.

1. They must have positive operating cash flows.

2. They must have low or no debt

3. They must have straight forward business models with sustainable competitive advantage.

And few such companies that Ambit names are ONGC, Voltas, Torrent Power, Oberoi Realty, Pidilite, Exide, Amara Raja, and Navneet Publications.

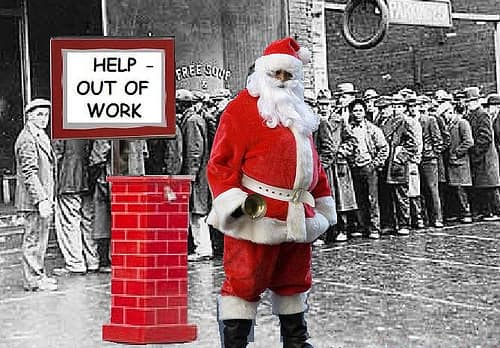

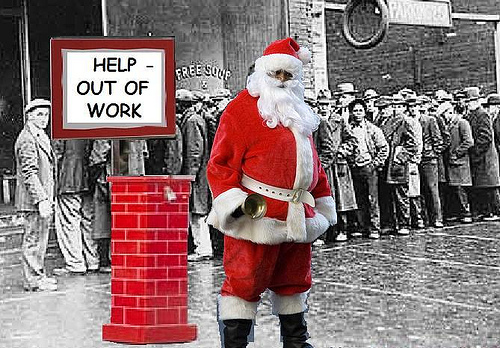

[caption id=“attachment_109737” align=“alignleft” width=“380” caption=“The report picks up studies and explanations by American economists Carmen Reinhart and Kenneth Rogoff which says that after a banking crisis, sovereign debt rises rapidly. Photo: MikeLitch/Flickr”]

[/caption]

[/caption]

The report picks up studies and explanations by American economists Carmen Reinhart and Kenneth Rogoff which says that after a banking crisis, sovereign debt rises rapidly. This happens mainly due to three reasons. The fiscal balances deteriorate as the government has to provide fiscal stimuli to banks and also tax revenues go down. The cost of public borrowing goes up as well due to perceptions of high risks. When government debt to GDP ratio goes over 90 percent, in most cases, it is seen that nominal GDP growth falls. Real GDP growth suffers as business sentiment is low and people are scared to take on risky projects.

USA, Japan, France and Italy- the four economies which consist of 30 percent of world GDP- will operate at sovereign debt-GDP ratio of 90 percent by this year end, says IMF. In that case, one can understand the significant slowdown in world GDP growth that will follow.

Ambit says this world scenario will impact India in two significant ways. First the economic crisis will only worsen in 2013 from 2012, unlike their previous assumption that 2013 will be as bad as 2012. Second, once the Indian economic outlook worsens, RBI will cut interest rates once the crisis emerges.

In conclusion, Ambit says, “We are cutting our GDP growth forecast for FY13 to 6.2 percent Y-o-Y as the persistence of macroeconomic uncertainty translates into weak investment demand growth which in turn affects industrial sector growth and services sector growth.” Agrarian growth might come down in 2013 as the base of 2012 is likely to be high due to good monsoons. But the non-farm sector growth will be hit mainly due to a global scenario, both of which together will hamper the over all GDP growth of the nations.

)