ByShobhit Agarwal

While banks have aided most real estate development in the past, the cost of debt is getting higher by the day. The strict guidelines introduced by the RBI have made real estate lending even more expensive and cumbersome.

Currently, the costs of key inputs for real estate development are up by at least 7%. This is over and above a rise of about 25% last year. Labour cost is up 10-15% and the costs of steel and cement by about 7%. To add to this, funding costs have headed north. If we look at a city like Mumbai, the recent DCR amendments would add to developers’ costs by about 15%, which includes the fungible premium payable if the builder opts to take the additional 35% (floor space index) FSI option.

Cumulatively, this comes to an approximate hike of 20% in construction cost, which most developers would pass on the consumers. The Indian real estate sector is in dire need of foreign funding - both in terms of maintaining growth and for the benefit of consumers.

FDI - The Only Feasible Option

Unlike most developed economies, India does not allow REITs (Real Estate Investment Trusts). Many would point to the M&A route, but this is also a lacklustre option as it comes at a cost of about 20%.

Meanwhile, REMFs (Real Estate Mutual Funds) - India’s tentative answer to the international REITs model, adapted to the existing Indian mutual funds platform - do not seem to be the right answer, either. While everybody is working on entry and creating assets, the important question of who will buy these assets to provide an exit to the developers / investors needs to be addressed.

The leveraging allowed in the case of Indian REITs is the lowest (at 20% of the value) compared to 35% in case of Malaysia, Hong Kong, Singapore, and Taiwan and 200% in the case of Korea. This could result in a lower yield - and because it is not really leveraged, the risk factor is also higher.

With all these routes being plugged because of the risk involved, FDI is clearly the only life-saver which the real estate sector can look up to. However, the ever-changing policies on FDI, taxation and development, coupled with a lack in transparency in the system and a high amount of friction in approval mechanisms, have led to an uncertainty in yields and tenure of lock-in for investments in real estate.

Today, if a foreign investor is willing to invest for a medium term like 5-6 years, he is bound to be hesitant as it is most likely that the targeted projects would take longer than 5 years to be completed. Also, foreign investors are bound to miss out on the cream of returns, which comes only after the project is in advanced stages of development or nearing completion.

This uncertainty of the quantum and time of returns is the reason why most foreign investors are currently shying away from Indian real estate sector.

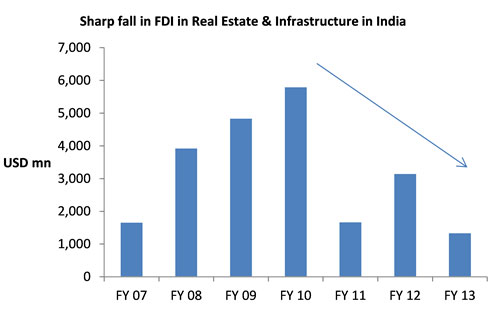

FDI Slowing on Low Yield, Long Gestation

Some international and domestic real estate funds are still focused on investments in residential projects in India. Luxury housing projects are out of the picture, as they are not large enough to meet minimum size for FDI requirements. Today, a majority of real estate investments are targeted towards the mid-income housing segment with unit typically priced between Rs 50 lakh and Rs 1.5 crore. Now, even affordable housing projects are failing to strike a chord with investors owing to the low yield and long gestation period involved.

[caption id=“attachment_1010739” align=“alignleft” width=“489”]

(Source: Department of Industrial Policy and Promotion)[/caption]

What Is Needed To Boost FDI in Indian Real Estate?

To enable the Indian real estate sector to meet its massive capital requirements and capitalise on the opportunities for large-scale real estate developments, the sector needs investor-friendly, streamlined policies from the government. The most important steps would be:

Allowing 100% FDI in most real estate segments (with relaxation of certain parameters)

Introduction of a dedicated regulatory body

Ramping up the speed of the approval process.

These, coupled with increased transparency, adapting modern designs and technology for improved project execution and timely delivery from the industry are essential for attracting FDI back into Indian real estate.

Shobhit Agarwal is Managing Director - Capital Markets, Jones Lang LaSalle India

)

)

)

)

)

)

)

)

)