Even though New Delhi’s Connaught Place is still regarded the fifth most expensive office market in the world, the real estate battle is between Gurgaon and Noida.

The two are clearly the market winners when it comes to office space absorption as they accounted for 89 percent of the office space transacted in the National Capital Region in the fourth quarter of financial year 2012, according to a report by real estate research and consultancy firm Knight Frank.

Having emerged as industrial hubs of the NCR, these bustling suburbs of Delhi have also emerged as hot IT spots. The natural transition from industrialisation to corporatisation has led to a residential and commercial office boom in Gurgaon, while connectivity is Noida’s major trump card. The DND Fly-over has brought Noida and Greater Noida really close to Delhi and has provided a major fillip to real estate growth in this region.

While Noida-Greater-Noida belt has the potential to eclipse Gurgaon in the next three years, it is way behind Gurgaon when it comes to attracting multinationals, as the latter still remains the most preferred micro-market for office absorption, contributing nearly 60% of the quarterly absorption. But not without a caveat. While the ride to Gurgaon from Delhi is a nightmare, the connectivity from Delhi to Noida is rather smooth.

As this Times of India article points out, Noida is being developed as a self-contained town on the principle of “walk to work . While Gurgaon, has a headstart to Noida it has a lot of catching up to do, despite the ongoing frenzied construction activity that took place without a proper master plan.

“Gurgaon is a Coke while Noida is a Thums Up. “Noida needs to project five-star style if it is going attract MNCs,” it said quoting branding veteran Alyque Padamsee

Why MNC’s prefer Gurgaon, Noida over CP

CP still retains its ’exclusive tag’ as traditionally office space demand here was driven by government departments and private companies looking for a presence in the central part of the city for good connectivity. However, now that supply in the area is restricted to a few Grade A buildings, MNCs are betting on Noida and Gurgaon as both locations offer ample options to tenants looking for large and contiguous office spaces, coupled with a wide range of amenities in the premises. Good connectivity, planned infrastructure and most of all ample residential options foremployees are some of the key contributing factors to the growing demand.

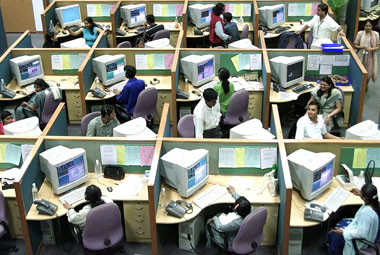

[caption id=“attachment_903931” align=“alignleft” width=“380”] Reuters[/caption]

“Post the IT/ITeS boom in India a steep upsurge in office space demand was observed. Secondary and Peripheral Business Districts emerged to accommodate the fast paced growth in office demand. Multinational companies entered the NCR market with specific requirements in terms of type and size of office spaces. Developers were able to grab this opportunity and a bulk of commercial projects were launched in Noida and Gurgaon,” said Dr Samantak Das Chief Economist & Director, Research, at Knight Frank.

Rentals rise but absorption dips

While the city did witness a 7 percent annual rise in average office rentals , it saw a 25 percent drop of office space absorption in FY13 against last year as only 27 transactions were recorded in Q4 against 45 in the year-ago period as a number of IT/ITeS companies have put their expansion plans on hold, while new hiring is also muted considering the global slowdown.

“The IT/ITeS sector has been the largest contributor to the overall office absorption pie in the NCR office market. However, its share came down to 35% in Q4 FY13 showing a drastic dip compared to the same quarter last year,” said Das.

[caption id=“attachment_904037” align=“aligncenter” width=“600”] Source: Knight Frank[/caption]

But while IT/ITeS in the doldrums, NCR saw good demand from the BFSI sector, which contributed to nearly 23% of total absorption primarily due to American Express taking up about 0.25 mn.sq.ft in DLF Cyber City.

According to the report American Express, Fiserv, Jacob’s, HCL, Micromax and Google were the top space occupiers in Q4 FY13 and accounted for approximately 75% of office absorption.

)

)

)

)

)

)

)

)

)