Apple under Steve Jobs has done everything a company should to reward shareholders. The company innovated to bring best-in-class products carrying best-in-class technology to consumers. Apple created a need for consumers to own Apple products. The need to own Apple products was not restricted to US consumers, the company’s home base, and the need traversed the globe.

Apple’s market is the world and there are absolutely no restrictions on anyone across the world using its products (except for places where it is fighting a patent war with Samsung). Apple’s stock has returned over 3,000 percent since the time Steve Jobs took it over in his second coming in the late 1990s. Apple, in fact, became the most valuable company by market capitalisation in the world briefly in August 2011, overtaking Exxon the oil giant.

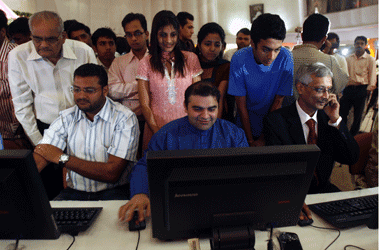

[caption id=“attachment_109586” align=“alignleft” width=“380” caption=“Investors should see if the stocks they own or are looking to own have any of the Apple traits and if not what is the threat their company is facing in the marketplace by not having any of the Apple traits. Reuters”]

[/caption]

[/caption]

What can investors learn from Apple?

Changes in technology or the way technology is delivered can wipe out well established players in the market.

The obvious example here is Nokia, which was the leader in mobile handsets in the first part of the 2000 decade, and now it is completely swamped by Apple, Samsung and other competitors and is struggling to survive. Investors should always keep a watch on changes in technology that can make the products of a company obsolete.

Investors should look at potential gainers from blockbuster products

Blockbuster products lead to demand for products and services that go to feed the blockbuster. In Apple’s case, the outsourcers and application (App) developers gained on the back of Apple’s products. The fact that Apple’s products are largely driven by wireless internet (Wifi) means holders of broadband spectrum benefit. Investors should look at potential gainers from blockbuster products apart from the company owning the blockbuster.

Investors should look for stocks that are not dependent on government policies

Technology or technological innovations are non-cyclical in nature and do not depend on government or central bank policies to do well. Apple did not need any fiscal or monetary support, unlike US automakers and banks did during the crisis period of 2008. Investors should look for stocks like Apple that are not dependent on government policies or central bank policies for profits or even survival.

The person at the helm does matter.

Apple with Jobs and Apple without Jobs were totally different in terms of market performance of the stock. Between the time Jobs started Apple and left it in 1985, Apple’s stock did well in the markets and then floundered till Jobs came back to push up the stock price up by his vision. Investors should carefully analyse any change of guard of any well performing company before voting to stick with the company.

The potential market for a company’s product is important.

In Apple’s case the market place for its products spanned continents. However, a product that caters to only a certain market, which may or may not grow, restricts the potential for the product. Hence internet-based companies such as Google make huge profits as users of Google are based everywhere in the world. The same is not the case with companies catering to a local market or a market limited by geographies.

Investors should look for companies that do not require debt or equity dilution

Apple did not need to leverage itself or dilute equity to succeed. It succeeded by taking the right products to consumers. Apple is a completely risk-free company in terms of its balance-sheet. Investors should look for companies that do not require debt or equity dilution to do well in the future, especially when the cost of debt and equity is expensive.

Apple is obviously a one-of-its-kind company, but it has shown how to make huge profits through sheer genius at the top, changing the way technology is delivered, and making consumers want its products. Companies that have one or two of these three Apple traits will also do well.

Investors should see if the stocks they own or are looking to own have any of the Apple traits and if not what is the threat their company is facing in the marketplace by not having any of the Apple traits.

Arjun Parthasarathy is the Editor of www.investorsareidiots.com a web site for investors.

Mitu Jayashankar is a Contributing Editor at Forbes India. She is a Delhi girl who has managed to embrace the quirks of the South Indian way of life after her move to Bangalore. A sceptic but not a cynic by her own definition, Mitu considers herself lucky to have been a part of the Garden City’s journey from a sleepy paradise to a bustling high-tech metropolis. Her interests range from technology and business to education, social entrepreneurship and philanthropy. She began her career at A&M and has passed through the portals of Businessworld and The Economic Times.

)