High inflation and weak economic outlook are adversely impacting urban consumers’ confidence affecting their discretionary and FMCG spends, a survey by Religare Institutional Research has found. Gold is losing its lustre as an investment avenue, and home and car purchases are also being deferred.

In the FMCG sector, urban consumers are downtrading-consumers buying cheaper and low quality products to adjust to the rising prices-as high prices are beginning to bite. However, Hindustan Unilever has managed to maintain its dominant position in soaps, skin cream and detergents, Procter & Gamble in shampoo, Colgate in toothpaste, and Bata in footwear.

Conducted among more than 1,000 respondents across 100-plus towns and cities, the survey has also found consumers decide to buy or sell property and car looking at the prices and not interest rates.

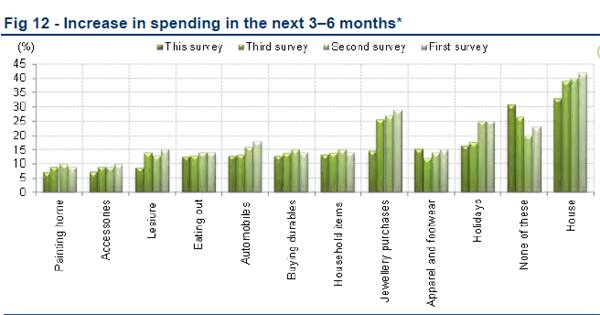

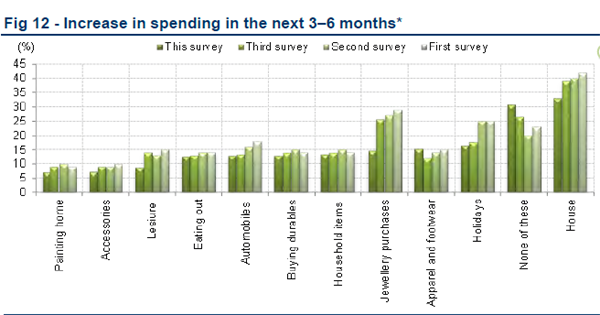

[caption id=“attachment_75488” align=“aligncenter” width=“600”]

Chart by Religare Institutional Research[/caption]

Chart by Religare Institutional Research[/caption]

Here are the key findings of the survey:

* Number of respondents who are confident about economy and own growth has declined to 33 percent from 40 percent in the last survey conducted in November 2012.

* As many as 52 percent prefer fixed deposits and 42 percent real estate as investment avenues; gold is losing its sheen.

* Among the higher income households, 22 percent preferred real estate.

* Most of the respondents are looking to buy cars, ACs, kitchen appliances, but 26 percent have no big-ticket purchases planned for the next 3-6 months.

* Overall spending outlook muted; as many as 20 percent of higher income households not planning any discretionary purchases.

* Jewellery purchase decisions have almost halved from the November 2012 survey; respondents who wanted to increase spends on homes fell to 33 percent from 38 percent in the last survey.

* More than 40 percent is looking to cut spends on eating out, holidays and leisure.

* For lower income households, inflation is felt the most in house rent (18% of respondents) and travel (30%).

* Food inflation hitting metros more than tier-3 cities.

* As many as 55 percent respondents said they would buy a house if prices correct or interest rates drop.

* Expectation of a decline in property prices is increasing. As per the survey, 74 percent of the respondents expected property prices to either remain flat or increase hence forth. The corresponding figure in the last survey was 85 percent.

* Fuel prices and bleak economic/employment outlook are key deterrents for potential car buyers.

* Online shopping is witnessing a steady increase. As many as 71 percent of the respondents now shop online, up from 64 percent in the November 2012 survey.

)