A surge in gold imports widened India’s trade deficit to an 11-month high in June, adding to the uncertainty from global oil prices that could pile more pressure on its current account balance.

The trade deficit swelled to $11.76 billion last month, its highest level since July 2013, after a Reserve Bank of India decision to ease tough gold import rules led to a 65 percent annual rise in overseas purchases of the yellow metal.

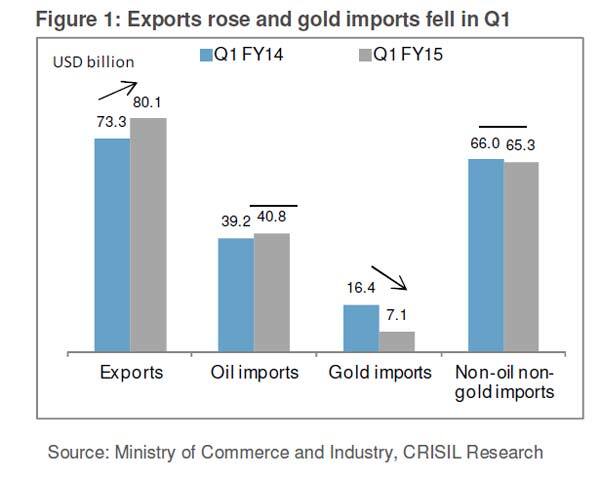

According to Crisil, the widening of merchandise trade deficit by $4.5 billion suggests a potential widening of the current account deficit (CAD) in Q1 fiscal 2015.

“For fiscal 2015, while export growth is expected to gain momentum with global recovery, imports too will rise as some of the restrictions on gold imports have been lifted and imports of oil, consumption and investment goods are likely to rise with recovery in GDP growth,” Crisil said in a note yesterday.

“Any surge in crude oil price due to intensification of the Iraq strife could also create upside risks for India’s trade deficit, as crude oil imports constitute around 1/3 of India’s overall merchandise imports. Average crude oil prices are already higher so far this fiscal at $109.8/barrel compared to $107.6/barrel in Q1, fiscal 2014,” it said.

Merchandise trade deficit during the month at $11.7 billion was almost unchanged from the previous month. Exports rose 10.2%, a double-digit growth for the second consecutive month and imports 8.3%, first positive growth in one year.

“The rise in imports was driven by higher gold as well as oil imports compared to year ago. Growth in non-oil imports excluding gold remained muted at 1.9% year-on-year indicating still weak domestic demand. Overall, oil imports grew by 10.9% and non-oil imports by 7% year-on-year,” the report said.

Gold imports in June doubled to $3.2 billion from $1.7 billion in April 2014.

The permission accorded to large private gold importers to resume imports and to nominated banks to offer gold metal loans to jewellery manufacturers from May have been partly the reasons behind higher gold imports, the rating agency said explaining the reasons behind the increase in gold imports.

A voracious appetite for gold among Indian consumers has made the bullion the country’s second-biggest import item after oil and was one of the principal factors in putting it on the brink of a full-scale balance of payments crisis last year.

In a desperate bid to trim a gaping current account deficit, India last year increased import duties on gold and imposed a rule that required a fifth of all bullion imports be re-exported.While those measures had dramatically reduced gold imports and improved the current account balance, they also pushed up premiums in the domestic market, sparking a rise in smuggling.

But a strong rebound in gold imports could mean the curbs stay in place for some time as the country’s overall import bill is expected to rise on the back of an improvement in investment and consumption activity, adding to the trade shortfall.

[caption id=“attachment_91036” align=“aligncenter” width=“600”]

Gold imports[/caption]

Gold imports[/caption]

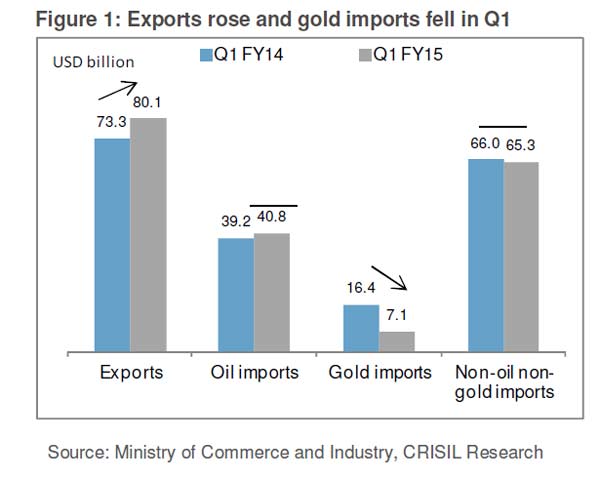

Merchandise exports, meanwhile, grew for a third straight month in June, helped by a pick-up in external demand and a weak currency, bolstering the outlook for an economy that is battling the longest sub-par growth in more than a quarter of a century.

Exports in June rose 10.22 percent from a year earlier to $26.48 billion, a slower pace than May but underlining a turnaround since March on improving global growth.

Here’s a look at the sectors that contributed the most to exports:

[caption id=“attachment_91037” align=“aligncenter” width=“600”]

Sectors that contributed to exports[/caption]

Sectors that contributed to exports[/caption]

The data comes on the heels of a sharp drop in inflation and a strong rebound in industrial production, offering some cheer to Prime Minister Narendra Modi who swept to power in May on a promise to revive Asia’s third-largest economy.

Economic growth has been stuck below 5 percent for the past two years, weighed down by weak investments, tepid domestic and external demand, and high inflation and interest rates.

However, poor monsoon rains this summer could hit farm exports and slow down overall export growth. The waning of a favourable statistical base and a relatively stable currency are also expected to weigh on the sector.

)