Indian equity markets are scaling new highs as investors are betting on more effective execution by the new government. However, according to Sajjid Chinoy and Toshi Jain of JP Morgan, not all problems (especially in the infrastructure sector) stem from New Delhi and simply relying on the next government to revive investment in the economy would be foolish. Here are the reasons why:

- Asurvey of the top 50 stalled projects revealsthat 80 percent of these projects are stuck because of problems whosesolutions lie largely in the hands of state governments rather than the central government.So whether the BJP comes to power or UPA, the new government will have much less leverage in dismantling the bottlenecks of these stalled projects.

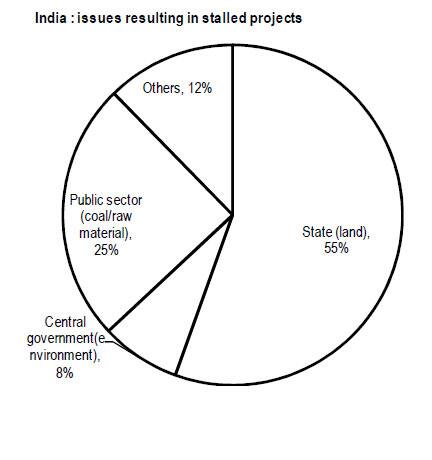

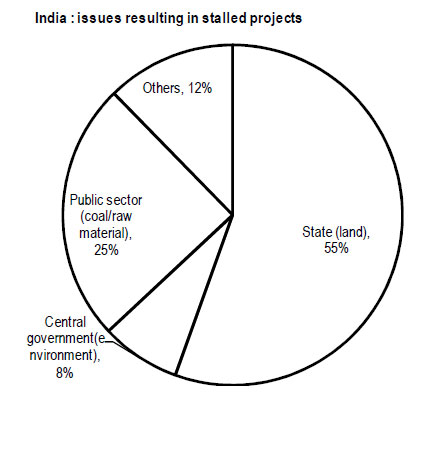

“Almost 55 percent of the projects-in value terms-among the 73 projects that were stuck because of state-related issues. Forty six percent of these projects were stalled on account of land acquisition-the single biggest constraint-which is a state subject. And the remaining 9 percent, on account of contractual and legal issues relate to individual states,” the analysts said.

So obviously these are constraints over which the central government has no jurisdiction.

And in comparison, only eight percent of projects were stuck due to environmental clearances, which are directly under the purview of a central government. Meanwhile, another25 percent of projects were stuck on account of not being able to attain coal, gas,and other raw materials.And even though the central government has been gung-ho about power secor reforms, the fact that the pricing by state electricity boards still remains a state issue implies the central government does not have too much power to de-bottleneck projects in the power sector.

[caption id=“attachment_81218” align=“aligncenter” width=“432”]

Source: JP Morgan[/caption]

Source: JP Morgan[/caption]

The chart above shows that state-specific issues account for 80 percent of the total stalled value and hence any new-government will find it difficult to jump start investment.

Also, let’s not forget that financing these inra projects is not going to be easy, since currently public sector banks are saddled with impaired loans, and would need a massive capital injection by the government - far in excess of what has been budgeted - to finance any large pick-up in credit growth.

" Accelerated recognition of the NPA stress among public sector banks and a recapitilzation of the budget would go a long way in reducing risk aversion and financing any capex cycle, but fiscal constraints preclude any such decisive recapitalization for now," said the JP Morgan report.

Basically, it’s all one-big pile-up and the central government alone can’t do much to clear it away.

)