The Reserve Bank of India has hiked the repo rate, its key policy lending rate, by 25 basis points and deregulated the savings bank deposit rate with immediate effect.

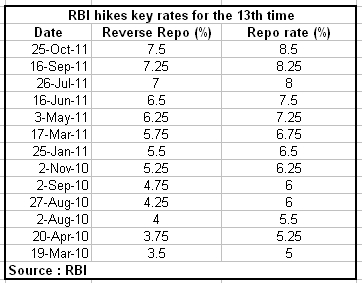

The repo rate now stands at 8.5 percent, while the reverse repo rate stands at 7.5 percent. The rate hike is the 13th increase in 19 months.The bank rate and the cash reserve ratio have been maintained at 6 percent.

The central bank also cut the growth forecast for the economy to 7.6 percent from 8 percent for the economy for the year ending March 2012.

While the repo rate hike had been expected, the savings rate deregulation took the markets by surprise.

[caption id=“attachment_116562” align=“alignleft” width=“380” caption=“D Subbarao. AFP”]

[/caption]

[/caption]

Here are excerpts of what governor D Subbarao had to say on growth, inflation and the savings bank deposit rate deregulation.

On savings banks’ deposit rate deregulation:

In a statement, the RBI said banks are free to determine the savings bank deposit rate subject to two conditions: “each bank will have to offer a uniform interest rate on savings bank deposits up to Rs 1 lakh, irrespective of the amount in the account within this limit.

“Second, for savings bank deposits over Rs 1 lakh, a bank may provide differential rates of interest, if it so chooses. However, there should not be any discrimination from customer to customer on interest rates for similar amount of deposit.”

Most experts said this was the most significant announcement in the RBI policy.C Rangarajan, chairman of the Prime Minister’s Economic Advisory Council, said freeing the savings deposit rate wouldresult in competition in banks but “would settle down”.

“Banks will have to take the cost of maintaining savings deposits (primarily because cheques can be issued and collected on these deposits) into account,” he said, adding that " interest rates would be determined by the costs incurred by banks on these deposits”.

He said the savings rate might endup 1-2 percentage points above the current 4 percent.

While continuing to remain vigilant against inflation, the RBI said that prices were likely to ease by December. “Both inflation and inflation expectations remain high. Inflation is broad-based and above the comfort level of the Reserve Bank. Further, these levels are expected to persist for two more months.

“Risks to expectations becoming unhinged in the event of a pre-mature change in the policy stance cannot be ignored. However, reassuringly, momentum indicators, particularly the de-seasonalised quarter-on-quarter headline and core inflation measures indicate moderation, consistent with the projection that inflation will begin to decline beginning December 2011,” the statement said.

Governor D Subbarao also said the likelihood of rate action in December was “relatively low” now, adding that rate action may not be warranted beyond December.

“The projected inflation trajectory indicates that the inflation rate will begin falling in December 2011 (January 2012 release) and then continue down a steady path to 7 per cent by March 2012. It is expected to moderate further in the first half of 2012-13,” the RBI said.

“With this in mind, notwithstanding current rates of inflation persisting till November (December release), the likelihood of a rate action in the December mid-quarter review is relatively low. Beyond that, if the inflation trajectory conforms to projections, further rate hikes may not be warranted. However, as always, actions will depend on evolving macroeconomic conditions.”

On economic growth:

The moderation in economic growth was acknowledged by the central bank. “…growth is clearly moderating on account of the cumulative impact of past monetary policy actions as well as some other factors. As inflation begins to decline, the opportunity emerges for the policy stance to give due consideration to growth risks, within the overall objective of maintaining a low and stable inflation environment,’ the statement said.

The key risks to growth, the RBI said, are the global macroeconomic environment, global commodity prices (which continue to be high), increased market borrowings by the government and food inflationary pressures.

On the expected outcomes of monetary policy:

Monetary policy is expected to continue to “anchor medium-term inflation expectations on the basis of a credible commitment to low and stable inflation; reinforce the emerging trajectory of inflation, which is expected to decline in December 2011; and contribute to stimulating investment activity,” the RBI said in a statement.

See the full RBI release:

SQR251011FL)