The India shining story till around a few months back was a favourite in the media, the corporate corridors and political rallies. Unlike China we had a vibrant domestic-demand-supported economy which made the India growth story almost infallible.

[caption id=“attachment_128358” align=“alignleft” width=“380” caption=“Ambit Capital pinpoints what they call the four problems that are tearing apart the India story. Reuters”]

[/caption]

[/caption]

Come in Anna Hazare, the growing talks of corruption, postponed policy decisions and the euro crisis, no one is so sure anymore. The long term still looks the same for the optimists. But the next year or two look riddled with pain. Ambit Capital pinpoints what they call the four problems that are tearing apart the India story.

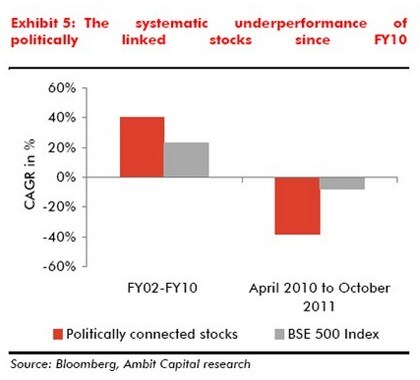

•The nexus between the state and private sector is quite apparent now. The state government has come a long way from the license Raj of the 1970s and 1980s. But the state still has the veto power in setting up most of the industries. The report says, “private sector has had to define an unwritten contract with the State.”

It has been known that corporate corruption is not separate from political corruption but it came under the lens only after the unveiling of the 2G scam. If a Jan Lokpal comes into reality, more names could spring in the public. But the fact that a fear of doing wrong is delaying decision making and implementation of projects is bad for infrastructure, capital goods, power and construction companies.

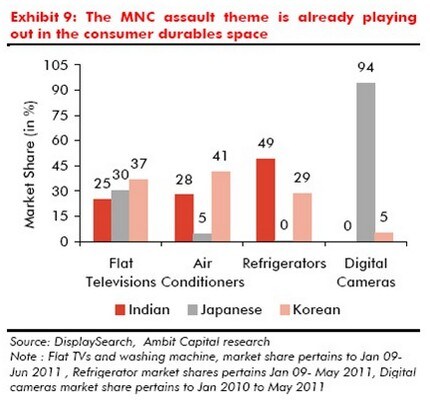

• India’s rapid urbanisation, rising income and favourable demographic dividend make for the perfect recipe for a growing consumption based economy. Add the global economic gloom and one knows that no one can stay away from India for long.

The flipside of this is Indian companies are increasingly at the risk of losing market share or margins. Except in the case where a company is a potential target to be taken over by a foreign company, Indian companies have only to lose in this fierce competition with foreign players.

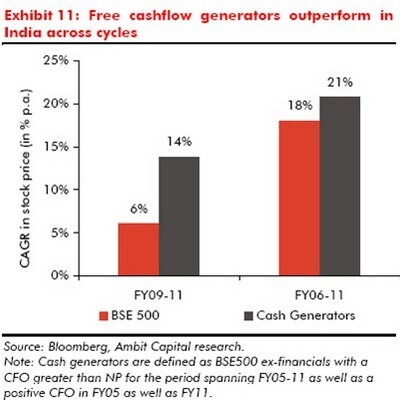

• The disparity between Indian savings and investments is well known. Most Indian households which save do not have access to a formal banking system or do not have enough risk free savings to invest in the markets. As a result only 2-5 percent of Indian savings go to the capital or debt market. With rising inflation and extremely high interest rates, cost of Indian debt has gone high.

Since India is dependent on foreign players for capital, any crisis there has the potential to affect us. As a result, simple business models which can generate enough cash flows will do better than the others. Banks must also do well in the long run as they are irreplaceable as the major fund providers in the Indian economy.

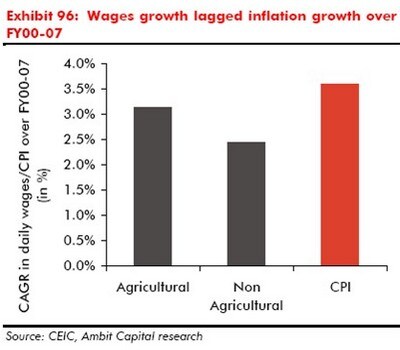

• The neglect of ’labour’ in India vis–vis ‘capital’ and the resultant conflict between these two factors of production, is another issue that the country needs to tackle. The strikes at Maruti or Coal India are the manifestations of this disparity. India has ignored its labour force, a major factor of production for too long.

In India share of labour in revenue is declining and minimum wages are deplorable compared to most emerging markets. Sectors like auto and auto ancillaries, mining, metals (non ferrous), banks etc which are labour-intensive but have reduced cost of labour compared to capital will lose out the most in this tussle between labour and capital.

)