New York: Finance Minister Pranab Mukherjee told American CEOs in a closed-door meeting that the Indian government would get its legislative agenda back on course in the winter session of Parliament to secure long-stalled tax, insurance and banking reforms.

While the Congress-led coalition has stopped having the Left breathing down its neck after its 2009 election victory, it still suffers from policy paralysis and has not been able to push through big-ticket reforms. Some experts say part of the problem lies in the fact that the Congress party’s two largest coalition partners - the Trinamool Congress and the Dravida Munnetra Kazhagam (DMK) - have voiced their opposition to some aspects of liberalisation.

Mukherjee, however, told US business leaders the government would fast-track reforms in the November-December session of Parliament.

“This coming winter session of Parliament will be an active one in seeking a sea change of legislation,” Mukherjee told a roundtable meeting of business high-fliers in New York on Wednesday.

Mukherjee said business would benefit from new legislation to overhaul India’s tax system - including a Goods and Services Tax (GST) bill. He said the adoption of GST would simplify India’s tax structure and iron out differences in taxes among India’s 28 states. The GST Bill is stuck in the Lok Sabha and has not been able to win parliamentary approval as it faces opposition mainly from the Bharatiya Janata Party. The measure has been delayed for two years and may miss an April 2012 deadline for implementation.

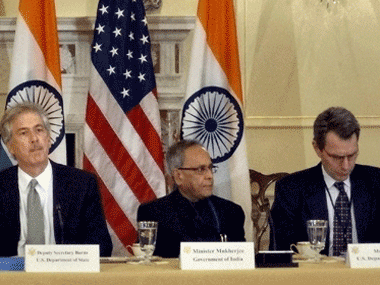

[caption id=“attachment_90377” align=“alignleft” width=“380” caption=“Union Finance Minister Pranab Mukherjee at the India-US CEO Forum in Washington. PTI”]

[/caption]

[/caption]

The finance minister said the government was working on a proposal to lift the cap on foreign holdings in insurance companies to 49 percent from 26 percent and scripting new legislation relating to banking, and pension funds, but needed to first arrive at a consensus with other political parties. The pension and the insurance bills are being examined by a parliamentary panel, headed by former BJP finance minister Yashwant Sinha.

India may allow foreign investment of up to 26 percent in the pension sector, giving global players access to roughly a $2 billion pool of assets that is expected to grow quickly as more Indians join the workforce. Not surprisingly, most of the 23 life insurance players in India, nearly all of which have a foreign partner holding a 26 percent stake, are eager to enter India’s lucrative pension fund market.

Mukherjee indicated the government was backing in principle foreign direct investment in multi-brand retail, but it needed time to build support for it; “A consensus on allowing foreign direct investment in multi-brand retail is being evolved and will be operationalised in the near future.”

Opening the retail sector remains contentious, as many fear allowing American companies like Wal-Mart unfettered access would ruin millions of Indian family-run shops. Currently, foreign retailers can run wholesale outlets. Wal-Mart Stores Inc., with Bharti Enterprises, opened its first in 2009, but it still can’t open direct-to-consumer shops that sell more than one brand.

Foreign investors say that the financial reforms in themselves are “no magic wand” but they will instill business confidence, and with it a more benign investment climate. Former US ambassador to India and USIBC executive board member Frank G. Wisner who chaired the business interaction with Mukherjee said a “big push” with financial reform would increase India’s ability to attract foreign investment during a global slowdown.

)