Indian power back-up companies are likely to see a demand boost for their products as power supply situation in the country has worsened, said Citi in a research report. Cummins India, Larsen & Toubro, and Havells India are its top picks in the sector.

[caption id=“attachment_349191” align=“alignleft” width=“380” caption=“The capacity addition during the Eleventh Plan has been a significant 51 gigawatts compared with 21 gigawatts in the Tenth Plan. Reuters”]

[/caption]

[/caption]

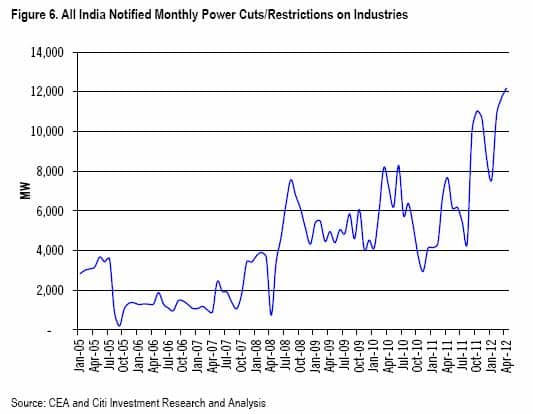

The brokerage has said power cuts/load shedding to high tension and low tension consumers had hit a historic high of more than 12 gigawatts (1,000 megawatt) in April. This is despite a strong pick-up in capacity addition during the eleventh five year plan (2007-12), it said, describing the situation intriguing.

The capacity addition during the Eleventh Plan has been a significant 51 gigawatts compared with 21 gigawatts in the Tenth Plan, Citi said in a research report.

“This has brought down India’s base deficits from -11 percent in FY09 to -8.5 percent in FY12. India’s peak deficit has also come down from -16.6 percent in FY08 to -11.1 percent in FY12. Longer-term trends in monthly base demand deficits and peak demand deficits also suggest improvements,” the report said. Peak demand deficit means the shortfall in electricity faced when the demand is peak, and base deficit is the deficit when the demand is minimum.

However, the brokerage says both these deficit figures do not reflect the reality. Peak deficit is not capturing the unscheduled power cuts which are rampant in India. And if the scheduled power cut is itself more than 12 gigawatts, what could be the unscheduled load shedding, the report wonders.

According to the power ministry, which has set a goal of power for all by 2012, the country has an installed capacity of around more than 201 gigawatts . Of this coal-fired output accounts for around 56 percent, hydropower around 19 percent and natural gas around 10 percent. With ever increasing supply shortfall, electricity back-up companies are unlikely to witness any fall in the demand for their products.

)