India is still among the lowest ranked countries in Asia Pacific for transparency of its property transaction process, while UK has most transparent commercial property market in the world, according toto the eighth global real estate transparency index from real estate constancy firm Jones Lang Lasalle.

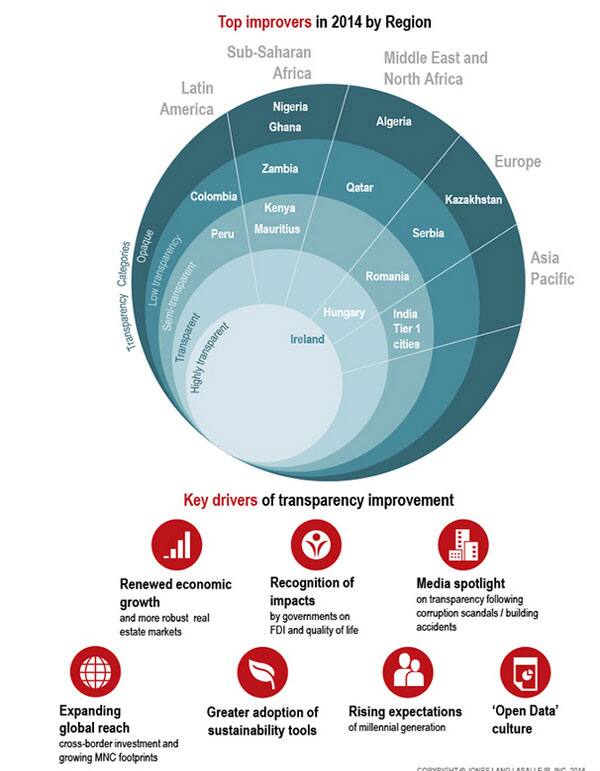

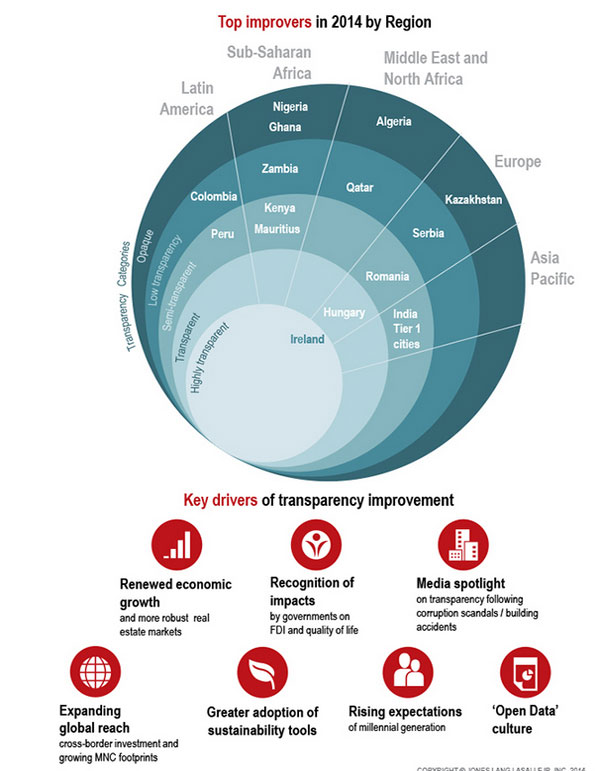

Primary cities in India have shown modest improvement in transparency over the past two years, mainly due to advancement in market data availability ( as shown in the graphic below) but gains in Tier III cities have remained limited.

[caption id=“attachment_88915” align=“aligncenter” width=“600”]

Source: JLL[/caption]

Source: JLL[/caption]

“Progress has nonetheless been the strongest in the Asia-Pacific region, with Indian cities starting to make up for the lost ground against other BRIC markets, where progress has been weaker. We expect momentum in transparency improvements to build over the next two years,“Jeremy Kelly, Director-Global Research, Jones Lang LaSalle, said.

“For example, India is likely to enact the Real Estate Regulation Bill, which seeks to improve regulation over real estate agents and the quality of land registry records. More generally, India could see faster improvement in real estate transparency, with the new government undoubtedly in a stronger position to push through economic reforms,” he added.

However, of the top 15 most transparent markets in 2014, Hong Kong ans Singapore were the only two Asia-Pac cities to make it to the list.

“The competition for the most transparent market in Asia has intensified, as Singapore moves ahead of Hong Kong, where cooling measures have compromised transparency levels,” the report said.

Top on the list is the UK followed by the United States, Australia, New Zealand and France.

The survey also showed that of the 102 markets covered, over 80 percent of markets have registered an improvement since 2012, although typically, increases in most markets have been ‘slow but steady’.

The top gainers in each survey generally correlate with a surge in foreign direct investment and corporate occupier activity, as investors help to accelerate transparency reforms and governments realise that poor transparency will affect continued inward investment, long-term growth prospects and the quality of life of citizens.

)