A non-event. A non-issue. That’s how most leading brokerages described the proposals of the Draft New Telecom Policy (NTP) 2011 announced by Telecom Minister Kapil Sibal on Monday.

Edelweiss, a local brokerage, even went so far as to say that “expectations of a draft NTP policy were belied as the telecom minister laid out an agenda for NTP 2011.”

The biggest grouse for most observers was that the policy, while high on ambition, was extremely short on specifics.

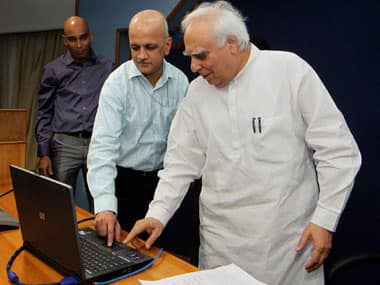

[caption id=“attachment_104575” align=“alignleft” width=“380” caption=“Minister of Communications and Information Technology Kapil Sibal alongwith Telecom Secretary R Chandrashekhar launching the National Telecommunications Policy-2011 draft in New Delhi on Monday. PTI”]

[/caption]

[/caption]

In fact, the only specific conclusion that most experts could draw was that the abolition of roaming rates would hit all companies in the industry.Kotak Institutional Equitiesestimated that the impact of removing roaming charges on earnings per share in financial year 2013 (April to March) would be 9 percent on Bharti, 22 percent on Idea and 30 percent on Reliance Communications.

Most analysts also expected companies to raise tariffs as a result of losing roaming charges. About 5-6 percent of revenues is generated from roaming charges for telecom companies, according to analysts. Nevertheless, stock and sector recommendations by almost all analysts remained unchanged because most of the proposals of the draft policy had been factored in.

Edelweiss said the goal of making an additional 300 megahertz (MHz) spectrum for mobile telephony by 2017 and another 200 MHz by 2020 is “positive as it would address the issue of spectrum scarcity in the sector.”

The recognition of telecom as an infrastructure sector, it added, would allow operators to enjoy 100 percent tax exemption for 10 years. Currently, telecom operators get tax benefits allowing 100 percent tax exemption for five years and exemption on 30 percent of profits for another five years. However, “as it is more than 10 years since Bharti, Vodafone and Idea launched services across circles, it is unclear how this will be affected,” Edelweiss pointed out.

Morgan Stanley noted the provision to create a new Spectrum Act to deal with all issues pertaining to spectrum pricing and related issues would further delay the process of determining spectrum-related liabilities for operators by 6-12 months.

HSBC said, overall, the draft policy was halfway through but directionally positive.

Indeed, that’s all it was, folks.

Nomura summed it aptly when it said the “draft policy is a step in the right direction, but is still a long way from providing regulatory clarity on key issues in our view. Specifically, it did not provide further details on spectrum renewal charges, spectrum refarming, license/spectrum levies and guidelines for consolidation or exit ofsome of the players. These are the key concerns at this point and will likely continue to overhang the sector.”

)