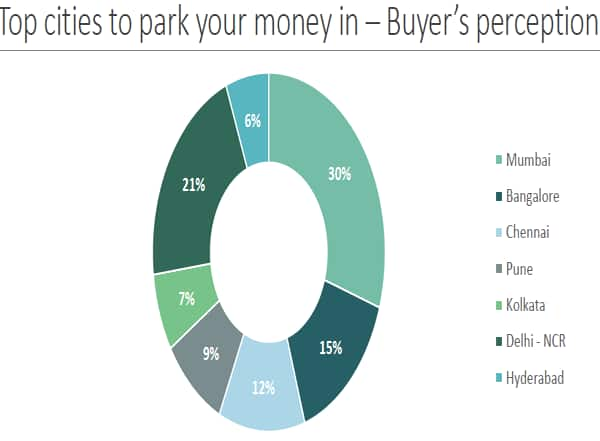

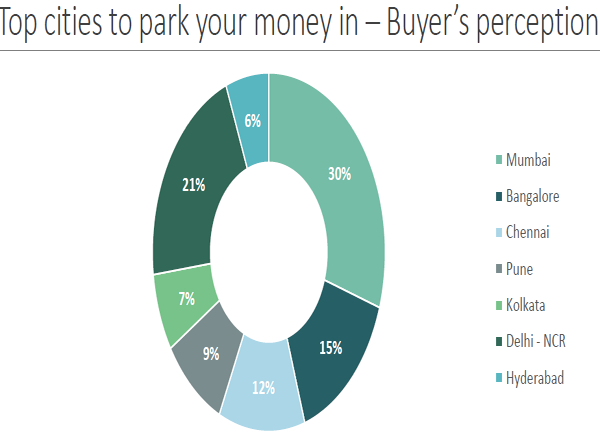

Mumbai is still the top favourite of property buyers, followed by Bangalore and Chennai as the next important destinations, according to a new survey conducted by Indiaproperty.com, which included a 2,583 sample of 40 percent respondents in the 25-35 age group and the rest above the age of 46 years.

In Mumbai, the hot localities include Airoli, Mira Road, Goregaon East, Borivali Westi, Kandivali, Andheri and Vashi, while in Bangalore the not investment destinations are Whitefield, Electronic City, JP Nagar, Sarajpur Road and Kanakpura Road, the survey revealed.

The other cities next on the rankings include Pune (Maharashtra), Kolkata, Delhi-NCR and Hyderabad.

[caption id=“attachment_89671” align=“aligncenter” width=“600”]

Source:Indiaproperty.com[/caption]

Source:Indiaproperty.com[/caption]

And ironically even though Indians have a penchant for gold, 67 percent prefer to invest in real estate while only 15 percent invest in gold. In fact, the survey found Indians love stocks and shares (18 percent) more than the yellow metal!

Nearly one-third of the respondents feel that the time is ripe to make a property investment decision, while 49 percent plan to wait and watch for sometime, with the remaining 16 percent saying the time is not right yet.

[caption id=“attachment_89669” align=“aligncenter” width=“600”]

Source: Indiaproperty.com[/caption]

Source: Indiaproperty.com[/caption]

However, nearly two-thirds - 62 percent - of all respondents expect property prices to soar in the near future while the rest feel that there will be an escalation in the next 1-2 years, but a total of 79 percent prefer long-term investments in property.

More than half - 55 percent - of the respondents expect the NDA government to reduce home loan rates and the rest demand better infrastructure and setting up of a real estate regulator.

As far as the preferred mode of investment goes, flats/apartments top the list with 40 percent of the respondents, followed by individual bungalows with 24 percent and residential plots favoured by 23 percent of the people.Commercial properties found favour with just seven percent and country houses and row-houses were chosen by three percent each.

Below are the top reasons why buyers thinkreal-estate looks promising today

[caption id=“attachment_89670” align=“aligncenter” width=“600”]

Source:Indiapropety.com[/caption]

Source:Indiapropety.com[/caption]

According to a report released by real estate consultancy firm Jones Lang Laselle, infrastructure developments have direct impact on property values, especially transport infrastructure.

“Residential and commercial properties located close to transportation infrastructure tend to command a premium-it has been common for real estate prices to appreciate in tandem with the development of infrastructure. The general rule being- the better the infrastructure, the better the property value,” the report said.

In fact, upcoming infrastructure projects usually lead to development of new residential hubs and if land prices in such locations are not high then it creates immense potential for affordable and budget housing.

Little wonder that better infrastructure tops the reason for real estate buy decisions at the moment.

Meanwhile, another Real estate sentiment index released by ZyFin Research suggests an expected rise in real estate purchases in Hyderabad and New Delhi over the next six months. Among the regions, the sentiment index is highest in North India, reflecting stronger demand in this part of the country.

[caption id=“attachment_89674” align=“aligncenter” width=“600”]

Source: Zyfin[/caption]

Source: Zyfin[/caption]

Also metro cities would see a quicker recovery in housing demand in the next six months, closely followed by Tier II cities. In fact, tier-I cities lag behind both metros and tier-II cities.

)