From being a poster-child of emerging market vulnerability, Indian equity markets have transformed into one of the biggest investor darlings in the past 12 months, so much so that foreign investors just can’t seem to get enough of India.

According to a JP Morgan report titled “India: elections, markets & the tyranny of economic reality,“India has received more than $3 billion in foreign institutional inflows(FIIs) in March even as most peers have seen just a trickle and yet others have bled outflows.”

Portfolio managers are strongly overweight on India compared to other emerging markets, and all this optimism has

fueled a sharp rally in recent weeks causing the Sensex and Nifty to trade at record highs every day.

India’s equity market is up 6 percent this year, while the MSCIemerging market index has been practically flat in the same period, despite hiccups on the economy front.

Even the Indian rupee is trading at an eight-month high since foreign equity inflows have been complemented by a surge in debt-inflows in response to India’s improving macros such as fiscal consolidation, a credible monetarypolicy that has kept interest rates high in the face of elevated inflation, and halving of the current account deficit , says Sajjid Z Chinoy, economist at JP Morgan.

However, he cautions thatthis euphoria among equity markets comes despite India’s GDP growth languishing below 5 percent for a second consecutive year-for the first time in 26 years, while inflation continues to remain high (mainly because vegetable prices have crashed in the run-up to elections).

“Core CPI is still stuck at 8 percent despite weak growth. And food inflation has averaged 10 percent over the last 10 years, suggesting that an upward mean reversion of food prices is inevitable,” says Chinoy. What this means is the RBI doesn’t have too much room for easing rates going forward. So if India’s macro-economics are not stable, what is causing the markets to scale new heights?

Duh! Of course, it’s politics. The currentmarket rally is predicated on a stable, reformist government post the elections that is presumed by markets tofundamentally alter the policy agenda and jump start a new investment cycle, notes the report.

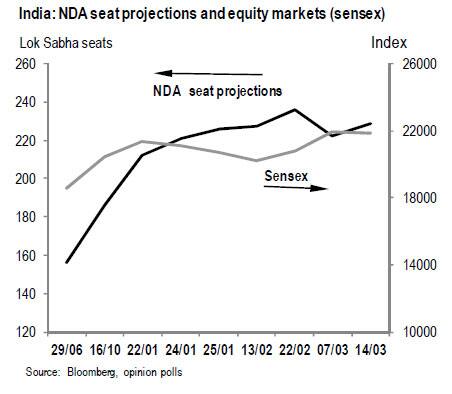

As the chart below shows, India’s equity markets have movedvirtually in tandem with forecasts of greater political stability.

[caption id=“attachment_81205” align=“aligncenter” width=“452”]  Chart 1[/caption]

But Chenoy thinks that markets may be running the risk of getting ahead of themselves and becoming a victim of their own ever-growing expectations since Indian pollsters have a patchy record in the last two general elections, while if a coalition government comes to power, the economy can kiss goodbye to a wave of reforms.

And thirdly, any immediate kick start to the investment cycle may be constrained by the debt overhang in infrastructure and impaired assets on public-sector banks.

" Growth is expected to lift as the business cycle begins to bottom. Improved implementation at the centre will help boost this cyclical lift. But with little space for fiscal or monetary support and implementation remaining constrained by state-level politics, the formation of a stable coalition at the centre, per se, may not be sufficient to deliver all that the market is hoping. Instead, markets may be forced to contend with the tyranny of economic reality,” noted the JP Morgan report.

)

)

)

)

)

)

)

)

)