Put India under a microscope - as we all do everyday - and its many deficiencies show up starkly. Everything from mass poverty to the rotten infrastructure to massive corruption to the skewed sex-ratio (and much else) gets magnified a thousand-fold, leaving one in absolute despair.

[caption id=“attachment_15400” align=“alignleft” width=“380” caption=“According to a Standard Chartered report, India could become the world’s third-largest economy by 2030. Reuters”]

[/caption]

[/caption]

Which is perhaps why it helps to take the long view on India - from the business end of a telescope, rather than a microsope. The picture that emerges then, of an India over a slightly longer time horizon, is much more hope-inspiring, although not without challenges.

Just ask the economists at Standard Chartered Bank, who have put out a research report in which they see India emerging a “winner in the current global super-cycle”.

The report, lead-authored by Chief Economist Gerard Lyons, offers a 360-degree perspective on India, and doesn’t flinch from looking hard at the many challenges it faces, but it is nevertheless extraordinarily bullish , summing up India as “tomorrow’s story and today’s opportunity.”

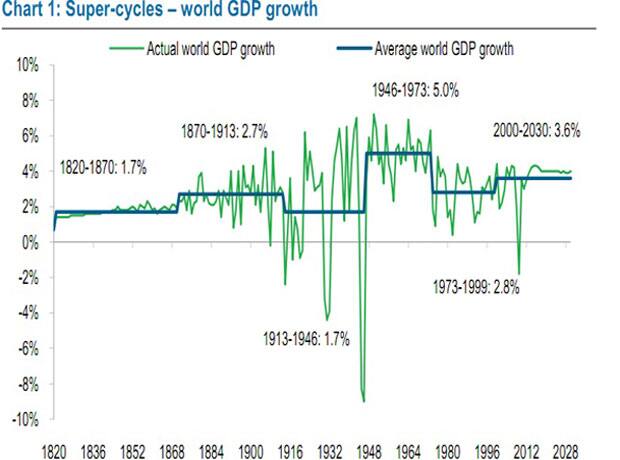

What is a supercycle?

The report defines a supercycle as “a period of historically high global growth, lasting a generation or more, driven by increasing trade, high rates of investment, urbanisation and technological innovation, characterised by the emergence of large, new economies.”

In their estimation, the world economy is currently experiencing its third suprcycle.The first such supercycle from 1870 to 1913 saw, among other things, the emergence of the US economy, which moved on the global economy charts from No. 4 to pretty much on top.

The second supercycle, starting after the Second World War and lasting until the early 1970s, saw the rise of Japan and the Asian tigers.

[caption id=“attachment_15386” align=“alignleft” width=“620” caption=“A supercycle is a generation-long period of extraordinary growth. Photo Credit: Standard Chartered”]

[/caption]

[/caption]

This third supercycle is being led by the rise of China, India and other emerging economies, which they say is shifting the balance of economic and financial power from the West to the East. Also benefiting from the current supercycle are Asia, the Middle East, parts of Africa and Latin America. The effect of all this, the analysts claim, “could transform the world economy over the next few decades.”

That’s not to say that growth will remain continuously strong over the entire period or that everything will go up all the time. There will be short-term uncertainties across the globe, and India and China will still be susceptible to the vagaries of business. But in their reckoning, by the time this supercycle has done its thing, the global economic landscape will look very, very different.

“China is likely to overtake the US to become the world’s biggest economy over the next decade, while India could become the world’s third-largest economy by 2030. Moreover, India is likely to grow faster, on average, than China over the next two decades. We factor in a trend rate of growth of 6.9% for China, allowing for setbacks along the way, and of 9.3% for India, again taking into account the business cycle.”

Strikingly, even that 9.3% trend growth rate for India for the next 20 years may be conservative, the analysts add. “Trend growth… could even be nearer 12-13% per annum.”

India, the report notes, has many of the features that will enable it to emerge as a winner in the supercycle. “We believe the winners will be those countries which have cash, commodities, or creativity, or a combination of these factors. India does not have an abundance of cash or commodities, but it has creative potential.”

India vs China, warily

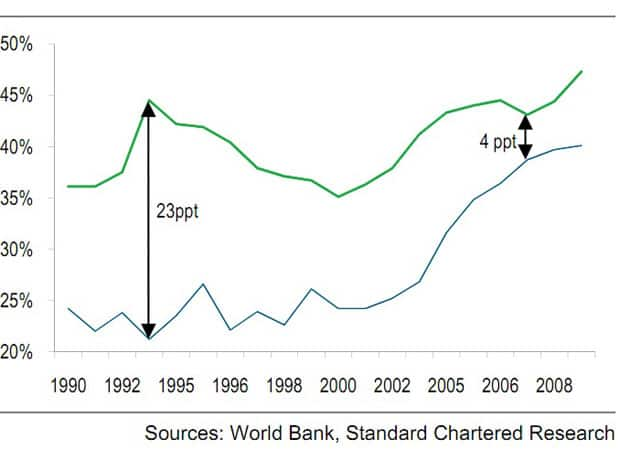

The analysts are justifiably wary of focussing on the China versus India debate, in much of which India gets unfavourable mention . But, in their estimation, comparing India’s and China’s records since 1978, when China’s economy opened up, is an “unfair debate” because India opened up its economy only in 1991, and then took more than a decade to get going. In that sense India’s opening up may be said to be two decades behind China’s.

In that framework, India, they note, has “tremendous potential to catch up with China and the developed world.” Based on their projections, India’s nominal GDP could grow from $1.7 trillion today to over $30 trillion by 2030.

[caption id=“attachment_15389” align=“alignleft” width=“620” caption=“India’s investment as % of GDP (blue line) is catching up with China’s (green line). Photo Credit: Standard Chartered”]

[/caption]

[/caption]

“A super-cycle, with globalisation and an open trade and financial system, can be positive for all regions, although some will grow more than others. India should be one of the relative winners.”

It’s of course too early to celebrate India’s ascendance in this supercycle, given the formidable challenges that India faces - which too the analysts address. Yet, it’s worth bearing in mind that the long view on India, under certain propitious circumstances, is rather more hope-inducing than the up-close, warts-and-all delineation that we get on a daily basis.

Venky Vembu attained his first Fifteen Minutes of Fame in 1984, on the threshold of his career, when paparazzi pictures of him with Maneka Gandhi were splashed in the world media under the mischievous tag ‘International Affairs’. But that’s a story he’s saving up for his memoirs… Over 25 years, Venky worked in The Indian Express, Frontline newsmagazine, Outlook Money and DNA, before joining FirstPost ahead of its launch. Additionally, he has been published, at various times, in, among other publications, The Times of India, Hindustan Times, Outlook, and Outlook Traveller.

)