Putting a number on corruption in India is tough, but Global Financial Integrity came out with a report in November which estimated that $213 billion, or at least $462 billion at today’s prices, was illegally transferred overseas between 1948 and 2008. It calculated the figure by using the World Bank Residual Model along with data from the International Monetary Fund’s Direction of Trade statistics.

Washington-based Global Financial Integrity found that in the last five years of the study, India lost illicit assets at a rate of $19 billion a year, far more than it was losing at the beginning of the research period.

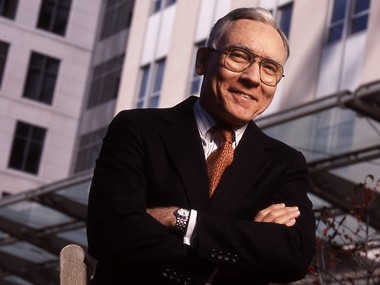

“I am well aware how big the story in India is about getting back the black money stashed abroad. I hope that India will continue to pursue that but the more important objective is to curtail the ongoing outflow of money,” said Raymond Baker, director of Global Financial Integrity.

[caption id=“attachment_107400” align=“alignleft” width=“380” caption=“Raymond Baker. Global Financial Integrity”]

[/caption]

[/caption]

Baker who has written a seminal book, “Capitalism’s Achilles Heel: Dirty Money and How to Renew the Free-Market System” says the money laundering business has become one of the key determinants of the success of the US financial system.

“The US and other rich countries make it illegal to handle proceeds of crimes committed within their borders. But don’t criminalize funds from illegal activity in other countries. There is an implicit cost-benefit analysis in the back of our minds that the movement of other people’s tax-evading money is okay,” said Baker.

The colour of money - whether black or white - doesn’t really matter, at least economically speaking, is Baker’s contention. Over the years, the US’s import of illegal money from countries such as India, South America and drug-producing Mexico is what has helped the country fund its huge external account deficits and keep demand for the dollar strong, says Baker.

Baker talked to Firstpost’s Uttara Choudhury in New York about how expanding India’s tax base, insisting on the automatic cross-border exchange of tax information on personal accounts, and curtailing trade mispricing has high potential to curtail illicit flows.

Media reports say US authorities have tax statistics from 10 Swiss banks. Do you think the US has finally shown some leadership in the global battle against money laundering?

I think the United States is doing a pretty good job of going after people who are cheating on US taxes. But there is a whole lot left to be done in the fight against global income tax invasion. It is not illegal in the United States to receive tax evading proceeds from abroad so when Indian, Mexican, Nigerian or others nationals show up with money for deposit in US accounts or wire transfer money to the US, even if it is tax evading money, we are perfectly prepared to take the deposits.

As long as you are willing to take the tax evading money, the doors remain rather open to money from other sources: criminal money, the proceeds of corruption or other forms of money laundering. It is impossible to keep open the doors to tax evading money and at the same time try to close the doors to the other kinds of illegal money.

Your question needs to be broken up into two parts. Yes, we are showing energy in the fight against the evasion of US taxes, but I don’t think we are showing much energy in the fight against our receipt of the proceeds of tax evasion from other countries.

Do Indians launder vast sums in the US?

Yes, I think so. Look at the case which is under consideration at the present time concerning HSBC Bank. As you probably know HSBC has a particular service appealing to Indians out of India and expatriate Indians. Certainly, I think banks in the US and elsewhere are still helping Indian citizens get their money abroad.

I thought the HSBC case revolved around affluent Indians living in the US sending money to India to dodge US taxes?

I don’t doubt for a single moment that there was some activity in there that was likewise cheating India out of income taxes. It is very difficult to draw a distinct line between the two when you offer such a deposit service. Some portion of the money transfers ended up helping Indian citizens evade Indian taxes.

Can India take a leaf out of America’s playbook and shake down the secretive Swiss banks? Does India have the negotiating power?

I certainly think India has the negotiating power. India along with China is a huge developing country that has more clout than it has utilized. Having said that I also talked to Indian officials regarding whether or not India should seek the same type of agreement that Switzerland has entered into with Germany and the U.K, whereby Switzerland will pay the tax equivalent for deposits it has but retain bank secrecy.

At Global Financial Integrity we are opposed to these agreements because they maintain bank secrecy. Quite honestly, I would like to see India approaching the European Union for an agreement to have automatic exchange of tax information with the EU. A country of the size and power of India should say; “We want the same agreement that you have going between the countries belonging to the EU.”

It is not that difficult for the EU to exchange tax information with India, it is already exchanging it among all the EU countries. They just have to press another computer key and say instead of Italy, it is India that we want to bundle this information about, and send it to New Delhi. This would be a monumental development in global finance for India to request automatic exchange of information. It could have huge ramifications.

Under the double-tax treaty with the Swiss government, after 1 April 2011, Switzerland will provide details to New Delhi on transactions involving Indians. Is money flowing out of the Alps because of this or is it a lame agreement?

I don’t think it is all that lame. India has negotiated more mutual legal assistance treaties than any other country in recent months. The treaties allow the Indian government to ask for and exchange tax information on request. However, the process is fraught with difficulties because it only works on request and it requires the other party to respond.

Let’s say India sends the US a request, the US will ultimately have to decide that there is enough meat here to respond. The Tax Information Exchange Agreements (TIEA) process is not perfect, but it is a step in the right direction.

Do Swiss wealth management bankers make fishing expeditions to India?

They were certainly still doing it in the late-1990s. There is no question about that, but I don’t know whether they are still doing it. The way to prevent that is to arrest one of them and send him out of the country. That will stop bankers who are coming in and offering illegal services.

What needs to be done to bring back Indian black money parked abroad?

I said this repeatedly when I was in India, the emphasis needs to be on curtailing the outgoing outflow of money. It doesn’t do much good to try to bring back the black money when the channel still exists for the ongoing outflow of the black money. Let’s get the priorities right.

India’s focus should be on curtailing the ongoing outflow. Expanding India’s tax base and improving tax collection has high potential to curtail illicit flows. To stem the outflow of illicit money from India you have to curtail trade mispricing which is a widely utilized tax avoidance technique of international businesses. Also require confirmation of beneficial ownership in all banking and securities accounts. When you have done that you can turn your attention to that accumulated stock of black money that is already abroad and put pressure on Swiss and other officials to work with you as they have worked with the US in this connection.

Don’t stop putting pressure on the stock of black money abroad, but curtail the outflow which continues to take money outside India. Illicit outflows contribute to stagnating levels of poverty and an ever widening gap between India’s rich and poor.

Do you think that there is little will in India to curb “black money?

No, I think there is some will to curb black money. The risk in this business is that the emphasis will be on corrupt money and criminal money and let commercially tax evading money slide. You can’t do that - you can’t leave the doors open for the escape of the tax evading money and expect to close the doors for the corrupt and criminal money. You have to deal with this problem across the board if you are going to be successful.

There is urgency in India around passing the anti-corruption Lokpal legislation and corruption is a burning issue.

)