Gurgaon: For much of the last decade, the Hyderabad real estate market was the cynosure of developers and investors, with the city witnessing a strong growth in residential supply as well as capital values.

Average residential capital values shot up from Rs 1,000 per sq ft in 2000 to Rs 3,100 per sq ft by the third quarter of 2008, an appreciation of about 15 percent a year, according to PropEquity, a real estate data and analysis firm.

But since the downturn in the last quarter of 2008, following the global financial meltdown that dragged down markets everywhere, the sentiment hasn’t recovered in Hyderabad. In fact, weighted average capital values have actually fallen from Rs 3,100 per sq ft in Q3 2008 to Rs 2,980 per sq ft in the first quarter of this year, a negative annual return of 1.4 percent. This period has also been characterised by fewer project launches.

Real estate markets in other Indian cities have outperformed Hyderabad since 2008. Indicatively, according to PropEquity, on the index of capital value since January 2008, with capital values as on that month rebased to 100, Hyderabad’s price index score in the second half of 2012 remains at 105, a minor uptick. By contrast, the value for Gurgaon is 175, for Navi Mumbai 170, for Bangalore 149 and for Chennai 133.

[caption id=“attachment_455518” align=“aligncenter” width=“620”]

Source: PropEquity[/caption]

Source: PropEquity[/caption]

So why is Hyderabad a laggard?

Much of it relates to the political uncertainty surrounding Hyderabad in the context of the demand for a Telangana state to be carved out of Andhra Pradesh.

[caption id=“attachment_455969” align=“alignleft” width=“380”]

An under construction building in Hyderabad. Reuters[/caption]

An under construction building in Hyderabad. Reuters[/caption]

The Telangana region, which comprises 10 districts, was formerly part of Hyderabad State. But, during the 1956 linguistic reorganisation of States, the region was merged into the newly created cohesive state of Andhra Pradesh. At the time, it was agreed that Telangana would get fair representation in power-sharing, administrative domicile rules and distribution of expenses. But politicians and activists pushing for a separate state of Telangana say that whereas the region accounts for the largest geographical bloc in Andhra Pradesh, and contributes over 75 percent of its revenue, it gets a raw deal in the distribution of water, budget allocations and employment.

The long-dormant movement for a Telangana state regained momentum in 2009. On 9 December, the Indian government announced the process of formation of a Telangana state, but the matter was put on hold following objections and counter-agitations. Today, more than three years later, Telangana’s fate is still in limbo. It is this political uncertainty that has weighed on Hyderabad’s real estate market.

Yet, analysts argue that for all the political instability, Hyderabad may well trump the circumstances to come out as a lucrative market for investors and buyers.

An opportunity in disguise?

At its current valuation levels, Hyderabad is one of the most undervalued markets. Capital values in some of its central locations such as Somajiguda, Begumpet, JubileeHills and Banjara Hills are comparable to - or in some cases lower than - those in peripheral locations of Gurgaon, NOIDA, Navi Mumbai, Thane, Pune and Chennai.

Capital values in Hyderabad are also close to their fundamental levels, which lowers the downside risk for investors, say analysts.

For example, peripheral locations of Navi Mumbai such as Kalamboli (Rs 4,800 per sq ft) and Kamothe (Rs 4,900) command a price that is on a par with Begumpet (Rs 5,000) - a centrally located micro market - and higher than in Gachibowli (Rs 3,487) and Madhapur (Rs 3,896), which are prime locations close to the Financial district and Hi-Tech City in Hyderabad.

Similarly, peripheral and futuristic locations of Gurgaon such as New Gurgaon (Sector 90-95) and the Dwarka Expressway (Sector 99-115) command higher weighted average capital values compared to established location in Hyderabad.

[caption id=“attachment_455531” align=“aligncenter” width=“620”]

Source: PropEquity[/caption]

Source: PropEquity[/caption]

All this, say analysts, point to a seriously undervalued real estate in Hyderabad, which presents an opportunity for buyers.

Samir Jasuja, Founder and Chief Executive Officer of PropEquity, said,“The average capital values of residential units in the prime locations of Hyderabad are comparable or in some cases lower than the average capital values in peripheral locations of Gurgaon, Navi Mumbai and Thane. The average capital value in Hyderabad is going at a discount of approximately 30 percent.”

That is a substantial discount, considering that Hyderabad offers amenities, infrastructure and a location comparable to other markets.

Long-term investors will benefit

Hyderabad being an end user market, it is better suited for mid-term to long-term investor, says Gaurav Pandey, senior vice president and head - Research and Consulting at PropEquity.

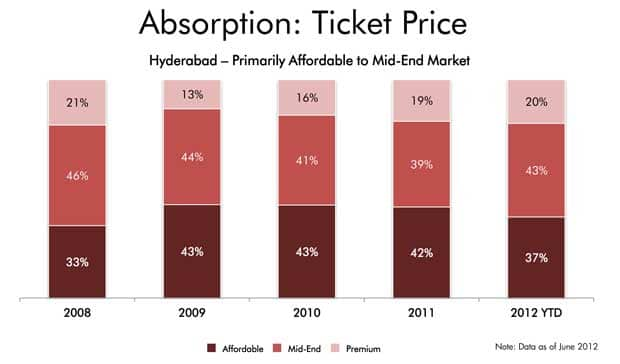

The stagnation in capital values in Hyderabad owes to various factors such as a demand-supply mismatch and the political uncertainty over Telangana, which has made builders, developers and even buyers overly cautious. Average annual new launches have declined by 50 percent since 2008. However, the city remains an affordable to mid-level segment market.

In 2008, some 79 percent of the market was accounted for by affordable and mid-end buyers. PropEquity data as of June 2012 shows that 80 percent of the market is still dominated by the same set of buyers.

[caption id=“attachment_455539” align=“aligncenter” width=“620”]

Source: PropEquity[/caption]

Source: PropEquity[/caption]

And, although the Telangana issue has caused investors some disquiet, the city also has strong real estate drivers such as infrastructure and commercial activity.

Why Hyderabad has what it takes

Hyderabad’s upcoming Metro Rail project, which is similar to the Delhi Metro, is expected to provide a boost to real estate activity. The micro markets along the metro rail routes are expected to witness higher appreciation compared to the other micro markets. The connectivity of the city’s core to peripheral locations will improve, and likely result in significant new project launches along the corridor.

Strikingly, while capital values may have dropped over the years, rentals in Hyderabad have witnessed a steady increase. The yields from residential property in all the prime residential locations have risen in the range of 3 percent to 5 percent, largely because of the freeze on new launches and increased end-user demand. A higher yield and lower capital values makes EMIs more affordable, relative to renting out. In other words, home-buying becomes more lucrative.

In relation to other cities, residential real estate in Hyderabad has one of the most attractive valuations: the weighted average capital value is approximately Rs 2,980 per sq ft, against Rs 4,210 for Chennai; Rs 3,800 for Bangalore; Rs 4,300 for Pune; and Rs 3,480 for Kolkata.

The main challenge for buyers will be to time their entry into the market. Since stagnant capital values and increasing input cost have squeezed developer’s margins, you can drive a hard bargain with developers looking to generate quick cash flows.

Analysts reckon that although the sentiment for realty in Hyderabad is downbeat, it will be well served by the city’s commercial clout, its infrastructure and its growth drivers, irrespective of the political outcome in Telangana. In any of the three scenarios - of Hyderabad becoming part of Andhra Pradesh, of Hyderabad becoming part of Telangana or of Hyderabad becoming a union territory - it would be to the benefit of politicians and the local population to ride on the city’s reliable economic structure.

“In case the pessimistic macroeconomic scenario sustains, the region may witness a price correction of 5 percent to 10 percent in the short term. However, over the medium term, investments can generate an annual return of 12 percent to 15 percent, in addition to rental income. Today, investing in Hyderabad makes sense primarily on account of valuations. In the long run, Hyderabad can compete with the hottest real estate markets in India. To summarise, the long-term opportunities overweigh the short-term risks,” Pandey said.

)