Faced with unprecedented levels of stressed assets, banks, led by the country’s largest lender State Bank of India (SBI) sold over Rs 10,000 crore of bad loans to asset reconstruction companies (ARC) in March alone.

“This single-month figure is higher than any other yearly number from the past,” an industry source was quoted as saying by PTI.

Due to the high accretion of non-performing assets (NPAs) in the recent past - total NPAs stood at 4.2 percent as of September 2013- banks are being nudged to sell bad assets to the 14 asset reconstruction companies (ARCs).Together with restructured assets, the total stressed assets in the system touched 10.2 percent as of the December quarter.

Banks have recast nearly Rs 1 lakh crore worth of loans in the past fiscal alone, taking the total corporate debt restructuring (CDR) book to over Rs 4 lakh crore.

SBI, which had reported an NPA level of 5.73 per cent in the December quarter, led the chart by reportedly selling close to Rs 4,000 crore to ARCs. This is the first time the bank has done so.Apart from SBI, other lenders have also gone public with their intention of selling bad assets. Public-sectorBank of India said it was mulling offloading Rs 900 crore of NPAs to ARCs in the March quarter alone, after auctioning Rs 2,000 crore in the first three quarters.The troubled United Bank of India, which reported a spike in gross NPAs to over 10 per cent as of December, was planning to sell Rs 700 crore in bad assets.

However, India’s banks couldbenefit from a stronger government that will be able to enact reforms and promote infrastructure development.

“Rapid benefits could come in terms of improvements to the operational cash flows of corporates and infrastructure companies that will, in turn, lead to improvements to banks’ asset quality,” noted HSBC in a report. However, it was quick to caution thateven ifNarendra Modi-led BJP wins the most number of seats in parliament, it is likely to need the support of smaller political parties to be able to form a government. This means policymaking will become difficult and little can be achieved to kick-start the growth process at least in the first six months of the new government.

The brokerage also adds that as long as India can maintain a growth of 4-5 percent per annum, the banking sector will be able to heal itself over time.

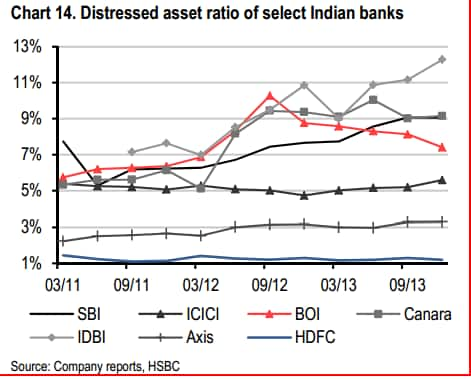

[caption id=“attachment_82131” align=“aligncenter” width=“471”]  Chart[/caption]

“Private sectorbank fundamentals continue to improve as asset quality stabilises and these banks look to retail lending for growth. On the other hand, public sector banks continue to face pressure on asset quality.. (but)their ratings remain supported by the government’s majority ownership and willingness to inject capital,” said HSBC.

The divergent path of private vs. public sector banks can be seen in the above figure by the average gross distressed asset (NPA + restructured assets) ratio of less than 5% for private banks vs. an average of 9.5% for public sector banks.

In fact, in the report, HSBC analysts Devendran Mendran and Dilip Shanahi go on to say that India’s credit profile is more dependent on the actions of the Reserve Bank of India than the outcome of the country’s general election.

With inputs from PTI

)

)

)

)

)

)

)

)

)