As India awaits the election verdict, buyers waiting to purchase property should stop waiting in the wings if they are hoping prices will fall any further for most real estate stakeholders ( builders, financial institutions and home buyers) do not expect prices to fall any further, revealed the real estate sentiment index prepared jointly by industry body Ficci and real estate consultancy firm Knight Frank.

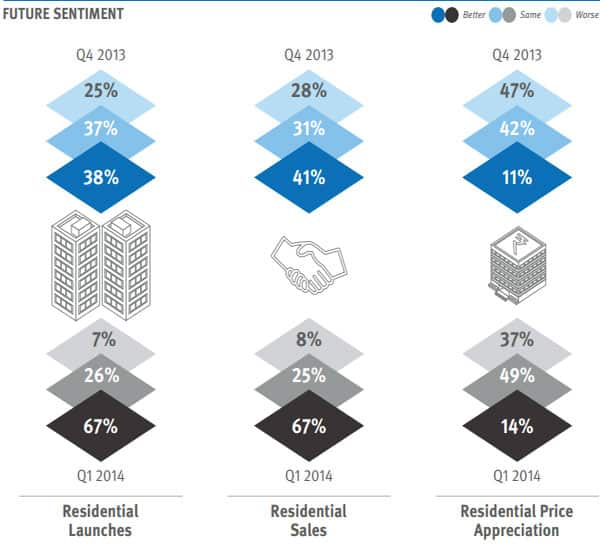

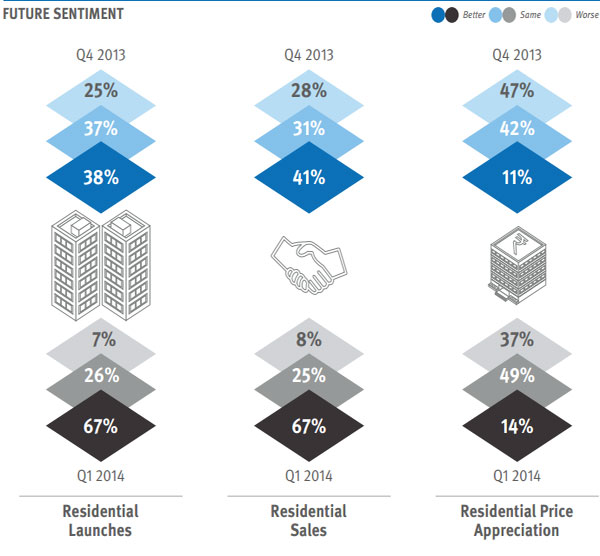

While residential project launches and sales volume are expected to grow in the coming six months, price appreciation is likely to remain sluggish.

[caption id=“attachment_83488” align=“aligncenter” width=“600”]

Source: Knight Frank[/caption]

Source: Knight Frank[/caption]

According to the above graphic, only 14 percent of realty stakeholders expect an improvement in the outlook for house prices, while a majority 49 percent expect the outlook to remain stagnant. As many as 37 percent actually expect the sentiment to get even worse. However, it is slightly better than the previous quarter when 47 percent were pessimistic about residential price appreciation.

Meanwhile, as many as 67 percent expect a slew of launches in the next six months as against 38 percent in the fourth quarter of 2013. Similarly, 67 percent expect residential sales to grow in the first quarter of FY14 against 41 percent in the previous quarter.

Says A Didar Singh, Secretary General, FICCI, “As the country waits for the new government to take charge at the centre, future sentiments have improved across all zones in realty sector. Majority of the developers and financial institutions are quite bullish about the future of the economy as well as the funding scenario. The stakeholders are cheerful and expect the business environment to be upbeat in the coming six months.”

Thirdly, future sentiment has improved across all zones, displaying a strong positive outlook across geographies while South India seems to be the most upbeat about the future.

[caption id=“attachment_83489” align=“aligncenter” width=“600”]

Source: Knight Frank[/caption]

Source: Knight Frank[/caption]

The number of new launches in the residential segment during the first quarter of this year has increased by 43% at 55,000 units across eight major cities. Bengaluru recorded the largest number of units launched at an increase of 22% at 16,838 units.

Another report by real estate consultancy firm Cushman & Wakefield revealed that the number of new launches in the residential segment during January-March increased 43 percent to 55,000 units across eight major cities while Bengaluru recorded the largest number of units launched at an increase of 22 percent at 16,838 units.

Bengaluru was followed by Mumbai and Chennai with new launches at 10,698 units and 7,436 units with a growth rate of 93% and 191% during the first quarter. NCR saw the sharpest decline in number of new launches by 18% at 6,555 units.

[caption id=“attachment_83490” align=“aligncenter” width=“479”]

Data: Cushman and Wakefield[/caption]

Data: Cushman and Wakefield[/caption]

The largest number of launches was in the mid-end segment at 90% over the previous quarter.

[caption id=“attachment_83491” align=“aligncenter” width=“463”]

Source: Cushman and Wakefield[/caption]

Source: Cushman and Wakefield[/caption]

Rental values remained stable in Ahmedabad, Chennai, Hyderabad and Kolkata during the quarter. However, the rental values in a few high-end segment sub-markets of Bengaluru, Mumbai and the NCR registered a decline in the range of 3-10%, primarily due to large companies and individuals adopting a cautious approach in the wake of overall economic scenario and political environment in the country.

“However, as concerns about the inflationary trends in the economy and an expected adverse impact of the El Nino remain, we believe that a cautious approach needs to be maintained for residential markets that are not primarily driven by end-user demand. With the general elections already past the half-way mark, the industry and buyers are eagerly looking forward to some positive policy changes to boost the housing sector by the new government that emerges,” said SanjayDutt, Executive Managing Director, South Asia, Cushman & Wakefield.

)