The Reserve Bank of India (RBI) on Tuesday announced a deregulation of the savings deposit rate, the rate that banks offer on savings account deposits.

The RBI had released a discussion paper in November 2010, asking for feedback on the proposal to deregulate rates.So while the move had been in the offing for some time now, the announcement came as a big surprise when governor D Subbarao announced it along with an upward revision in policy rates today.

The deregulation of the savings rate comes with two conditions attached. First, each bank will have to offer a uniform interest rate on savings bank deposits up to Rs 1 lakh, irrespective of the amount in the account within this limit.

[caption id=“attachment_116632” align=“alignleft” width=“380” caption=“The banks likely to be worst hit due to the deregulation are those with the highest ratio of current and savings account deposits (CASA). AFP”]

[/caption]

[/caption]

Second, for savings bank deposits over Rs 1 lakh, a bank may provide differential rates of interest, if it so chooses. However, there should not be any discrimination of customers on interest rates for a similar amount of deposit.

That means up to a deposit of Rs 1 lakh, the interest rate depositors earn from a bank will be uniform. Preferential and perhaps increasing rates might be offered only for deposits with higher amounts.

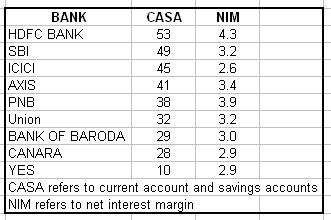

The banks likely to be worst hit due to the deregulation are those with the highest ratio of current and savings account deposits (CASA).

As these banks will now have to offer more interest for savings accounts, the overall cost of their deposits are set to rise. Consequently, net interest margins (NIM) are set to fall.

NIM is the difference between a bank’s cost of deposits and earnings on advances (loans). This metric typically indicates the profitability of banks.

HDFC Bank has one of the highest CASA ratio (appx 53 percent) among banks. No wonder, its stock plunged 6.3 percent after the RBI’s announcement.

Jagannadham Thunuguntla, strategist and head of research, SMC Global, said the banking sector would have to pay total additional interest of Rs 14,469 crore if interest rates increase by just 1 percent. Last year, the sector’s profit before tax totalled Rs 1,12,612 crore. The higher interest costs could cause profitability to plunge by 12.85 percent, which is quite significant for the banking industry.

In contrast, smaller banks like Yes Bank (which has a lower CASA ratio of about 13 percent) are set to benefit. First, their cost of deposits is less significantly affected. In addition, these banks can aggressively hike savings deposit rates to attract more retail customers. That’s one reason why Yes Bank’s shares gained 5 percent after the RBI policy.

“The announcement of deregulation today was not expected and will have a negative impact on banks,” said Vaibhav Agarwal, analyst-banking, Angel Broking. “The hardest hit will be State Bank of India, Punjab National Bank, Axis Bank, HDFC Bank and some smaller players like Dena Bank. The biggest gainers will be banks like Yes Bank.”

For now, banks are playing it cautious. At a bankers’s conference, SBI chairman Pratip Chaudhuri said his bank would continue with the current savings rate (4 percent) for now.

Indeed, the effect of freeing the savings rate might not fully play out in the short term. First, some experts noted that the preferential interest rates on deposits above Rs 1 lakh is unlikely to have a significant impact because those kind of amounts are not generally kept lying in savings accounts by investors.

Second, the impact will be greater for banks trying to gain more retail customers than on those trying to retain the loyalty of their existing customers. Customers stick to a bank because of a lot of reasons other than deposit rates. These include services such as making direct bill payments with a savings account or credit card. It’s unlikely that they will shift from one savings account to another account every few months just for a 0.5-1 percent difference in deposit rates.

Second, the impact will be greater for banks trying to gain more retail customers than on those trying to retain the loyalty of their existing customers. Customers stick to a bank because of a lot of reasons other than deposit rates. These include services such as making direct bill payments with a savings account or credit card. It’s unlikely that they will shift from one savings account to another account every few months just for a 0.5-1 percent difference in deposit rates.

That being said, it’s an inescapable conclusion that the cost of deposits for most banks is set to increase. Given that we’ve reached the peak of the current interest cycle and rates are already quite high, banks will not be able to share this increased cost with borrowers.

Therefore, the profitability, return on assets and equities, and even valuations for some banks like HDFC Bank are likely to be reworked by analysts.

)