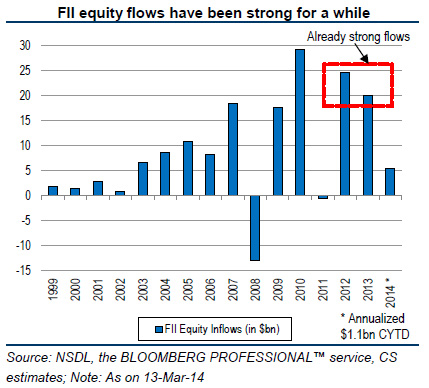

Are you feeling the love yet? You should. In the past five years, foreign investors poured $90 billion in Indian stock markets, a Credit Suisse report titled “Elections: Much Ado about Nothing”.

That has enabled foreign institutional investors (FIIs) to own about $218 billion of Indian equities as of December 2013, more than 40% of the free-float in the market.

Indeed, both 2012 and 2013 were exceptionally good years for Indian equities, as foreign investors poured $20 billion or more for each year, as can be seen below in the chart.

The investment house notes that FII equity buying has therefore, become an important determinant of the short-term direction of the broader market. Given the relative attractiveness of India and the perceived rosy outlook for the economy post-election, these flows are likely to stay robust, the report notes.

That, despite the current reality that is the exact opposite of the ‘rosy’ outlook. Economic growth has slumped, inflation is stubbornly high, exports are shrinking and manufacturing is sputtering.Yet, foreign investors are choosing to overlook these economic warts and are hoping for the best.

Indeed, the recent rally in the markets is being driven by foreign investors, who are betting that a new government will kick-start much-delayed reforms.

A report by Goldman Sachs notes that foreign flows have generally been supportive in the run-up to recent elections. During both the 2004 and 2009 elections, foreign institutions bought a net $3-4 bn of equities in the three months heading into the elections.

Nevertheless, the pattern has been less consistent post elections, notes Goldman Sachs. For instance, money exited Indian stocks after the 2004 elections as the election outcome was different from thepopular opinion poll.

Let’s hope the new government justifies the foreign enthusiasm.

)