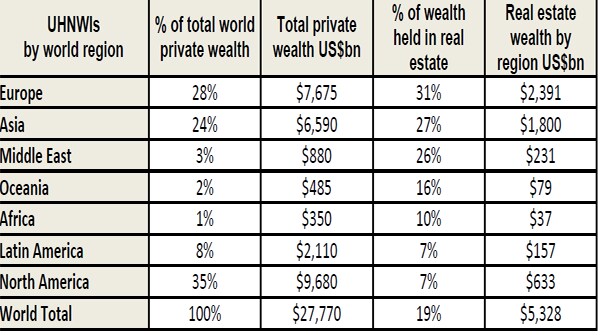

European and Asian ultra high networth individuals (UHNWIs, or the super rich) hold by far the biggest share of all privately-owned real estate, together accounting for almost 80 percent by value, according to a new report by real estate services firm Savills and wealth intelligence provider Wealth-X.

[caption id=“attachment_1005815” align=“alignleft” width=“380”]  AFP[/caption]

While European UHNWIs hold 31 percent of their wealth in realestate and Asians hold 27 percent, with a total value of around $4.2 trillion.

European real estate markets are the largest and most international, having attracted the most global inward investment, with London standing out as the global destination for private inward real estate investment from virtually every corner of the globe.

[caption id=“attachment_1341181” align=“aligncenter” width=“600”]  Source: Savills World Research/Wealth-X[/caption]

This is because in recent years the super rich have been focusing on ‘safe havens’, trophy properties for capital growth and wealth preservation.

According to the report, ultra-wealthy individuals are becoming an increasingly influential force in the world of real estate, acting as a critical source of capital for big-ticket deals in the sector.

“Global real estate is mostly residential and held by occupiers, but private owners are becoming moreimportant in the world of traded investible property,” said Yolande Barnes, head of Savills worldresearch.

Since the ‘North Atlantic debt crisis’ of 2008, sovereign wealth funds, wealth managementcompanies, private banks and family offices have stepped into the property deals that corporatebankers have deserted.

In the world’s leading cities, the willingness of private wealth to take the place ofdebt finance or to take a higher-risk development position is now making the difference between dealsdone or schemes mothballed.

Savills estimates that around 35 percent (or 6,200) of global big ticket(in excess of $10 million) deals in 2012 were only possible because of private funding.

Total value of the world’s real estate is now around $180 trillion, some 72 percent of which is owner occupied residential property, the report estimated.

Of the $70 trillion that is ‘investible’ and, therefore, traded regularly - including $20 trillion of commercial property - over half is being bought by private individuals, companies and organisations.

Investing institutions, listed companies and publicly owned entities are becoming relatively less important to world real estate as a result, said Barnes.

)

)

)

)

)

)

)

)

)