As India goes to the polls, here’s some more bad news for the UPA: Not only have the number of new project announcements in the fourth quarter of FY14 fallen sharply on a quarterly and yearly basis, the number of stalled projects are also on the rise, implying that already limping infrastructure development has come to a grinding halt.

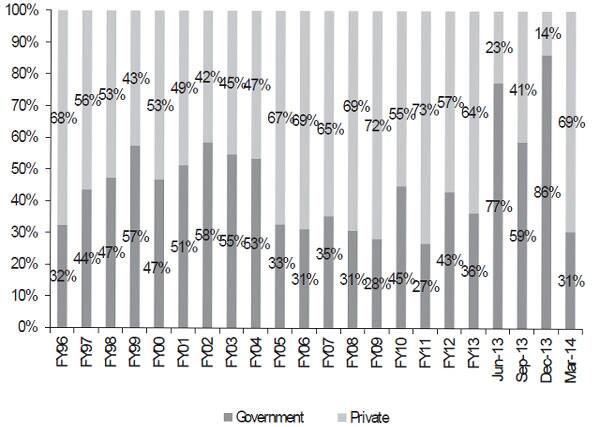

According to data analysed by global brokerage Citi, total new project announcements in the fourth quarter of fiscal 2014 (January-March 2014) fell 44 percent year on year, and a whopping 63 percent quarter on quarter. Of the total number of project announcements, government projects, which drove new project announcements over the last few quarters, fell 66 percent year on year and 87 percent percent quarter on quarter to Rs 16,500 crore. Ironically, this fall in announcement coincides with the government curbing overall expenditure too.

[caption id=“attachment_82123” align=“aligncenter” width=“600”]

Source: Citi[/caption]

Source: Citi[/caption]

The table above shows that new government projects, which were driving total new projects over last few quarters, fell sharply in the fourth quarter and constituted only 31 percent of total announced projects in the last quarter. This can largely be attributed to the election code of conduct kicking in. Surprisingly, project announcements by the private sector has jumped 86 percent on quarter but are still down 24 percent from the same period in the previous year, implying a slight recovery in business confidence.

Secondly, despite the cry for speedy clearance, stalled projects (both in absolute terms and as a percentage of under implementation projects) remain stubbornly high. “Under implementation but stalled projects rose by 13%t YoY / 5% QoQ in 4Q FY14,” showed the Citi report.

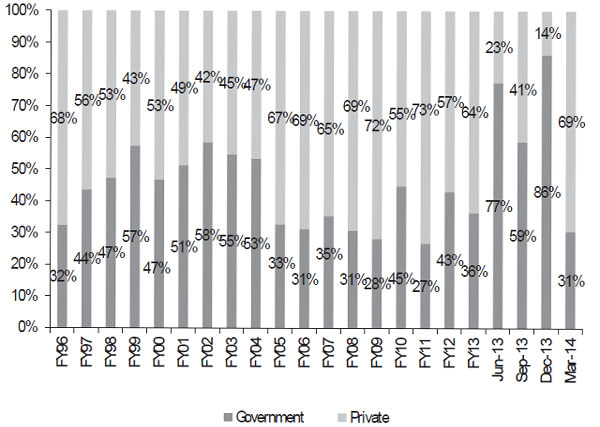

Meanwhile, the number of completed projects has improved from the previous quarter but is still down by 50 percent from the previous year, according to Citi. In fact of the completed projects, electricity, services as well as the financial sectors account for the largest shares in the past couple of quarters, while construction and real estate has witnessed slipped in the fourth quarter of fiscal 2014 both on a quarterly and yearly basis.

[caption id=“attachment_82124” align=“aligncenter” width=“600”]

Source: Citi[/caption]

Source: Citi[/caption]

Completed government projects fell 67 percent year on year but were still an improvement from the previous quarter – up 77 percent. Completed private projects fell 45 percent from a year ago but were higher by 22 percent from the previous quarter in the fourth quarter.

Citi believes a stable government post the general election and a continued push to resolving execution bottlenecks remain key to reviving capex in the next two years. Little wonder that an infrastructure push is on top of the opposition Bhartiya Janta Party’s (BJP’s) agenda at the moment. The BJP is widely expected to come into power.

In an interview with Reuters, senior BJP leader Arun Jaitley, who is touted to be India’s next finance minister if the NDA comes to power, said restarting the investment cycle by approving five big-ticket investments quickly is key if the party wants to signal that it means business.

“You will have to, both in terms of policies and procedure, give an impression that it’s now easy to do business in India. You make five big clearances, some big-ticket clearances,” Jaitley was quoted as saying. ( Read more here)

In India, capital investments contribute nearly 35 percent to the economy, but it barely grew in the fiscal year that ended in March as delays in clearances from various ministries and funding issues grounded many major projects.

)